[ad_1]

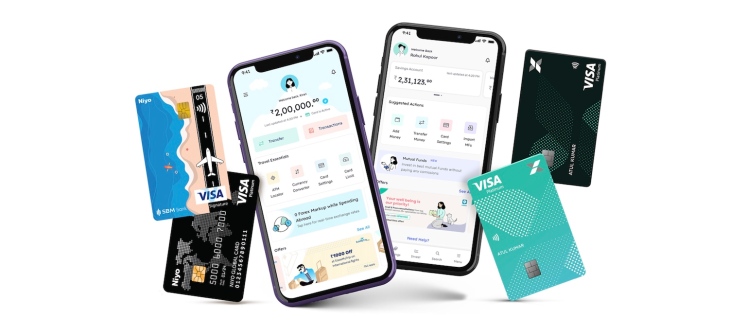

General Atlantic has invested another $100 million in PhonePe, leading a $350 million investment in the Indian fintech startup, which has so far raised $750 million in its ongoing financing round.

Walmart-backed PhonePe disclosed the investment in a filing with local regulators on Wednesday. A company spokesperson confirmed the investment. The ongoing round is valued at $12 billion for the Bengaluru-headquartered startup. PhonePe is looking to raise up to $250 million in the next round.

With a valuation of $12 billion, PhonePe is India’s most valuable fintech startup. It competes with Google Pay and Paytm, the latter currently valued at around $5 billion.

PhonePe, which completed a full spin-off from e-commerce giant Flipkart last year, will handle transactions on UPI, built by a consortium of Indian retail banks. UPI is the most popular way Indians transact online – processing over 8 billion transactions a month. Google’s GPay and PhonePe currently handle more than 80% of UPI transactions.

Seven-year-old PhonePe commands about 50% of these transactions by price and is not slowing down. The company said earlier this year that it is on pace to process $1 trillion in annual transactions.

Walmart, which owns a majority stake in e-commerce giant Flipkart, said earlier this year that the separation of Flipkart and PhonePe is very similar to that of eBay and PayPal, each of which will be able to pursue their own initiatives.

General Atlantic has backed several Indian companies over the past decade, including Jio, Bildesk, Baijus, Amagi, Nobroker and Unadami, and plans to deploy at least $2 billion to $3 billion in India over the next five to seven years. People familiar with the plans of the New York-headquartered growth equity investor.

The new investment comes at a time when PhonePe is significantly expanding its product offerings. The startup earlier this month launched a hyperlocal commerce app called Pincode, powered by the Open Network for Digital Commerce (ONDC), an Indian government initiative that strives to democratize the e-commerce landscape by offering a zero-commission platform.

PhonePe said it will work hard to enable every Indian shopper to reach every lane and every corner in the next few years through Pincode.

PhonePe is looking to capitalize on its 450 million strong registered user base by expanding into additional financial services including wealth management, lending, stock raising, ONDC-based trading and account aggregation.

A possible hindrance to PhonePe’s growth is the National Payments Corporation of India (NPCI), which regulates the UPI network, and has sought to impose market share restrictions on players. However, NPCI has extended the deadline for compliance to 2025, allowing PhonePe two more years of rapid expansion.

In another good development, the Reserve Bank of India, the country’s central bank, has decided to abandon its ambitious project that was initially planned to compete with the UPI platform.

[ad_2]

Source link