[ad_1]

ExxonMobil CorporationNYSE:XOMOne of the world’s largest integrated oil companies, has shown strong financial and market performance in 2022, helped by rising oil prices. The company’s prospects, however, are closely tied to its carbonization business as it has seen increasing interest in expanding its revenue streams in recent months due to regulatory concerns. With oil prices expected to remain strong, I am pessimistic about the prospects for ExxonMobil as the company enters a turnaround.

A different strategy from their peers

Many of Exxon’s peers have grown in renewable energy such as wind and solar power, but Exxon’s primary products are centered around crude oil. Although this strategy has helped the company capitalize on higher oil prices, ESG-focused investors have raised concerns about Exxon’s future as the company’s earnings power could erode without exposure to clean energy.

In response to this threat, Exxon has decided to double down on its carbon capture efforts as opposed to embracing renewable energy. In the year In 2021, the company officially launched the Low Carbon Solutions business unit, focused on carbon capture and storage, hydrogen and low-emission fuels.

According to CEO Darren Woods, this carbonization business unit can grow the fuel business in less than 10 years with the help of aggressive investments in this sector. Earlier this year, Exxon increased its planned investment in this sector from $15 billion to $17 billion by 2027.

Last October, Exxon signed the first commercial agreement for this segment with CF Industries Holdings (C).NYSE:CF) and EnLink Midstream (NYSE:ENLCStarting in 2025, to capture and store the 2 million tons of carbon emissions produced annually by the fertilizer plant. Earlier this month, Linde (NYSE: Linn) signed a long-term deal with Exxon to capture carbon emissions from a proposed clean hydrogen project in Texas.

As many companies are forced to reduce carbon emissions to meet net-zero emissions goals announced by the US government, Exxon seems well-positioned to use carbon emissions knowledge to win new customers in the future.

The market opportunity that can be reached is vast.

According to the International Energy Agency, there are currently 35 carbon capture and storage facilities with the capacity to capture 45 metric tons of carbon emissions per year. However, to reach net zero emissions by 2030, carbon capture facilities must capture 1,300 metric tons of carbon emissions per year. These numbers suggest that the world is a long way from where it needs to be to meet these goals, which creates a good opportunity for Exxon to earn attractive returns from its carbon investments.

The regulatory environment is also becoming favorable for the carbon capture business. The Inflation Reduction Act, signed into law last year, provides tax credits based on captured and sequestered carbon emissions. The law paves the way for a company to receive a tax credit of between $50-$85 per carbon emissions captured.

Exxon is aggressively building facilities to capture carbon emissions, and the Houston facility is expected to capture 100 million metric tons of carbon emissions. Once this facility is fully operational, assuming current policies remain in place, Exxon will receive billions of dollars from tax credits alone.

Driven by policy decisions and lack of existing facilities; Fortune business insights The carbon casting and extrusion market is predicted to grow at a CAGR of 19.5% by 2028. As one of the early movers in this sector, ExxonMobil is well positioned to benefit from this stellar growth.

Should Exxon Mobil buy, say analysts?

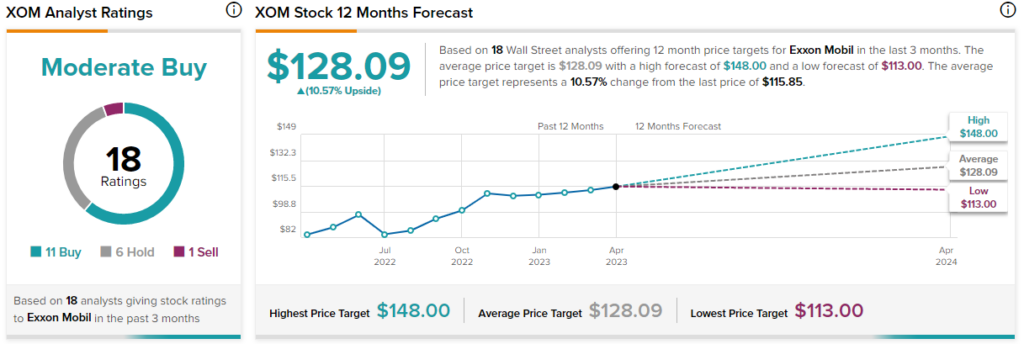

Morgan StanleyNYSE:MS) analysts have included ExxonMobil as one of their top 30 stock picks for 2025, citing strong momentum for the decarbonization business and favorable conditions for oil prices over the next few years. Many Wall Street analysts share that hope for the oil giant. Based on 11 buys, six holds, and one sell over the last three months, XOM’s average stock price is $128.09, indicating a potential upside of 10.6% from the current market price.

Conclusion: Exxon is a good bet on oil markets and decarbonization.

As one of the few oil companies focused on crude oil-related businesses, ExxonMobil will benefit from continued strength in global oil prices over the next few years. Its growing carbonization business, on the other hand, will add much-needed stability to its long-term business.

Carbon capture trading is not as cyclical as oil trading, which is good for investors looking for stable income growth trends. Exxon’s business turnaround is well and truly gathering pace, and the company looks poised to deliver attractive long-term returns for shareholders.

Disclosure

[ad_2]

Source link