[ad_1]

Often high growth companies Set significant goals knowing full well that the idea of ”overnight success” is for the history books. However, there is no better time than in the midst of a market downturn to plan to make the jump from a private to a public company.

Risking your way to the public requires strategic planning, which takes time. Companies aiming to go public in less than three years should plan now — even if there’s a setback — to explore the open market for a run.

Let’s examine why this bad economy is conducive to planning an IPO and what to do about it.

Growth investors recently retreated

While some companies are delaying their IPOs, others are able to play with their gains and prepare for when the open market fails to reinvest.

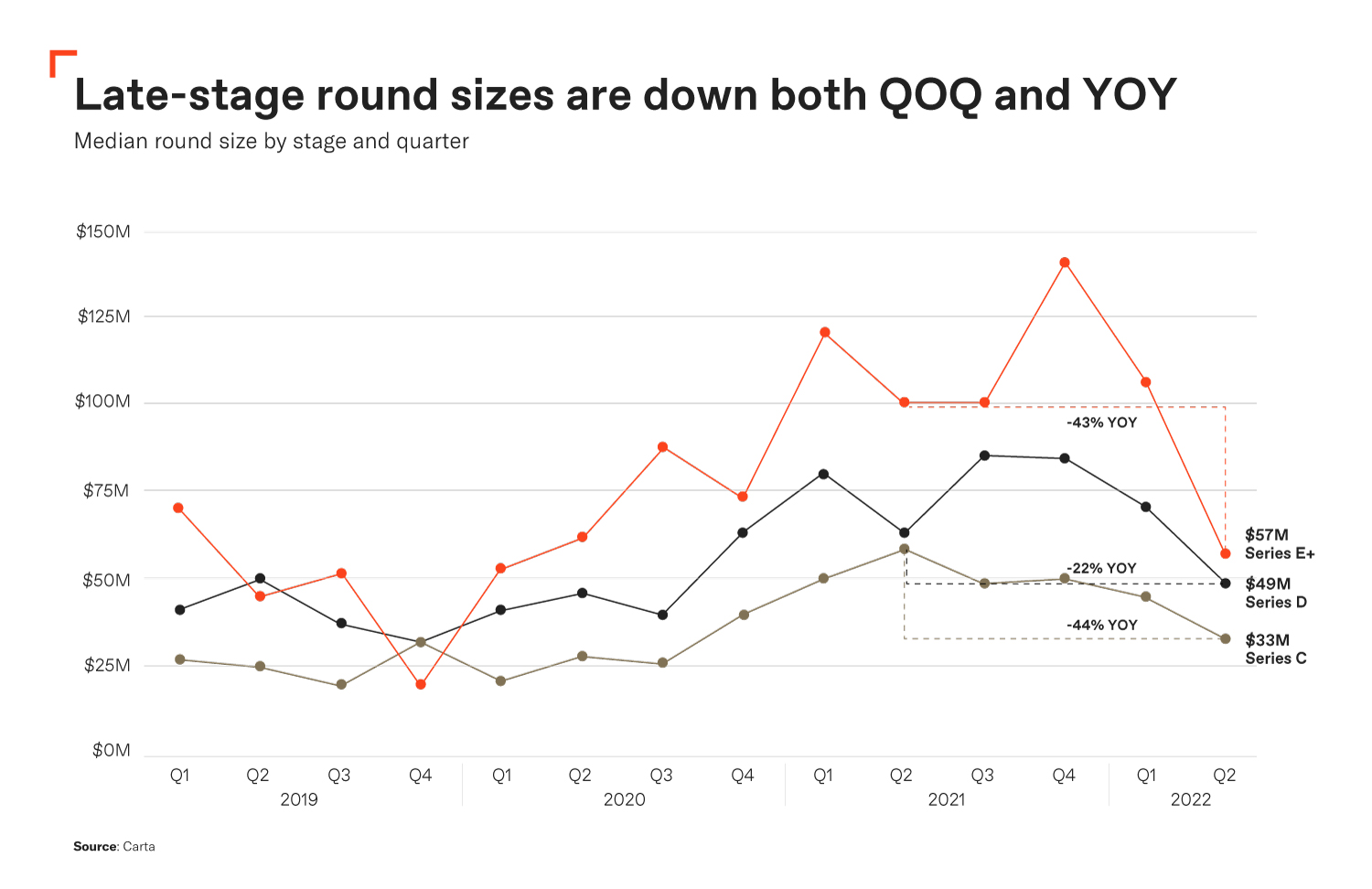

According to Maps, the level of private fundraising in the United States is down from 2021. Incredibly latecomers have suffered the brunt of this.

Nowadays, marketers are encouraging leaders. no i don’t Although there is plenty to pin their hopes on venture capital dry powder. As the graph below indicates, the volume of late-stage funding rounds has decreased.

Image Credits: founder shield

Although few are excited about a market crash, it can provide insights for late-stage companies paying attention to how it unfolds. On the one hand, many leaders are embracing the Sequoia Note message. We can agree with their thoughts on prioritizing profit over growth – scaling is different than it used to be and we need to swallow that bitter pill.

On the other hand, it’s not all doom and gloom to cut costs and abandon fundraising hopes. After all, when there is money to be found, some innovators will find it. We see it every day; Only now the path seems different.

Market declines trigger valuation adjustments.

Course correction is a frequently discussed concept in market downturns. The pendulum swings one way for a period of time, then begins its journey back to equilibrium. In this case, the open market was rich with inflated valuations – most startups were overvalued before 2021.

Additionally, 2021 was said by many to be a miracle year, especially as VC investment nearly doubled to $643 billion. The US saw more than 580 new unicorns and more than 1,030 IPOs (more than half were SPACs), which is significantly higher than last year. It received only about 170 public listings this year.

[ad_2]

Source link