[ad_1]

courtneyk

Hub Group, Inc.Nasdaq Cruise HUBG) He is launching many initiatives to become more efficient and more creative. I’ve also seen profit-making initiatives, which can lead to revenue generation. With all that said, I believe in the supernatural. Stock prices are not enough to describe the place in stock. There are many risks, which can reduce stock prices. I try to hold stocks, but not at current stock prices. Remember I like Hub Group, but I don’t like stock prices.

Hub Team Mission

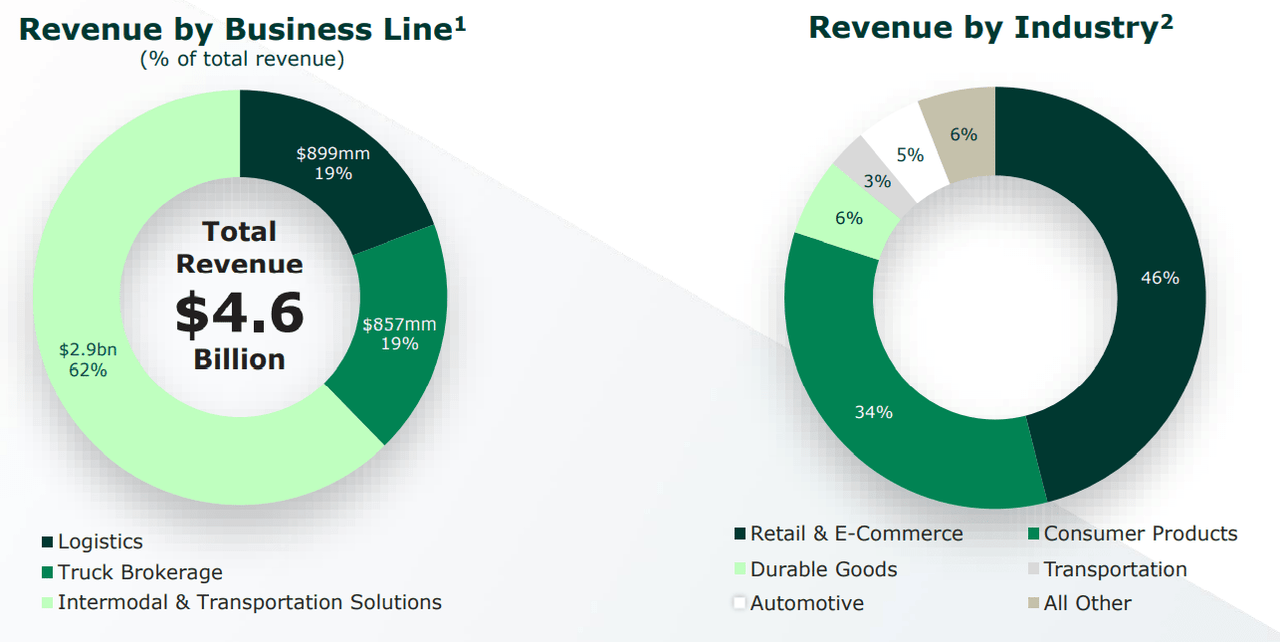

Hub Group, Inc. is a provider of supply chain solutions that provide transportation and logistics management services. The company provides services such as truck loading, temperature control, commitment and regional loading.

Most customers come from the consumer goods industry as well as the retail and ecommerce sectors. Therefore, a decline in these activities could lead to a reduction in the company’s revenue.

Investor approach

As soon as I saw a number of profit-making initiatives announced in the recent quarterly report, I decided to investigate the Hub team. In my view, the efficiency and revenue sharing of equipment and drivers in the new business line called Intermodal and Transport Solutions is very important.

As part of our profit improvement initiatives, we are focused on realizing the efficiency between the delivery and delivery of trucks, including the sharing of equipment and drivers, and the implementation of integrated driver support services.

