[ad_1]

Ilya S. Savenock

Introduction

Fevertree (OTCPK:FQVTF) is an example of a great business going through tough times. Indeed, in recent years, sales have been going well and the brand has been strengthened by gaining market share In some markets, geopolitical uncertainty and still-troubled supply chains are weighing on margins. The decline in profitability weighed heavily on the stock price, causing it to fall to what I would call an attractive level. Now, analysts are very pessimistic about the future of Fevertree, in fact the current estimates do not envisage profits returning to pre-Covid levels.

All great businesses have fallen on hard times, sometimes due to management mistakes, other times due to macroeconomic factors. When these events occur, it is important to consider whether these problems are temporary or permanent. For the reasons they explain Later, I believe that Fevetre’s current problems are temporary and it can return to a more than satisfactory level of profitability while growing its earnings significantly.

Business

Fevertree operates in the premium segment of the cocktail mixer sector. The company It was founded in 2004 by Charles Roll and Tim Warrilow (current CEO) with the aim of filling what for them was a gap in the market. The cocktail mixer market has been focused for years on the proliferation of brands and price cuts, inevitably reducing the flavor of the products they sell. We can see it as a market where big brands like Schweppes don’t feel a great need to invest capital in R&D and product improvement, because it was not an option. Fevetre has undoubtedly been a first mover since its inception, offering high-quality mixers made with unique ingredients. Their motto: “If ¾ of your drink is a mixer, mix it with the best.” They have achieved remarkable success in winning significant market shares, they are the market leader in the UK with a 45% market share and in Europe they are outgrowing their competitors and achieving market growth.

Their business model is very streamlined as they rely on key partners to bottle and distribute everything.

Interim Report FY22

This business model requires very low CapEx compared to the operating cash flow that the company can generate, so this leads to a good FCF. The disadvantage of this strategy is that there is little control over the production chain and the partners to cooperate with must be chosen very carefully.

2016-2021 (really)

Fevetrey’s business partners are companies established in the sector, which gives the opportunity to effectively enter the sector, especially in relation to the on-business segment.

Fevertree business can be divided into two parts; Off trade and on trade. The non-commercial segment deals with direct sales to consumers. On-business, on the other hand, has other businesses such as bars, hotels, and casinos. We have received some news regarding business partners in Canada, where the transition of Tree of Life to Canada is completed on September 1 2022, that they will no doubt cooperate with Asahi breweries in Japan from January 1 2023, which will no doubt help the spread of the fever. Products in this market. In the year In 2018, Fevertree signed an agreement with Southern Glazers, the largest alcohol distributor in the US. Southern Glazers has a 35% market share in wine and spirits distribution and can distribute spirits products in the commercial market. Although on-trade has a lower TAM than off-trade, it is a good way to build brand image and also drive growth in the off-trade market. Another strategy used to improve the brand in the eyes of consumers is to use advertising campaigns in collaboration with major alcohol brands.

Annual Report FY21

Fevertree strategy

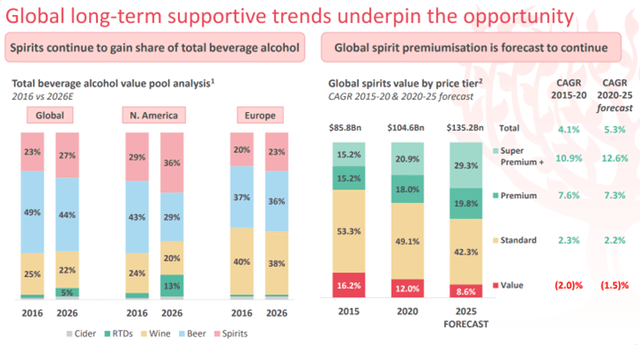

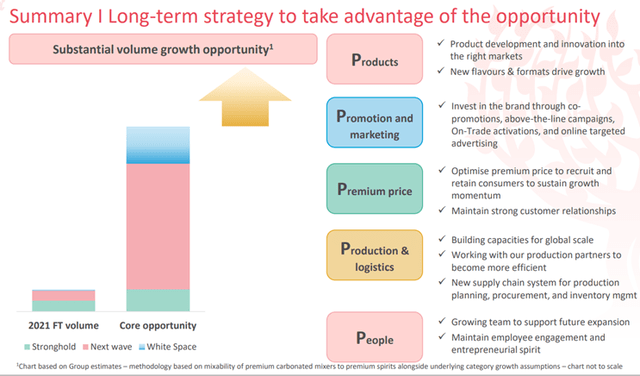

Spirits have been gaining market share over other beverages like beer or wine for a few years now, and the spirits premium segment is driving growth. As more and more people prefer to spend more money to drink high quality spirits, Fevertree follows this trend by giving people access to high quality mixers.

Interim Report FY22

The main focus of the company is on the quality of the products, research and the use of the best ingredients that can be found around the world. Another goal is to win more and more shares in the on-trade market (they are already leaders in the UK with a 50% market share) which will result in growth in the off-trade market.

Interim Report FY22

In terms of production and logistics, they are trying to reduce the use of sea freight as much as possible, using sea plants in the most difficult to reach markets. In the last couple of years they have had problems with the new plant in the USA and this has caused a significant erosion in the margins of manufacturing in the UK and then shipping the products. We should see improvements in 2023.

