[ad_1]

Shenzhen Gong

Supply constraints that have plagued global electronics manufacturers since early last year worsened in July as demand in key industries weakened. Since the middle of 2020, new orders received by electronics manufacturers have decreased significantly In Asia’s major manufacturing hubs, such as China and Taiwan, it reported a blanket collapse in demand from both large developed markets such as Europe and the US. Falling sales for electronics companies in key industries like tech and auto will add more woes to an already troubled sector.

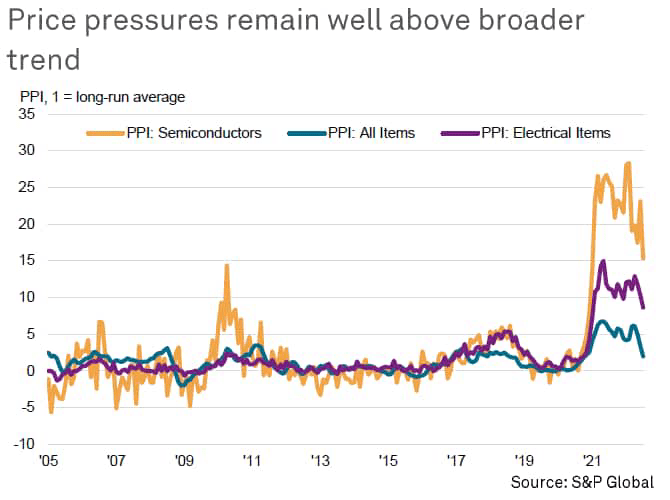

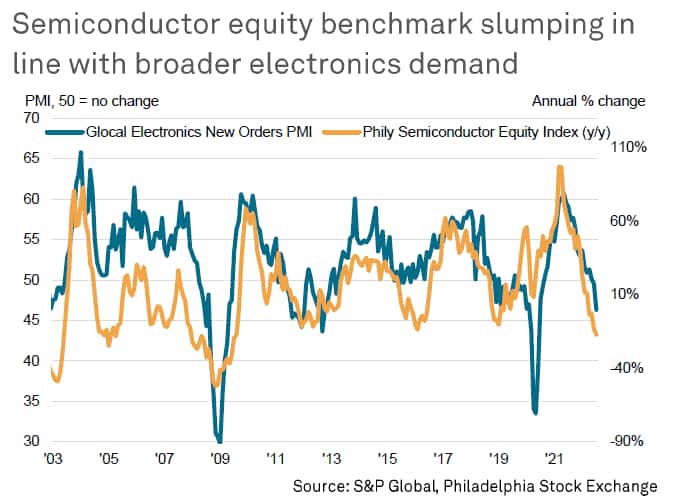

Indicators of proprietary supply shortages and price pressures from S&P Global Market Intelligence’s PMI surveys provide further evidence that a worldwide shortage of semiconductors and continued high inflation are squeezing profitability for chip-based companies. Although these pressures have eased slightly, this is mainly due to declining demand due to worsening global economic conditions. The increasing demand for semiconductors has caused problems for technology stocks, the Philadelphia Semiconductor Index (SOX), which covers the 30 largest US companies involved in the production, design and sale of microchips, has shown a significant decline this year.

Delayed normalization in semiconductor stocks will send price pressures sky high

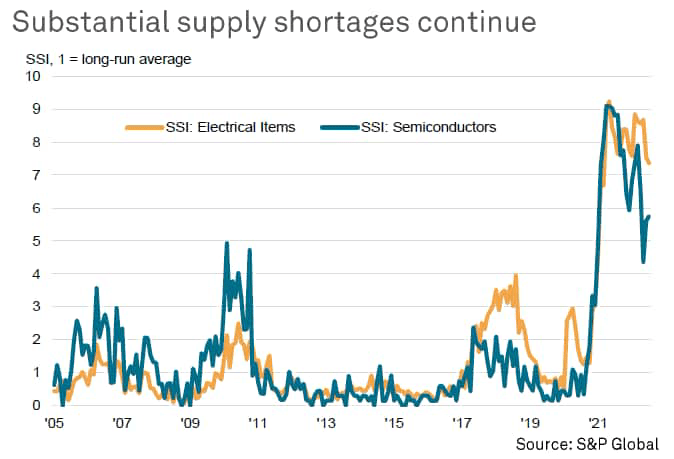

Although we have seen data showing that the shortage of electronic and electrical equipment has decreased from a high level last year, our ownership data suggests that the shortage is still at a high level (see chart). Semiconductor shortages in July were about 6 times the long-term average. New blockades in China and disruptions at Shanghai ports have recently exacerbated the problem, increasing in scale.

