[ad_1]

Michael we

Investment thesis

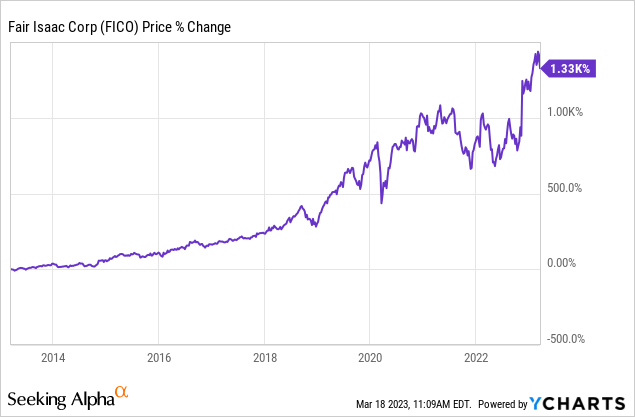

Isaac the Fair (NYSE: FICO) has been one of the best-performing stocks of the past decade, with shares up more than 1,300% during that time. Unlike most companies that have struggled over the past year, it continues to outperform and is currently trading well. Near the 52-week high. The company has a strong reputation as it enjoys a near monopoly in the credit score space. Often overlooked by investors, the solution has strong growth potential in its analytics and decision-making software. The company continues to deliver impressive results in its bottom line, with its bottom line growing by double digits despite facing severe macro headwinds. However, the company’s valuation looks overstretched after the recent rally and further upside should be limited. Therefore, I rate Fair Isaac as a hold and expect a better entry point.

Why fair Isaac?

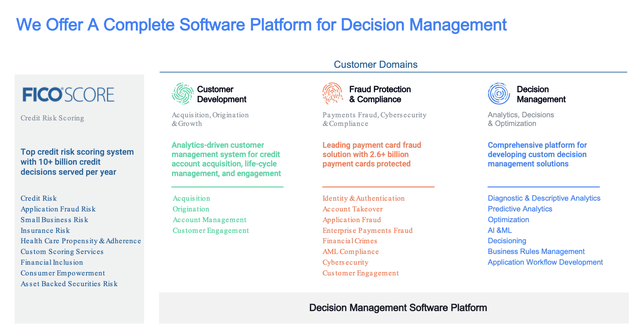

Fair Isaac is a California-based financial technology company that specializes in analytics and data decisioning software solutions. It is the company behind the popular FICO Score, a standardized measure of consumer credit risk in the US. In addition to credit scores, the company provides decision management solutions to businesses for fraud protection, compliance, analytics, customer engagement and other use cases.

Fair Isaac has a strong streak thanks to ranking and data leverage. Since the FICO score was introduced in 1989, it has gained a strong reputation and popularity thanks to its accuracy and precision. Over the years, credit risk has gradually become a standard measure for lenders. Credit scores have made it very difficult for new entrants to compete, as most lenders now don’t bother using other metrics. Accepting multiple credit scoring systems is complicated because they all use different algorithms and preferences, making it difficult for lenders to process applications efficiently. For example, 98.8% of underwriters in the US only refer to the FICO Score as a measure of credit risk.

FICO

It also has a strong information advantage that makes it more difficult for other companies to disrupt its business. FICO Score currently processes more than 10 billion credit decisions each year, and the data from these decisions can be leveraged with advanced AI and ML (machine learning) to further improve its decision-making capabilities. His accuracy and consistency should improve over time and strengthen his leadership position.

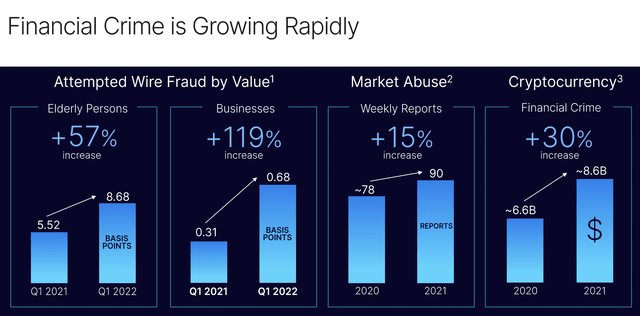

The company’s analytics and decision-management solutions have significant growth opportunities, especially in areas such as anti-financial crimes. According to Nasdaq (NDAQ), the TAM (total accessible market) of anti-financial crime is estimated at 18 billion dollars in 2022. The market was expanding due to the increase in financial crimes. Last year, value-tested wire fraud grew 119% YoY (year-over-year). The growing number of anti-financial crime solutions should be a strong driver of growth going forward.