Financial overview

in fact

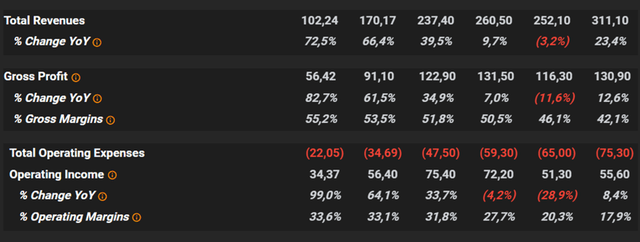

In the image, you can get an overview of Fevertree’s results from 2016 to 2021. Revenue growth was very strong, to triple the revenue in 5 years, growth in the sector and increase in market share. The deterioration in gross margin in the past period is due to the logistics and raw material cost issues I mentioned earlier, which may also be responsible for the decline in operating margin.

in fact

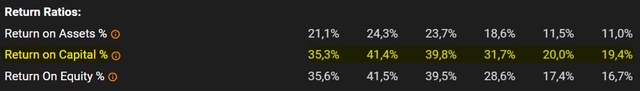

At the same time, the ROC has been impressive and even in 2021 it remains at an excellent level of around 20%. In the coming years, as margins improve again, I believe we can expect capital levels to return between 25%-30%. The balance sheet is fantastic; The latest quarter shows the company has cash and cash equivalents of £166 million and total liabilities of £54.5 million. We are unlikely to see Fevertree fail.

in fact

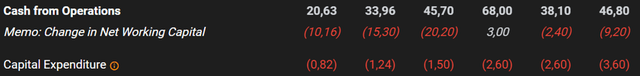

The cash flow statement is excellent. The company Cash from operations made good progress in 2019, hitting a record high of £68 million and then declining over the next two years. CapEx is very low thanks to the asset-light business model and this allows it to generate a high amount of FCF that can be reinvested in the business.

Price

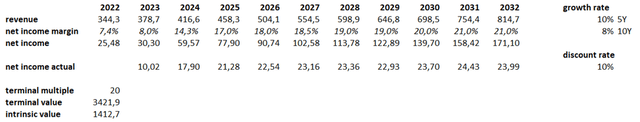

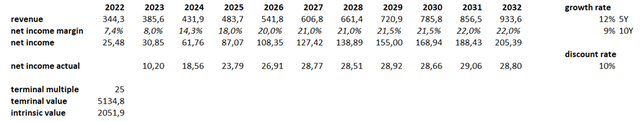

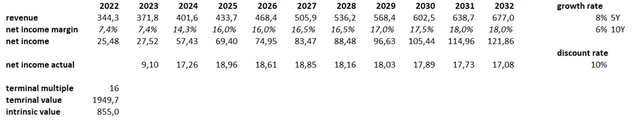

I consider three hypothetical cases with different growth and profit assumptions. The discount rate I used is 10%. In this review I consider a gradual return to “normal” margins. Also note that current management guidance is for 2023 revenues of between £390-£405m, up 13%-18% in 2022.

- Base containerCAGR 10% to 2027; 8% by 2032

The author’s opinion

- Best caseCAGR 12% to 2027; 9% until 2032

Author’s opinion

- The worst caseCAGR 8% to 2027; 6% until 2032

Author’s opinion

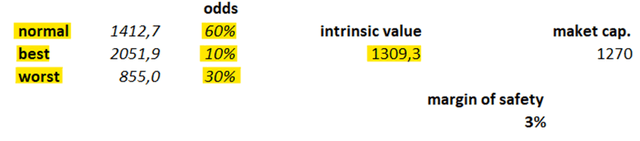

Taking the average of the values obtained, we have an intrinsic value of approximately £1.3 billion.

Author’s opinion

I think I’m conservative enough in my estimation and I believe Fevertree can do even better than I thought. Given that, even with these conservative estimates, the fact that the company appears to be fairly valued leads me to believe that there is a decent margin of safety. I’ve already invested a small portion of the total space I want to build in Fevertree, I’d rather wait for the margin of safety to be bigger and therefore lower the price to make more substantial entries.

Accidents

My investment research and assessment is based on the assumption that Fevertree can at least partially re-establish the level of profitability of the past years in the next few years. If this situation does not happen, all estimates should be revised downwards and as a result the price will decrease, and at these prices the company seems to be overvalued. I think the chances of this happening are low.

Another risk to consider is competition. Although Fever has a leading position in the premium sector, the possibility of new competitors entering this market segment and winning the relevant shares cannot be excluded. If this happens, we will see price competition, which may lead to the deterioration of the company’s profitability. If the management continues to work with the current strategy and focuses on the commercial part of the business as a way to enhance the brand image, I believe that they will be able to maintain their reputation and position.

Summary

As I mentioned in the introduction, Fevetre is a very good business that is going through a tough time. I believe that analysts’ expectations about the company’s future profitability are extremely pessimistic and therefore I think Fever can beat these expectations in the coming years. Currently the company’s market value is in line with my calculated intrinsic value, if the assumptions I have made are not correct the company’s value could be much lower than it is now. If you are satisfied with a good risk-reward ratio, Feverree can be a good investment choice right now. If the stock price experiences further downward pressure due to short-term negative news, the risk-reward ratio may be very favorable.

Editor’s Note: This article discusses one or more securities that are not traded on a major US exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link