As such, price pressures are high, especially when compared to the broader trend in other commodities included in our tracker (see this note for more details). While price pressures in “all commodities” are about twice what would be considered “normal” levels, semiconductor prices are running at about 15 times their historical average.

Tech, auto and electronics will struggle amid high cost pressures and declining global demand

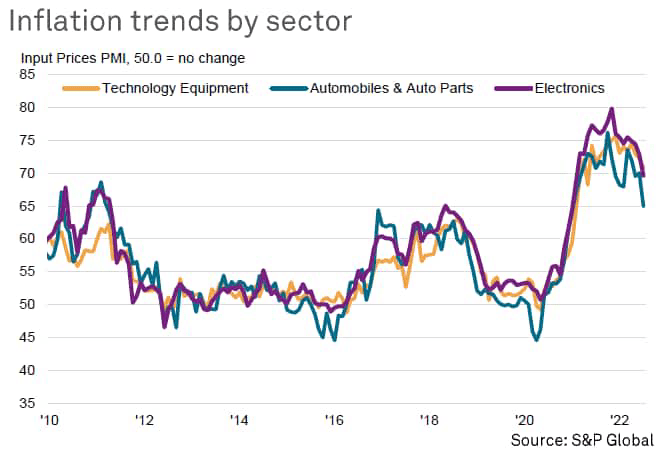

Sectors with strong ties to the semiconductor industry, such as technology equipment, automobiles and auto parts, and general electronics, are experiencing rising input costs and limited production capacity. In addition to the rates of increase seen since the outbreak, input costs at technology equipment and electronics companies are growing faster than at any other time in their respective series histories.

But companies’ ability to share the burden of higher costs with customers has been challenged by weakening global demand conditions. of 2020.

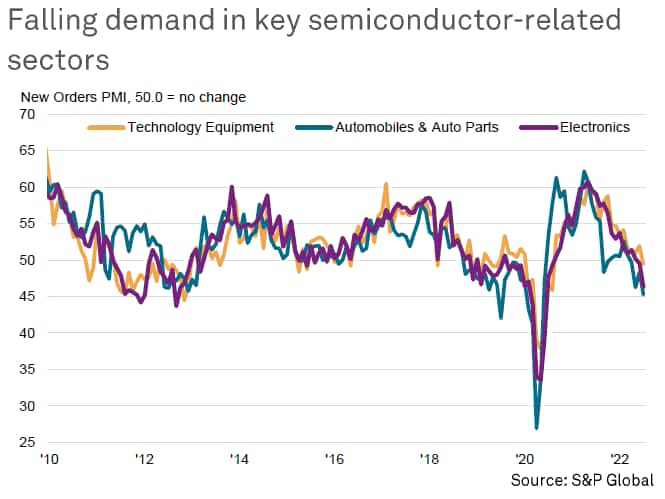

Industries that rely more heavily on semiconductors, such as technology equipment, automobiles and auto parts, and electronics, saw new orders fall in July, underscoring the additional problems these industries could face if semiconductor supplies fail to improve and prices remain too high. As the global economy shifted demand to commodities, high prices and slowing global growth saw a sharp slowdown in sales trends in the middle of last year, further accelerating this trend.

Semiconductor and technology stocks will suffer.

Next, the outlook for the semiconductor sector looks bleak. The Philadelphia Semiconductor Index, which covers the 30 largest U.S. companies involved in the manufacture and sale of semiconductor products, fell sharply year-on-year, in line with trends in the global electronics new orders index, as demand concerns weighed. On a wide range of technology stocks.

However, supply issues have prompted some measures by policymakers to protect future producers from external shocks. The United States has signed legislation to support domestic semiconductor manufacturing, and other microchip makers are reportedly planning to invest heavily in American production. Other countries may also look to offshoring their supply chains to protect their industries from external shocks.

Original post

Editor’s Note: Bullets for this article’s summary were selected by Search Alpha editors.

[ad_2]

Source link