Our dedicated and dedicated team now operates as a joint venture. As a result, starting in the first quarter of 2022, we will now report revenue for these activities through the Intermodal and Transportation Solutions line. Source Pub Hub Group, Inc. It reported the results of the first quarter of 2022

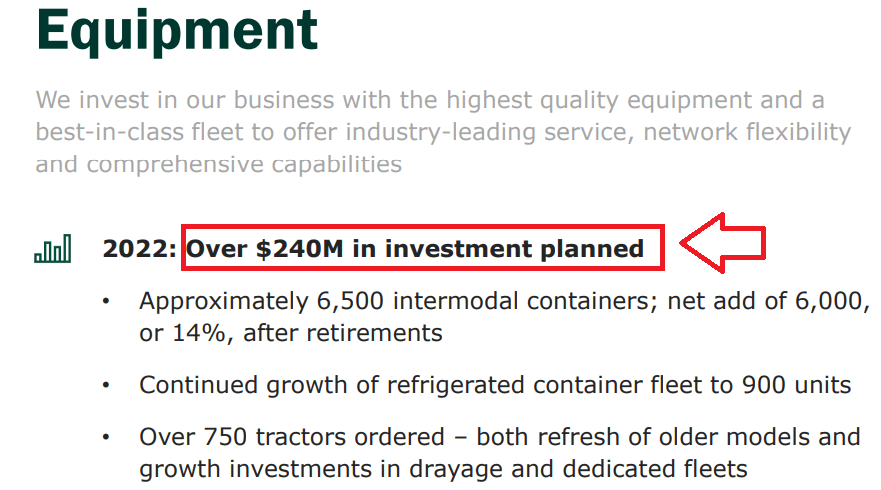

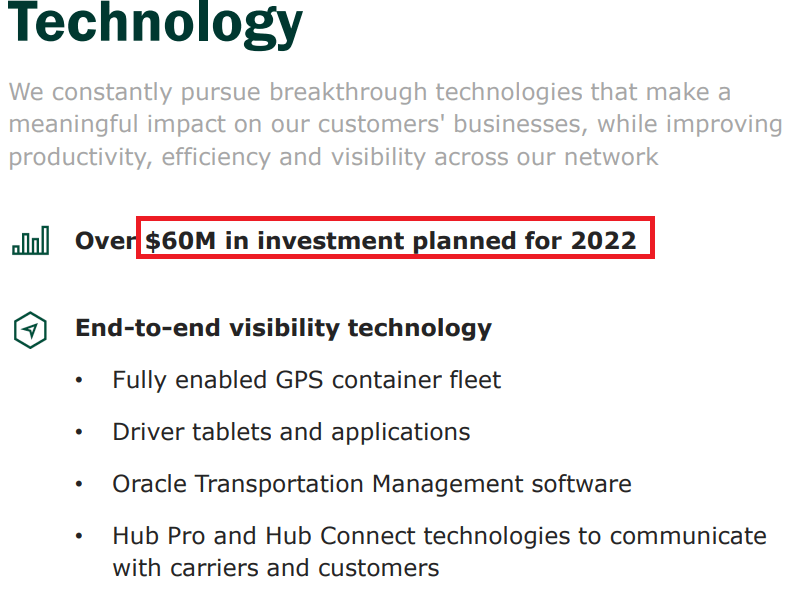

The administration has announced new investments in equipment and technology, which will increase revenue generation by 2022.

