[ad_1]

Data Snapshot is a regular AFN feature that examines AgriFoodTech market investment data provided by our parent company. AgFunder.

Click over here For more research from AgFunder and Subscribe to our newsletter To receive alerts about new research reports.

A recurring theme in AFN Late climate technology VC investment in Europe is still in its infancy, and we need a lot more.

Overall, the continent’s first-rate agrifoodtech ecosystem is flourishing with startups addressing food-related climate challenges. What’s needed: More growth and late-stage funding to scale these technologies out of the lab and into the field (literally).

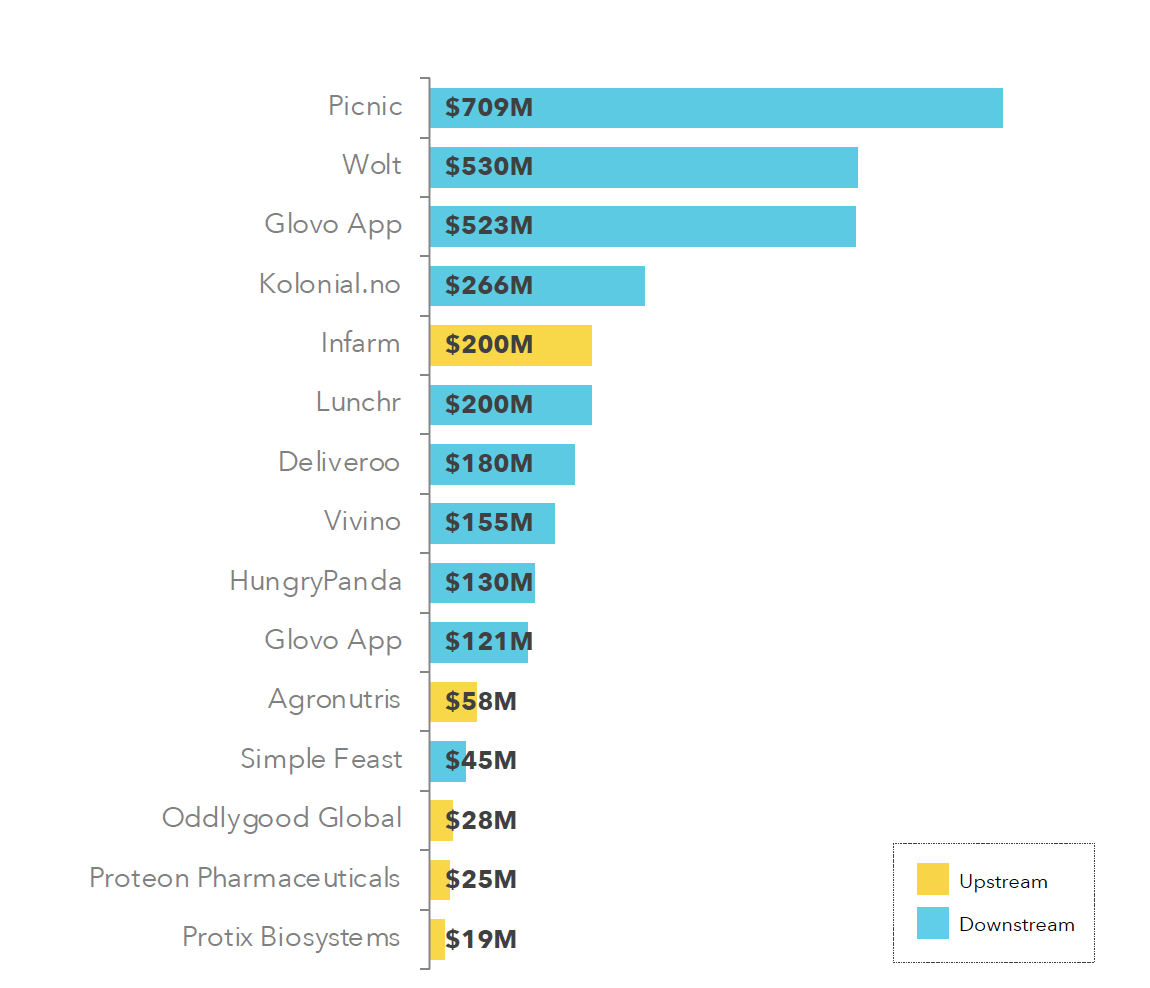

A quick look at the top late-stage deals for European agrifoodtech startups for 2021 underscores the point.

When late-stage VC investments were made in Europe last year, there were few companies developing upstream technologies or close to the farm or laboratory. According to information in AgFunder’s 2022 European Agrifood Tech Investment ReportOnly one upstream company recorded a 100-million-plus late-stage round (Series D and later) last year.

Four others made the top 15 list, but the round sizes are smaller than most series A and B rounds.

Because upstream categories are more closely tied to climate strategies than downstream, it’s safe to say that climate technology hasn’t been included in the mega-deals that the grocery sector has enjoyed until now.

German vertical farming startup Infarm came very close 200 million dollar round late last year. Expanding the number of high-profile late-stage deals to 15, a few more top companies entered the mix, but none of those rounds topped the $60 million mark and fell short of Picnic’s $709 million or Walnut’s $500-plus million in earnings.

Climate technology: what it is, why it matters

The most recent report from The Intergovernmental Panel on Climate Change identifies eight key issues Climate impacting sectors that need more investment: SOil Carbon Management, aGro Forestry, Use of biochar, iImproved rice breeding, lLivestock and Nutrient Management, SMoving to a sustainable healthy diet, rEducating food waste and bWrapping with wood, biochemical, bio-textiles and bio-materials.

On the European AgrifoodTech Investment Report, Agfunder worked with Dutch impact investor Invest-NL to present the report’s data in three themes, identifying technology types and companies; Alternative proteins, sustainable agriculture and circular food systems. Those three themes underlie many of the IPCC’s eight agricultural priority areas.

We are less than eight years from the 2030 deadline to achieve the Paris climate agreement and keep global warming below 1.5 degrees Celsius by 2050, and to meet that deadline with trillions of dollars in funding shortfalls.

Even so, investors committed only 16 percent of European agrifoodtech capital to the three thematic issues targeted in the AgFunder/Invest-NL research. AgFunder says many sectors with potential climate impacts will see funding cuts from 2020 to 2021.

look forward

But it’s not all bad news. While late-stage sectors (like eGrocery) that were funded last year are struggling to stay afloat in the current downturn, climate-focused tech startups seem to be holding steady. Climate tech startups have raised $18.6 billion in the first half of 2022, according to Climate Tech VC. Despite a 21% decrease in financing compared to the second half of 2021, H1’22 investment still exceeded H1’21 ($16 billion).

Climate Tech VC notes that seed and Series A funding and deals have more than doubled during this time.

Investors should see this as an opportunity to invest in climate-friendly companies that are positioned higher up in the food value chain.

[ad_2]

Source link