[ad_1]

Key insights

-

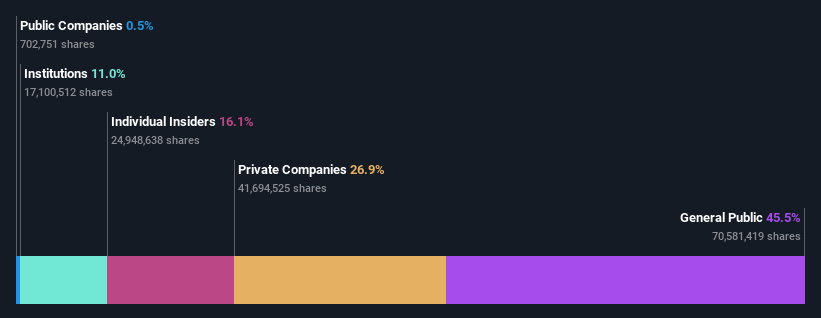

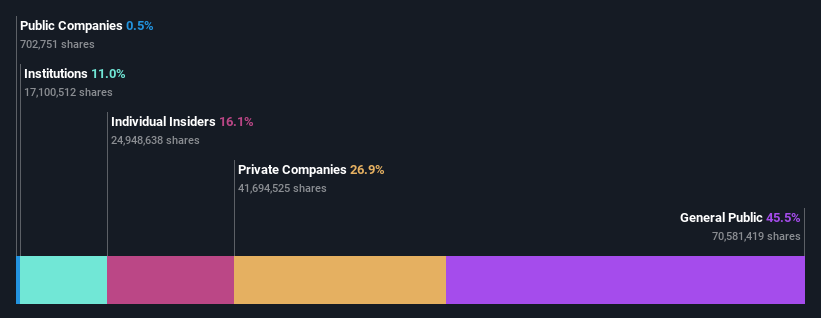

Helloworld Travel’s ownership by significant retail investors suggests that its key decisions are influenced by shareholders from the general public.

-

The top 6 shareholders own 50% of the company.

-

16 percent of HelloWorld travel is booked by adults.

If you want to know who controls Helloworld Travel Limited (ASX:HLO), you should look at the make-up of its share register. We can see that retail investors hold the lion’s share in the company with a 46 percent ownership stake. In other words, the group stands to gain the maximum (or maximum loss) from their investment in the company.

On the other hand, private companies hold 27 percent of the company’s shareholders.

Let’s take a closer look to see what various stakeholders can tell us about HelloWorld Travel.

Check out our latest analysis of Helloworld Travel

What does institutional ownership tell us about Helloworld’s journey?

Many institutions measure their performance against an index that approximates the domestic market. Therefore, they usually pay more attention to companies that are included in the main indexes.

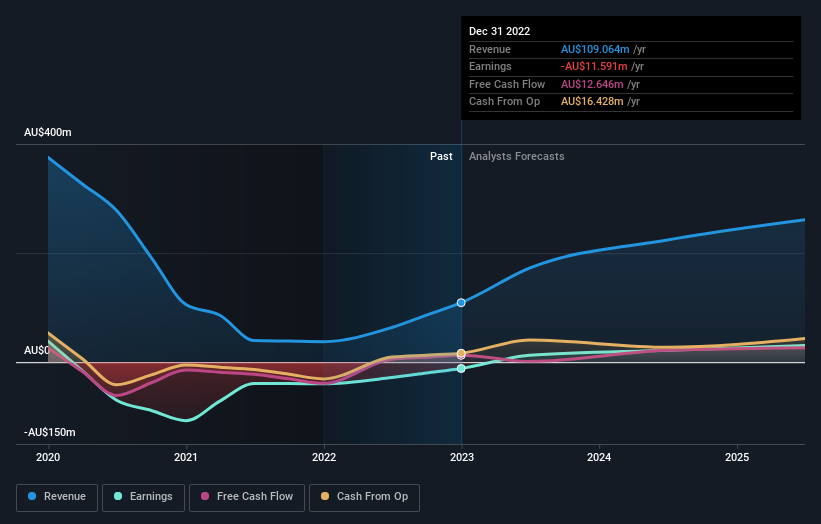

Helloworld Travel already has establishments in the stock register. Of course, they have a respectable share in the company. This shows some credibility among professional investors. But institutions sometimes make bad investments, so we can’t just rely on that fact like everyone else does. If two large institutional investors try to sell out of a stock at the same time, it is common to see a large stock price drop. So it’s worth checking out the past earnings of Helloworld Travel (below). Of course, keep in mind that there are other factors to consider.

We note that hedge funds do not have a meaningful investment in Helloworld Travel. Looking at our data, we can see that the largest shareholder, Syntech Pty Ltd, has 13 percent stake outstanding. Burns Group Pty Ltd and Fidelity International Ltd are the second and third largest shareholders with 13% and 9.3% stake respectively. In addition, the company’s CEO, Andrew Burns, directly holds 6.6 percent of the total shares.

On further inspection, more than half of the company’s shares are owned by the 6 largest shareholders, and we have pointed out that the benefits of the largest shareholders are somewhat balanced by the smaller ones.

While it makes sense to study a company’s institutional ownership data, it also makes sense to study analyst sentiment to determine which way the wind is blowing. There are many analysts who cover the stock, so it may be worth seeing what they are predicting.

Insider ownership of Helloworld travel

The definition of insider may vary slightly between different countries, but members of the board of directors are always considered. Management ultimately answers to the board. However, it is not uncommon for managers to be board members, especially if they are the founder or CEO.

Insider ownership is positive when it indicates that management is thinking like the real owners of the company. However, high insider ownership can give a small group within the company greater power. This can be negative in some cases.

Our data indicates that insiders hold a significant position in Helloworld Travel Limited. Insiders have a stake of AU$64m in this AU$397m business. This may indicate that the founders still hold more shares. You can click here to see if they were buying or selling.

Total public ownership

The general public, who are usually individual investors, own 46% of Helloworld Travel. While this group can’t necessarily call the shots, it can have a real impact on how the company is run.

Owned by a private company

According to our data, private companies hold 27% of the company’s shares. It is difficult to draw any conclusions from this fact alone, so it is worth investigating who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next steps:

I find it very interesting to see who owns the company. But to gain true insight, we need to consider other information as well.

I like to dive deep. How a company has performed in the past. In this you can find historical income and income Detailed graph.

If you’re like me, you might want to wonder if this company is growing or shrinking. Fortunately, you can check out this free report that shows analytical predictions about the future.

Note: The figures in this paragraph are calculated using data from the last twelve months, which refers to the 12-month period ending on the last day of the month in which the financial statements are completed. This may not be consistent with the full year annual report figures.

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality content. Simply put, Wall St has no position in any of the listed stocks.

Join a paid user research session

They receive a. $30 Amazon gift card 1 hour of your time helping us build great investment tools for individual investors like yourself. Register here

[ad_2]

Source link