Investor approach

Investor approach

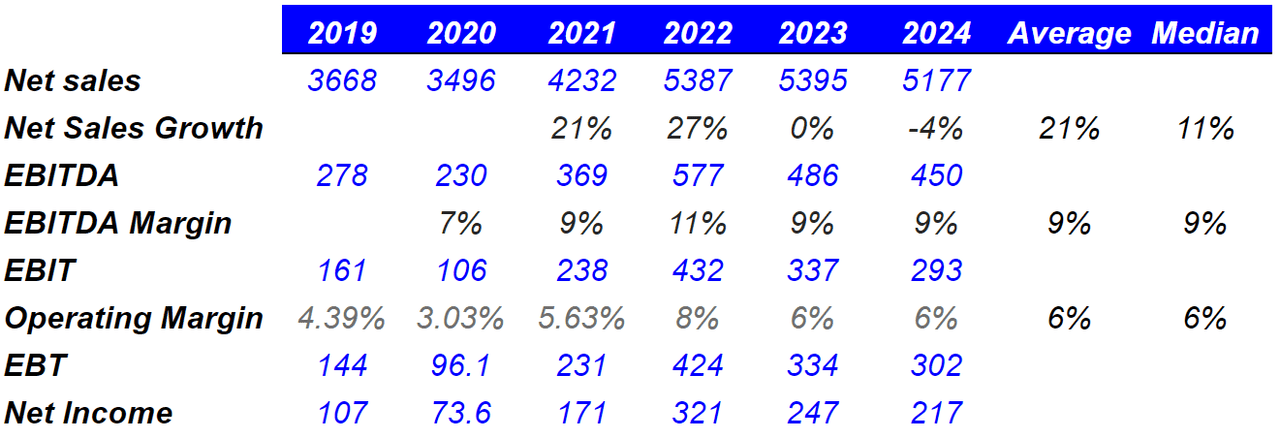

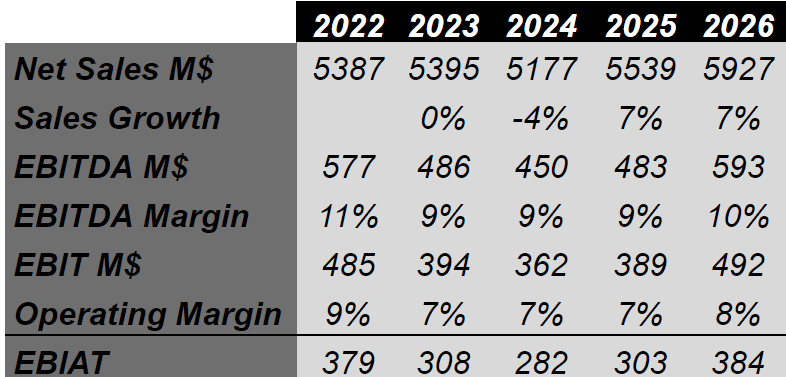

Analysts are expecting sales growth, net revenue and free cash flow

In my view, investment analysts are relatively optimistic about HUBG. A.D. They expect sales growth to slow in 2023, but sales growth is expected to close to 27% by 2022. The EBITDA margin can be doubled, and the operating margin could be 8% to 6% between 2022 and 2024.

Marketscreener.com

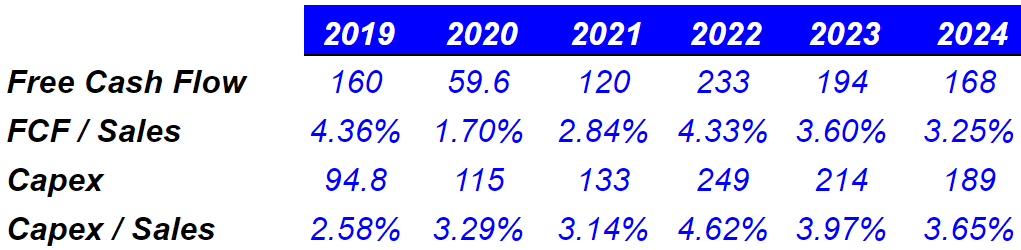

About the income statement, the cash flow statement will be even more interesting. Estimates of HUBG include FCF sales between 4.3% and 3.25%. Capt. Sales are expected to stop at around 3.6%. Check out some of my models based on analysts’ estimates based on other financial analysts.

marketscreener.com

The management has high hopes for 2022. In a recent presentation, HUBG presented the 2022 Sales Directive at a cost of $ 5.3-5.5 billion and capital expenditures of $ 240-265 million. In my basic case, I used some of these figures.

We expect our 2022 deductible to be $ 9.00 to $ 10.00 per share. We estimate that revenue will reach $ 5.3 billion to $ 5.5 billion, and that the overall margin will increase from 15.6% to 16.0% as a percentage. We estimate that our costs and expenses will reach $ 420 to $ 440 million a year. We estimate that the tax rate for the year will be 24-25 percent. We expect capital expenditures of $ 240 to $ 265 million by 2022. Source Pub Hub Group, Inc. It reported the results of the first quarter of 2022

