[ad_1]

Boarding 1 now

I’ve been looking at airport stocks for investors to take advantage of the growth in air transport demand. In my view, airport stocks offer better stability than airlines where overcapacity, pilot and aircraft shortages play a major role, for example. Airport Names are more attractive in this regard, with business risks supporting the need for air travel and maintaining a diverse and attractive portfolio of airports. No Covered Fraport AG (OTCPK:FPRUF) last month, the company announced that it was unable to pay a dividend during a cash-strapped period, but that its business was recovering well. with him First quarter results In, I am visiting the name of the airport.

How do airports make money?

So how do airports make money? It is basically two sources of income; The first is aeronautics. Revenues include landing and departure fees, passenger fees, terminal space rental, security and aircraft parking. The second stream is non-aeronautical revenues, which include things like parking, car rentals, ground transportation, retail, food and beverages, and fast track.

Therefore, there are two sources of income that are ideal for wrapping up travel reimbursement. On the one hand, airlines increase their flight schedules again, which benefits the airport through aeronautical revenue. On the other hand, the passengers are returning to the terminal halls, and they have money to spend, which will benefit the commercial revenue, which is a large part of the non-airline revenue.

So, as an airport, to make money, you have to appeal to airlines that offer smooth operations and offer travelers a different experience.

Fraport Operations: Which airports does Fraport operate?

Fraport’s cash cow is Frankfurt Airport, but the company also has a portfolio of airports in Greece, such as Corfu, Kos, Santorini, Zakynthos and Rhodes, which perform strongly in summer leisure travel. In addition, the airport in Antalya, Turkey, which is jointly operated with TAV Airports, and the airports in Varna and Burgas, Bulgaria, feed Sunny Beach tourism. In addition, retail space through Fraport USA is being marketed at some US airports, with Fortaleza and Porto Alegre airports in South America and Lima in Peru.

Fraport is in recovery mode.

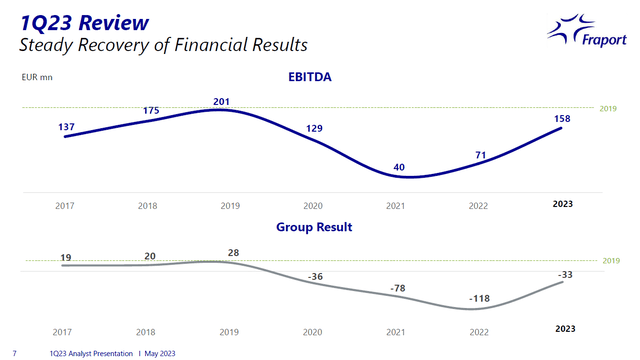

Freeport

We see EBITDA improving by over 120% year-on-year. There’s still some way to go to reach pre-pandemic levels, so the recovery phase isn’t V-shaped for Fraport, but it’s progressing satisfactorily with some headwind potential. Frankfurt Airport achieved 77% of 2019 levels, despite the loss of flights to Russia and Ukraine, and despite strikes, capacity constraints and China’s recovery should still accelerate. The complete group returned 89% of passenger inspection views. This was followed by a 98% recovery in Greece, a full recovery in Antalya and a 141% recovery in Bulgaria’s Sunny Beach Airport. Therefore, clearly holiday destinations are leading.

Aviation segment revenues were up 98% and EBITDA exceeded 2019’s level of €38 million by €2 million. However, this is due to a one-time security clearance of 22 million euros. Either way, aided by higher airport fees and higher volumes, the aviation segment should see revenue growth above pre-pandemic levels. Retail and real estate revenues returned 93% and EBITDA of €79 million returned 78%. EBITDA was burdened by higher energy costs of €18 million and 2019 achieved a turnover of €12 million. Adjusted to look at operational performance alone, we can conclude that this segment is largely operationally regressive.

Land management is where things get challenging. Year-on-year revenue growth should be driven by better rates and higher volume, but compared to pre-pandemic levels, revenue has returned 88%, but EBITDA is at a loss of €24 million compared to a profit of €5 million. Higher wages and costs for temporary foreign workers are driving the division into a loss position for Q1, otherwise it would have seen a loss of 7 million euros.

The Global Services segment saw revenues 34% above 2019 levels, while its EBITDA was 12.5% above 2019 levels.

If we add it all up, traffic is back 90% and adjusted revenue is back 96% due to a proportional increase. EBITDA recovery, however, is trailing slightly with a 79% recovery due to land management, labor and security business restructuring costs.

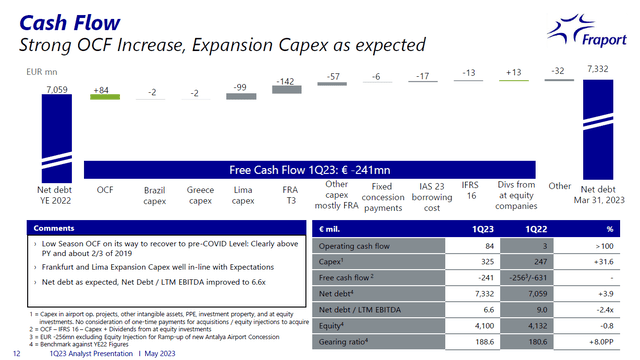

Freeport

Cash flow increased year-on-year from EUR 3 million to EUR 84 million. However, due to higher capital expenditure for Lima Airport and the new Terminal 3 in Frankfurt, cash flow was negative €241 million, a slight improvement from the €256 million expenditure for New Antalya Airport excluding the equity injection.

CapEx is driven by the project in Lima, which is a large project that will build a new ATC tower, taxiway, highways and a new terminal, a new runway. It has the capacity to handle 40 million passengers and from 2025 to 2041, Fraport, which has an 80 percent stake, will pay for that investment. Similarly, the CapEx for building Terminal 3 in Frankfurt was 142 million euros, which in 2016 It should start paying in 2026. There is still 2 billion euros in CapEx, which will be lost this year and next year. So, until 2024, there is some increased CapEx, but those investments should start paying off around the same years.

Is Fraport worth your investment?

There are a few things you should consider when considering Fraport AG as an investment. It is currently spending high capital expenditures, and will continue at higher levels this year and in 2024, but as EBITDA continues to improve and Lima comes into operation, we should see a drop in CapEx. I do not expect a dividend before 2025. Putting the numbers for Fraport in my model, there is no reason to buy Fraport. Fraport is another name you should consider adding to build a low-cost base for the moment when dividends return and the company begins to grow earnings following its long-term growth trajectory for air travel.

Conclusion: Fraport Stock is not very attractive.

I’ve been to Rhodes, Burgas and Varna airports, all part of Fraport’s airport portfolio. They are not attractive airports, rather they are easy airports to process tourists. Those airports are now pulling the wagon to Freiport as Frankfurt Airport slowly recovers.

Freeport is working through CapEx to reap the rewards in the years ahead, which should benefit investors with a higher share price and a dividend that should be restored first and increased later. Therefore, I see a long-term opportunity in Fraport AG, but from a fundamental perspective there is no strong incentive to buy Fraport AG stock. The only reason I would consider buying Fraport AG stock right now is to maintain a strong cost base for dividends and future share price appreciation, but I feel like I’m putting your money away for a couple of years. That doesn’t sound very attractive to me, and Fraport AG’s first quarter results also included a significant increase in labor and energy costs.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link