[ad_1]

Morgan Stanley started coverage on the shares Global Business Travel Group (NYSE:GBTG – Get Ratings ) In a report released on Wednesday, The Fly reported. The company has set an “equal weight” rating on the stock.

Morgan Stanley started coverage on the shares Global Business Travel Group (NYSE:GBTG – Get Ratings ) In a report released on Wednesday, The Fly reported. The company has set an “equal weight” rating on the stock.

Separately, Redburn Partners began coverage on Global Business Travel Group in a research report on Tuesday, June 21st. They set a “buy” rating and a $12.50 price target on the stock.

Shares of International Travel Group fell 1.7 percent

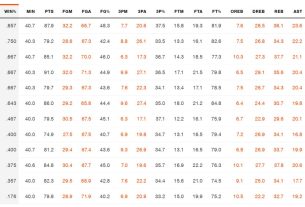

NYSE:GBTG opened at $7.12 on Wednesday. The company has a debt-to-equity ratio of 0.96, a quick ratio of 1.65, and a current ratio of 1.65. The firm has a 50-day moving average of $6.85. Global Business Travel Group has a 52-week low of $5.16 and a 52-week high of $10.02.

Hedge Funds Weigh On Global Business Travel Group

Institutional investors have recently bought and sold shares of the business. Credit Suisse AG bought a new stake in shares of Global Business Travel Group in the second quarter valued at about $69,000. Virtu Financial LLC bought a new stake in shares of Global Business Travel Group in the second quarter worth about $80,000. Prelude Capital Management LLC purchased a new stake in shares of Global Business Travel Group in the second quarter valued at approximately $271,000. Cobalt Capital Management Inc. bought a stake in shares of Global Business Travel Group in the second quarter valued at $327,000. Finally, Dendur Capital LP purchased a new stake in shares of Global Business Travel Group during the second quarter valued at approximately $876,000. Institutional investors and hedge funds own 18.27% of the company.

About the international business travel group

(get rank)

Global Business Travel Group, Inc. provides a business-to-business (B2B) travel platform. The company’s platform provides technology-enabled solutions for business travelers and corporate clients, travel content providers and third-party travel agencies. Its platform manages travel, expenses and meetings and events for companies.

Featured stories

This quick news alert was created using Narrative Science technology and MarketBeat financial data to provide readers with fast and accurate reporting. This story was reviewed by the MarketBeat editorial team before publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider an international business travel group, you’ll want to hear this.

MarketBeat tracks Wall Street’s top-rated and best-performing research analysts and the stocks they recommend to their clients daily. MarketBeat identified the five stocks that top analysts are whispering to clients to buy before the broader market begins… and Global Business Travel Group was not on the list.

While Global Business Travel Group currently has a “Buy” rating among analysts, top rated analysts believe these five stocks are better buys.

Check out the five stocks here

[ad_2]

Source link