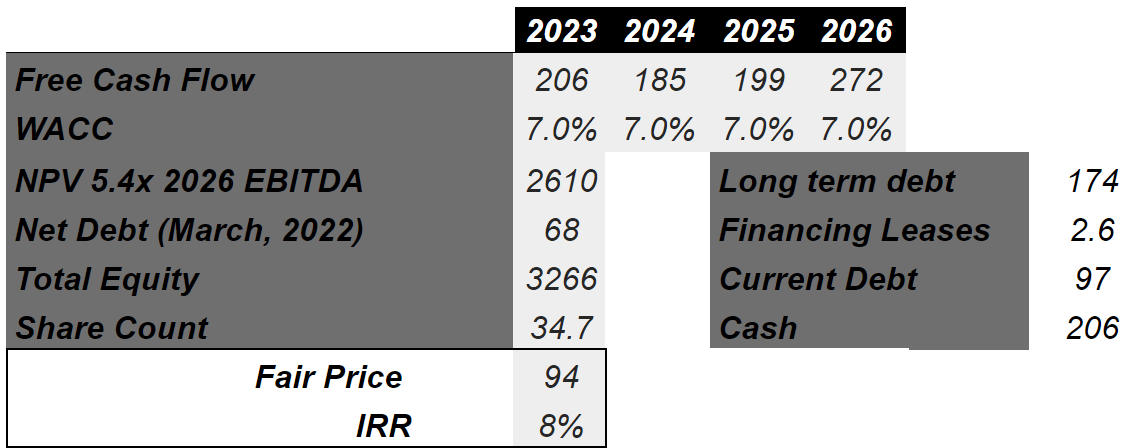

BASIC CONDITIONS Investments in technology can lead to $ 94 per share price.

In my opinion, investing in technology will successfully increase the company’s relationship with customers, drivers and vendors. Among the latest innovations, in my view, new robotic process automation and artificial intelligence improve efficiency and free cash flow.

A.D. In 2021, we have also provided solutions to streamline our operations and back office operations using computer vision, robotic process automation and artificial intelligence. This includes automating manual processes, developing trained robots to enable experienced supply chain professionals to complete critical tasks, and to provide better decision-making support to their operating teams. . Source 10-k

Also, I think a lot of technological innovations come from buying new competitors. Management ChopTank Transport, LLC and NostopDelivery, LLC have already reported significant purchases.

On October 19, 2021, Choptank Transport, LLC received 100% fairness. The purchase has scaled up our trucking business, improved the supply of our refrigerated trucks, and provided refrigerators for emerging intermodal containers.

On December 9, 2020, we found NstopDelivery, LLC. NSD provides final mileage services throughout the United States. NSD financial products, from the date of purchase, are included in our logistics business line. Source 10-k

Finally, in this case, I expect HUBG to develop energy-efficient transportation solutions as promised by the administration. As a result, the company may receive more attention than investors, which reduces capital costs. HUBG discussed these initiatives in last year’s report.

Our service delivery caters to the needs of our customers’ energy-efficient transportation solutions and helps them achieve their goal of reducing their environmental footprint. Our intermodal service is more fuel efficient compared to freight transport, and we are constantly looking for opportunities to convert our customers’ transportation needs from freight forwarding to intermodal. Our logistics supply also includes shipbuilding and network optimization services that will reduce fuel consumption per mile. Source 10-k