Nasdaq

Financial and cost

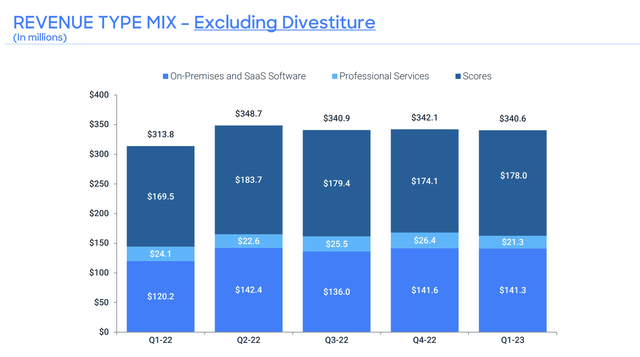

Fair Isaac’s recent earnings have been strong as most revenue comes from highly sticky subscriptions. The company reported revenue of $344.9 million, up 7% YoY from $322.4 million. The growth was largely driven by software revenue, which rose 9 percent to $166.9 million from $152.9 million. Software ARR (annualized recurring revenue) increased 11% from $582.9 million to $524.3 million. Customers continue to increase spending and the net retention rate was 110% in the quarter.

The Credit Results segment was soft, growing 5% YoY from $169.5 million to $178 million. The B2B (business-to-business) segment grew 11% due to higher prices and starting volume. Auto originations increased 24 percent, while card and personal loan originations increased 19 percent. However, this was offset by a decline in the consumer segment, which declined 6% as rates rose and mortgage originations declined.

FICO

The bottom line was strong as the company delivered strong performance. While revenue increased 7%, operating expenses decreased 1.1% from $206.8 million to $204.5 million. Much of the decline was attributed to SG&A (selling, general and administrative) expenses, which fell 5% to $93 million from $98 million. R&D (research and development) expenses fell 6.2 percent to $36.6 million from $39 million. This allowed net income to grow 14.8% YoY from $85 million to $97.6 million or 28.3% of total income. Non-GAAP EPS was $4.26 compared to $3.70.

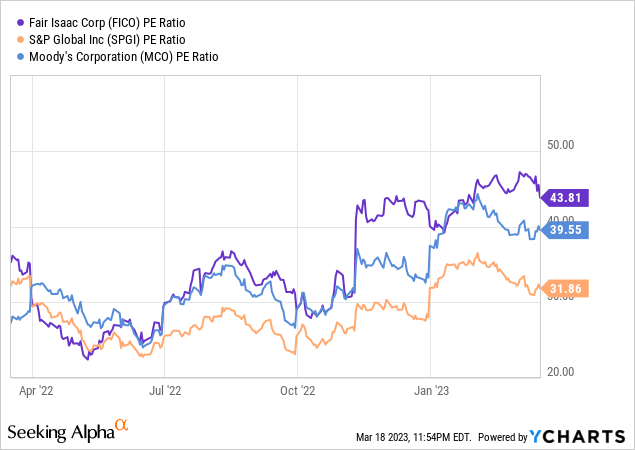

After a great rally since last May, the company’s valuations currently look overstretched. It is currently trading at a PE ratio of 43.8x, which is quite expensive considering its high single-digit revenue growth and mid-tens EPS growth. As shown in the chart below, the multiple is higher compared to peer ratings. The three companies have historically traded in the same range, but the trend has diverged recently. S&P Global ( SPGI ) and Moody’s ( MCO ) are currently trading at PE ratios of 31.9x and 39.6x, respectively, a meaningful discount of 37.3% and 10.6%.

Investors take

Fair Isaac is a fantastic company that should continue to do well in the long term. The tremendous momentum in credit scores provides strong pricing power, which should be another strong growth driver as use cases for decision-management solutions increase. As seen in recent earnings, the strength of the business generates strong operating performance that should enable long-term double-digit EPS growth. The basics are important, but so is the price you pay. The company currently appears to be fully valued at significantly more than its peers. I believe the current price level offers some upside and consider the company a hold.

[ad_2]

Source link