[ad_1]

TThe upheavals of recent years have posed major challenges for established companies, but for others, rapid change can represent great opportunities. Entrepreneurs are breaking new ground in important new areas, from artificial intelligence to biotechnology and ultra-smart energy meters. Here, we look at six companies that are taking advantage of the best time.

Green energy options

This year, keep an eye out for green energy options from a Cambridge-based energy specialist. Known as Jio, the company was founded in 2006 as a conventional smart meter business and has quietly grown to supply more than 8.5 million devices to date. The energy crisis could further boost business as households scrutinize their usage to cut costs.

Geo Energy Management System can reduce the heating when a house is empty. It also automatically activates appliances to be used when they are cheapest, which can save an estimated 10p per kilowatt-hour (kWh) or more. That could reduce demand for fossil-fuel-fired generation, which still depends on peak periods. GeoTech also charges electric vehicles during off-peak hours to save on motoring costs, and estimates the firm has saved customers £800m and 20 terawatt hours of energy in total.

Initially introduced as part of a smart meter rollout from energy suppliers, the devices can eventually be retro-fitted into any home with a smart meter.

The privately-owned firm saw losses rise in the last financial year and cut prices as the virus restricted access to homes. But this year sales are expected to more than double to £25m. Alex Lawson

Autolus Therapeutics

In the UK biotech sector, Autolus can go places. In the year Spinned out of University College London in 2014, the business develops programmed T-cell therapies—also known as living drugs—that rebuild patients’ immune systems to detect and attack cancer.

Autolus floated on the Nasdaq four years ago, raising $160m and a further $150m (£125m) from investors including British life sciences investment firm Cinchona. It also counts Blackstone Life Sciences, the UK biotech company’s largest private equity investment of up to $250m, among its backers.

Autolus has partnerships with major pharmaceutical manufacturers such as Bristol Myers Squibb and Moderna. This month, it announced what analysts at Numis described as “impressive” in mid-stage clinical trials for adults with acute lymphoblastic leukemia, a deadly form of blood cancer without treatment. Autolus plans to file the treatment for regulatory approval in the US in 2023 – the most advanced.

Confident in its success, the company is preparing to go into production: it has commissioned a cell manufacturing plant capable of producing at least 2,000 patient products per year. Julia Kollewe

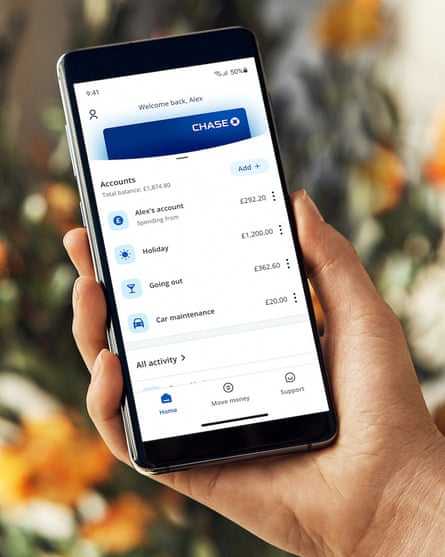

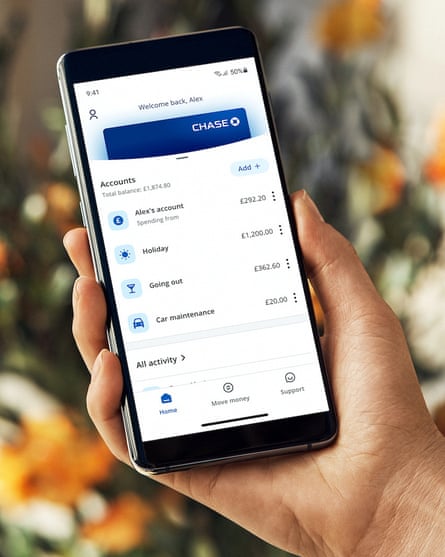

Chase UK

Britain’s once comfortable high street banks face a double threat: on the one hand from start-ups such as Monzo, Revolt and Starling Bank, and on the other from formidable Wall Street rivals in the retail banking sector.

