[ad_1]

A rise in green coffee prices may soon begin to seep into the costs paid by consumers for their daily caffeine correction, in the latest sign of how commodity markets are affecting the wider global economy.

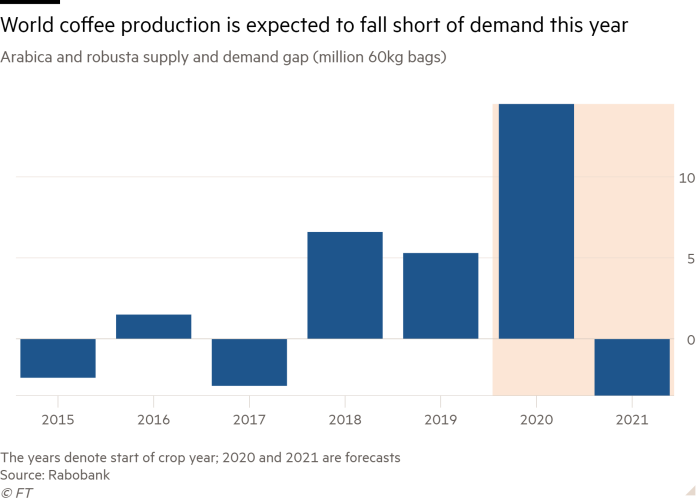

Prices of coffee beans in international markets have risen as the crops of the main Brazilian producer have been damaged by the even worse in almost a century, which led to the first supply deficit in the coffee market in four years. Anti-government protests in Colombia stopped exports earlier this year, further boosting markets.

In early June, New York’s benchmark futures for arabica, the high-end coffee bean, hit a four-and-a-half-year high of nearly $ 1.70 a pound, nearly 70 percent more than the pound. previous year. Since then, prices have fallen to about $ 1.50 a pound, although they have risen sharply since 2020.

The “devastating drought” has really had a significant impact on the [coffee] crop this year, ”said Ole Hansen, Saxo Bank’s head of commodity strategy.

Other commodities, such as iron ore, corn and oil, have risen this year, something economists say is happening to the economy as a whole as producers raise the prices they charge consumers.

Roasters and coffee buyers usually have forward contracts with their suppliers that isolate them from price volatility for about three to nine months. The small demand for coffee from cafes and restaurants due to the closures also meant that they still had some inventory on hand.

However, when these price deals end and savings open, many toasters seek to sign new purchase agreements at much higher bean prices, which can then be passed on to supermarket or coffee shop customers, according to analysts.

“We are still delivering coffee from previous contracts. It’s the next set of deliveries that will start to get more expensive, ”said Stephen Hurst, founder of Mercanta, which sells special beans for high-end toasters. “Wholesale and retail prices will start to react by the end of the year,” he added.

Martin Deboo, an analyst at Jefferies, said European retail coffee prices had been stable during the first half of the year, indicating that roasters were still covered by futures price contracts with their suppliers.

But he said prices are likely to start to rise over the next few months: “As we move forward over the summer, people’s roofs will start to run out.”

There are some indications that higher prices are starting to reach the consumer. Tchibo, the German retailer, announced which would raise prices by 50 cents to € 1 a pound starting this month, while JM Smucker, the American food company of coffee brands Folgers and Dunkin, dit he planned to raise prices in several categories, including coffee.

For coffees, rising coffee prices will be added to wages and other costs, which increase. However, the cost of coffee is a small portion of a cappuccino or latte sold in a coffee shop, with rent and labor usually costing more than half the cost.

Some roasters and coffee retailers can wait to see how the economic recovery unfolds and how consumer demand recovers before prices change. While demand for coffee at home jumped in the middle of closing, it decimated sales of restaurants and cafes, especially those that depend on office workers.

Nespresso, Nestlé’s premium coffee division, said a U.S. approach was being taken to wait and see how long high prices in the coffee bean market remained.

In terms of supply, while the current Brazilian harvest is expected to be poor, the country’s record harvest last season means producers and exporters still have inventories in warehouses, said Carlos Mera, an analyst at Rabobank. who added: “There is a lot of coffee in Brazil.”

However, large logistical bottlenecks caused by problems with shipping have caused producers and exporters to remain in their inventories. The shortage of containers and ships has led to an accumulation of goods and other goods around the world, and shipments that typically take four to six weeks, for example, take twice as long, according to coffee traders.

“It’s a big headache,” Mera said. There is a lot of coffee waiting to be shipped from producing countries, where protests earlier this year disrupted the flow of coffee, he added.

In Colombia, for example, production is not expected to be affected by the ravages of Covid-19, but due to national and international logistical problems, export flows “will need at least two months until things return to normal.” normalcy, “said Roberto Velez, chief executive of the Colombian Federation of Coffee Producers.

Uncertainty also persists about consumers ’buying habits in the wake of the coronavirus crisis. Marex, the commodity agent, expected post-pandemic coffee consumption to pick up this year, “but not in the pre-pandemic trajectory.” “Demand is the big question. It’s not as robust as some people think it is. It’s really mixed, “said Hurst of Mercanta.

Meanwhile, traders are also monitoring the movements of hedge funds, which are accumulating in the Arabica futures market, which exacerbates the rise in prices. Although its positions have declined since then, data from the Commodity Futures Trading Commission show that financial speculators in early June accumulated a large net long position – a bet that prices will rise – equivalent to annual production of Colombia.

“Some of the dramas we’ve seen in terms of price change have to be attributed to these huge capital inflows we’ve seen coming from non-physical players,” Maximillian Copestake told Marex.

[ad_2]

Source link