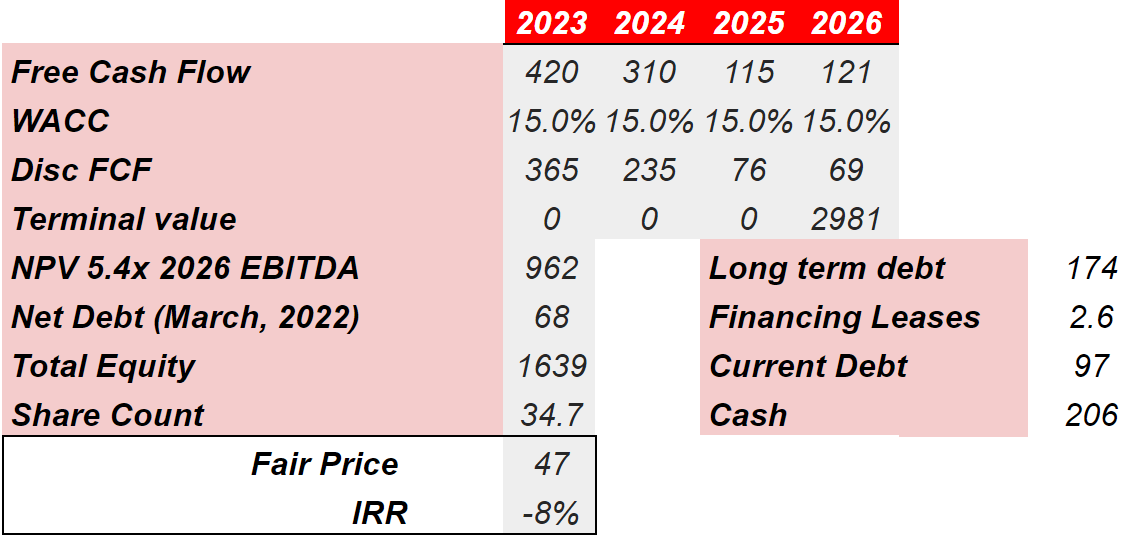

Considering conservative estimates, I used sales growth of -4% and 7% and EBITDA Margin of 9% -11%. The results for the 2026 EBIAT include $ 384 million.

Hohaf

My model includes $ 206 million in cash in 2023 and $ 272 million in cash in 2026. If I use a 7% discount like other analysts, indirect fairness is $ 3.26 billion, and the actual value is $ 94 per share. The internal return rate reaches even 8%.

Hohaf

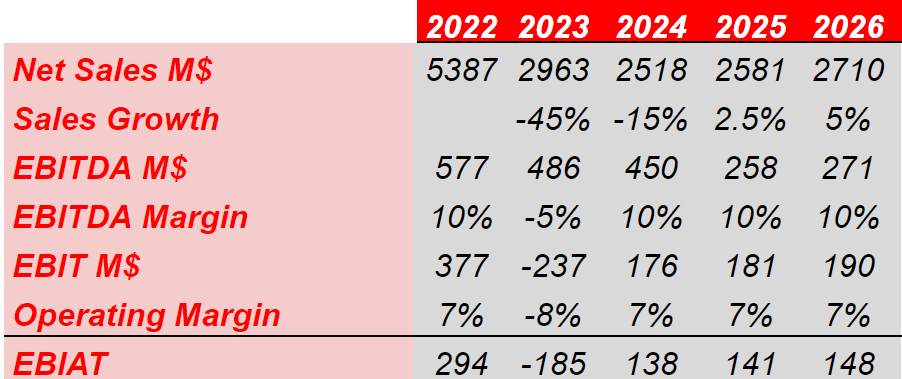

In the worst case scenario, the stock price could fall to $ 47 per share.

HUBG is based on rail service, and often there are not many options. When negotiating agreements, it means that the administration does not have the capacity to negotiate much. As a result, the company may increase transportation costs, which could affect the HUBG EBITDA margin.

We rely on the major railways in North America for our intermodal services. Rail service is restricted to one or a few rails in many regions. We rely mainly on the contractual relationship between the two railways to support our intermediate trade.

Rising prices will result in higher mid-modal transport costs, lowering the beauty of inter-modal transport compared to trucks or other modes of transport, which may reduce the demand for our services. Source 10-k

In my worst case scenario, I think there may be a lack of energy, stagnation or stagnation. The results include a slowdown in sales growth and a decline in free cash flow, which could lead to lower HUBG stock prices.

Our business can sometimes be affected by conditions that affect one or more railways, such as manpower shortages, stagnation or delays, bad weather, changes in railways, or conditions that prevent railways from providing reliable transportation, and so on. . These conditions may happen again in the future. Source 10-k

In the most extreme cases, I used -458% in 2023 and -15% in 2024 sales growth. I also have a 10% EBITDA margin, which means that by 2026 EBIAT is close to $ 150 million.

Hohaf

Now, with a 15% discount, a 5x exit multiplier, and nearly 35 million shares, the real value is around $ 50 per share. The internal return rate of the result will be -8%.

