[ad_1]

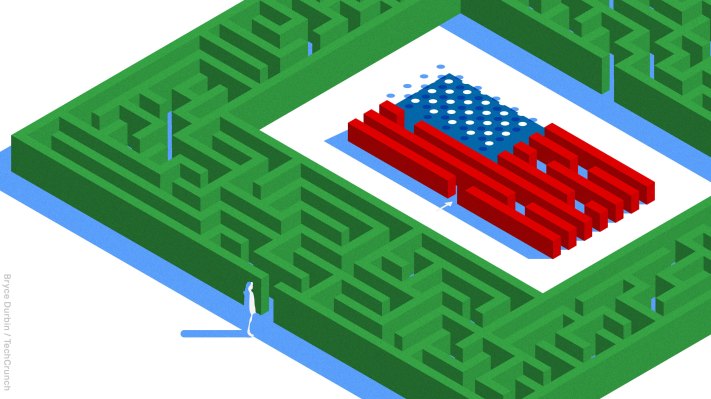

The private-market equity marketplace is a bet that unicorns stay illiquid

Forge Global will begin to trade on the New York Stock Exchange today, having completed its merger with Motive Capital Corp as part of a SPAC combination. TechCrunch covered the blank-check tie-up when it was announced last September. Our first look at the deal’s metrics is here.

To say that the IPO market has changed since last September is an understatement; the pace of public offerings from tech startups has slowed to a crawl in the wake of a sharp repricing of the value of technology stocks since late-2021 highs. Richly valued private companies that might have targeted IPOs have pulled back on plans and the rate of new S-1 filings is de minimis.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch + or get The Exchange newsletter every Saturday.

This makes the timing of Forge’s public debut illustrative. The company’s combination and flotation will at once provide a data point regarding market appetite for such deals, and the company’s stock price will also reflect, to some degree, the level of investor optimism in other companies not going public.

Let me explain. Forge operates a market for private shares – equity in unicorn startups, basically. And because the company’s business model is largely transaction-based, the more that folks buy and sell those shares, the more money that Forge earns.

Let me explain. Forge operates a market for private shares – equity in unicorn startups, basically. And because the company’s business model is largely transaction-based, the more that folks buy and sell those shares, the more money that Forge earns.

Optimism, therefore, about the company’s future is predicated on its supply staying high; too many IPOs would limit private-market availability of shares in hot companies, constraining Forge’s growth prospects.

The irony is this: The better that Forge fares when it trades today, the more likely it is that other tech companies will get off the bench and start to consider – once again – the public markets. If they do, the act could limit Forge’s market by reducing the number of unicorns that investors want access to, but cannot in normal ways given their private-market status. We’ll talk more about this in a moment.

The tensions between Forge’s public-market success and the pool of companies it wants to list on its private market, however, are modest in comparison to the sentiment impact from the company’s trailing performance and the cash haul from its SPAC deal. So before we get too lost in our market theoreticals, let’s talk hard numbers.

Cash, growth, and guidance

In its SPAC investor deck, Forge said it would record around $ 123 million in 2021 revenue and $ 151 million in 2022 revenue. But as we’ve seen some SPAC combinations miss guidance, we’re going to check Forge’s 2021 actuals to see not only how the company did, but how it performed compared to prior guidance.

Here’s what the company reported for 2021 revenues earlier this year and what it expects for 2022, based on the most recent data:

[ad_2]

Source link