One big name among American investors is JP Morgan. His Chase UK current account launched in September 2021, more than three years after Goldman Sachs introduced its Marcus savings account to the British public. But within 12 months, America’s biggest bank by assets managed to win over Marcus’s 750,000 account holders with a million of its own UK customers, with offers such as cashback and competitive interest rates. Chase offers 2.7% savings starting January 4th.

While it still lags behind Monzo’s 6 million users and Starling’s 3 million accounts, the pace of adoption is impressive. Between May and September this year, Chase doubled its user base and secured more than £10bn in deposits.

JP Morgan appears to be acquiring clients at a loss in hopes of long-term profits. The bank announced in May this year that it is set to lose more than $1 billion in venture capital in the coming years, not even expecting to break even until 2027-28.

Mortgages, credit cards and other traditional banking products are expected to be one of Chase UK’s by 2023. Kalina McCortoff

Level mobility

Dot, Voi, Lim… Electric scooter and bike operators are swarming the country and lower city streets, all vying for customers, but which one will win?

Bird, one of the biggest players in the United States, warned of possible losses. Voy and Superpedestrian laid off their staff. The sector seems ripe for consolidation. Lim is best capitalized, backed by taxi app company Uber, but European players have a strong foothold on the continent. Berlin’s ranking is one of Europe’s most competitive.

It was directed by Lawrence Lushner. It was co-founded in 2018 and has raised more than $600 million in equity and debt, including from Japan’s SoftBank and Abu Dhabi’s state-owned Mubadala. However, Thier is caught up in a 2022 turnaround of the broader tech company, and in August cut 16 percent of its workforce — 180 people — to “focus on profitability.”

In this difficult situation, Rank and its rivals must strike a difficult balance between continuing to spend on expansion into new cities and chasing real profits, as investors now have to wait years for revenues from startups. Who will continue to pedal? Maybe level. Or maybe it’s someone else. Gwyn Topham and Jasper Jolly

Baidi

No Chinese car brand has been popular abroad.

The transition to electricity – designs that start from a blank sheet of paper – is changing everything. Chinese carmakers are hoping to go global with battery models, and Shenzhen-headquartered industrial powerhouse BID could be among the leaders of the pack with European expansion on the cards by 2023.

BID is the world’s largest manufacturer of electric cars, overtaking Tesla in July, and has been supported by the world-famous investor Warren Buffett since 2008 (this bet earned his company Berkshire Hathaway billions of dollars). It is now launching three new models in Europe, going toe-to-toe with the biggest Western brands.

BYD is also the third largest car manufacturer by market value. If it can crack Europe, it could be the crown for Tesla. Jasper Jolly

Stability AI

In the year Founded in 2020 by former hedge fund analyst Imad Mostak, Stability AI develops artificial intelligence software that other businesses can use for free, though customers can pay if they want more bells and whistles. It describes itself as a “community” for producing music or applying machine learning to biological and pharmaceutical problems, but its main product is an automatic image generator.

Stable Distribution can take regular English sentences and turn them into high-quality pictures in seconds. The technology has been used by newspaper writers to create illustrations for their emails, by artists to generate backgrounds or details for their works, and by game developers to create new kinds of multiplayer experiences. Built with £500,000 of Mostaque’s own money and then given to developers in an open source model, it has reached a wider audience than some of its rivals.

Headquartered in London’s Notting Hill, the company, valued at more than $1 billion, has taken $101 million in outside funding, worked hard to eliminate copyright infringement and offensive images, and released a second version of Stable Diffusion, which produces better pictures. The long-term plan is to continue offering the basic trained model for free, while profiting from a hosted API version that businesses can use if they don’t want the technical overhead of running and tuning the AI model themselves. Alex Hearn.

[ad_2]

Source link