[ad_1]

nespix / iStock via Getty Images

Horizon Technology Finance CorporationNasadak Cruise HRZN) A.D. In 2022 it received a 24% discount, and the business development company is now eligible to buy at book prices.

Horizon Technology Finance is a high-tech, technology-focused BDC with more than 10 percent of recent production. To support him Growth, Business Development The company has a secure, debt-focused investment portfolio.

Horizon Technology Finance’s loan portfolio is doing well, and the stock could eventually trade in higher book prices.

Another gem in the BDC sector

Business Development Companies In 2022, they suffered a significant loss of value due to the expectation that investors would have an impact on the value of the sector.

During the post-recession, it is very difficult for commercial enterprises to make positive progress on key parameters such as net investment income (due to portfolio inflation) and book value (when the economic downturn increases due to pressure on credit quality).

With that said, I believe now is the time for DVD investors to target BDs that have the potential to outperform the sector due to their credit performance and volatility.

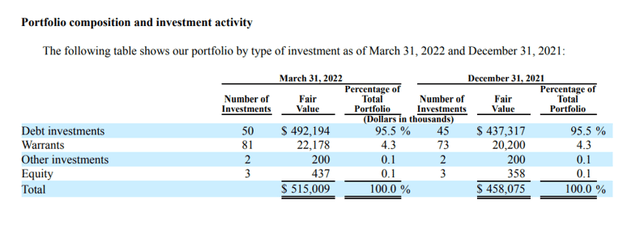

Horizon Technology Finance is a specialized financial company with a fast-growing monthly investment portfolio. The portfolio will have 50 debt investments and 81 securities starting March 31, 2022.

Debt investments in BDC are high-level loans, especially for BDC. In March, the company’s debt, order and equity were estimated at $ 515 million, and BDC invested an average annual portfolio of 12.4%.

Portfolio composition (Horizon Technology Finance)

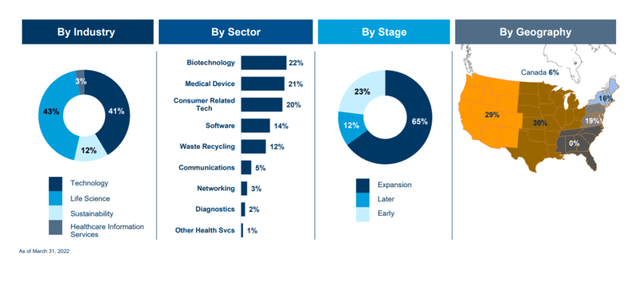

Horizon Technology Finance is an exciting dividend investment because it invests in technology, life sciences, health information and services industries, and is supported by equity and security positions.

Horizon technology financing is in many ways similar to Hercules Capital, the other BDC

Horizon Technology Finance has developed a technology focus in Venture Capital, where BDC sees the greatest potential for profit. BDC is highly diverse and avoids cyclical industries that generate revenue and cash flow risks. Biotechnology, as an industry, accounts for 22% of BDC’s total industrial exposure.

Investment Overview (Horizon Technology Finance)

B.I.I. Passed the broadcast

Horizon Technology’s financial portfolio generated $ 1.41 per share of net investment in 2021, with BDC paying $ 1.25 per share, an 89% payout ratio. The dividend ratio was 90% from 2019 to 2021, so investors can reasonably estimate that $ 0.10 per month is sustainable.

Take the hiking cycle to the next level of interest with Horizon Technology Finance

The central bank is raising prices significantly, making it a good time to select high-risk BDCs.

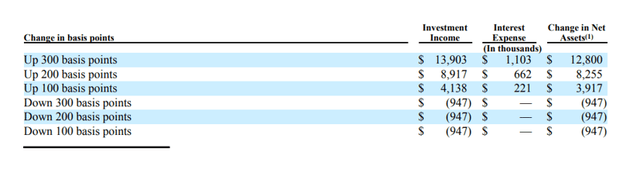

Horizon Technology Finance carefully configures financial agreements to ensure 100% floating rate exposure, which means that HRZN is faster than the average business development company in the sector.

This means that higher interest rates will benefit Horizon Technology financing more than other BDCs. Based on the BDC interest rate chart, a 200-base-point increase in interest rates is expected to bring $ 8.26 million in net assets to Horizon Technology Finance.

Feelings of interest (Horizon Technology Finance)

Book price transaction

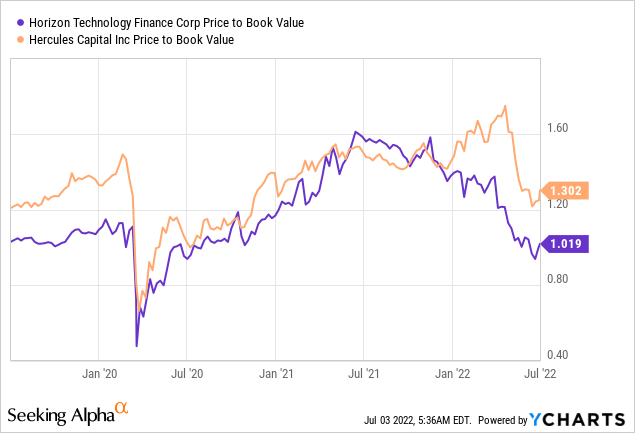

Because of the similarities between targeted industries and contract structures, I believe Hercules Capital is the best for Horizon Technology financing. Hercules Capital has a 1.3x P / B ratio, combining interest payments with equity with BDC’s high-tech investment strategy.

Because the market rewards HTGC for the consistency of its portfolio results, BDC trades at a premium for book prices. Horizon Technology Finance currently has a P / B ratio of 1.0x, indicating that HRZN may be a better purchase than Hercules Capital in terms of book price alone.

Are there any asset quality issues?

I don’t see any major issues right now. Horizon Technology Finance had a loan of $ 11.9 million until March 31, 2022, with a net worth of $ 5.5 million. In terms of price, based on the total value of the $ 515 million portfolio, the untapped ratio was about 1%.

Why Horizon Technology Finance could see a lower stock price

For up-to-date information on the performance of the Horizon Technology Finance portfolio, investors should keep a close eye on BDC’s book price trends and untapped ratios. With just one untapped investment, I say the quality of the portfolio is strong, but things can always get worse, especially if the BDC sector is hit by a recession.

My conclusion

Now that Horizon Technology is financing the book, the idea will be even more appealing.

HRZN is one of the best bets in the BDC sector to increase interest rates as it is 100% exposed to floating prices.

The partition is covered and reasonably safe, but the uncut ones are kept small.

Horizon Technology Finance is characterized by a focus on technology, and the appreciation of equity results in a unique distribution of profits.

[ad_2]

Source link