Hohaf

balance sheet

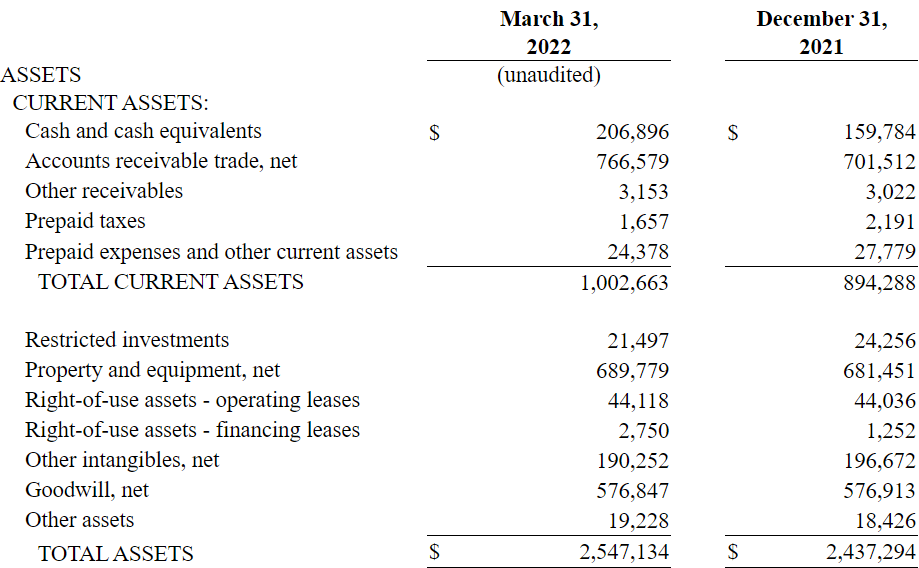

A.D. As of March 31, 2022, cash and cash equivalents were equal to $ 206 million, and the asset / debt ratio was more than 1 x. I believe the HUBG balance allows multiple new purchases.

10-Q

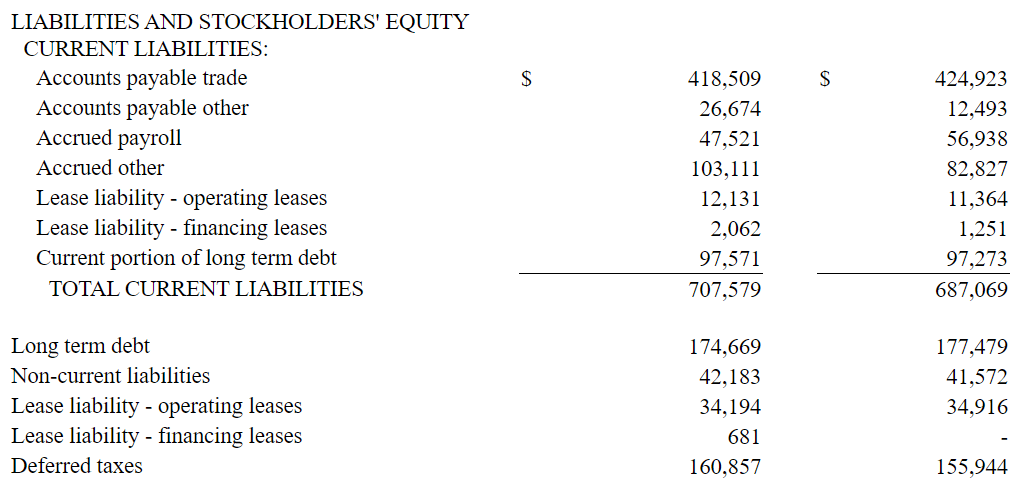

With $ 174 million in long-term debt and $ 97 million in current long-term debt, the total debt is not a concern.

10-Q

The actual price of my pick up is not far from the current stock price.

Management is doing a lot of start-ups to improve efficiency and technological innovation. I believe the company is well managed. With this in mind, I believe the current value of the review is not far off. In addition, there are some risks involved in declining stock prices. Overall, I believe that the potential upside and the disadvantages are moderate. I look forward to seeing that I can hold some stocks at a lower price, not at the current price mark. Remember that this is a company that I watch closely.

[ad_2]

Source link