[ad_1]

America And China has been ahead of the pack in robotics funding. However, data from 2022 shows that these innovation hubs may have some tough competition as the investment landscape in Europe begins to outpace the big players in robotics.

The quest for technological supremacy has been seen as a two-horse race between the US and China. Over the years, we have only seen this investment pull strengthen as both economies seek to become innovation superpowers. While robotics will see similar activity based on 2022 data, investors are already betting on the future contender: Europe.

In the year By 2022, nearly $8.5 billion in funding will flow into robotics companies worldwide—a staggering 42% less than last year—with an overall global decline in VC investment. However, between 2021 and 2022, the total US dollar investment in robotics for the US and China will change by more than 50%, while Europe will see a much smaller decline, down 5% over the same period. Although it is still early days, we are confident that this is just the beginning of how Europe is beginning to find its place in the modern robotics ecosystem.

Europe emerges as a serious competitor with a strong growth rate

While robotics will see similar activity based on 2022 data, investors are already betting on the future contender: Europe.

When we compare Europe’s investment rates in robotics with the US and Chinese markets, we notice a few key trends driving the continent’s recent robotics market power play.

In the year With a CAGR of 28% between 2018 and 2022, Europe is growing at a pace of 2% ahead of global growth figures. This growth is mainly led by Germany, which showed a 77% investment rate in the development of robotics.

Close neighbor France saw a 54 percent increase in robot investment. Meanwhile, with robotics powerhouses China and the US slowing growth, robotics investment has declined by 5% and 2%, respectively, since 2018.

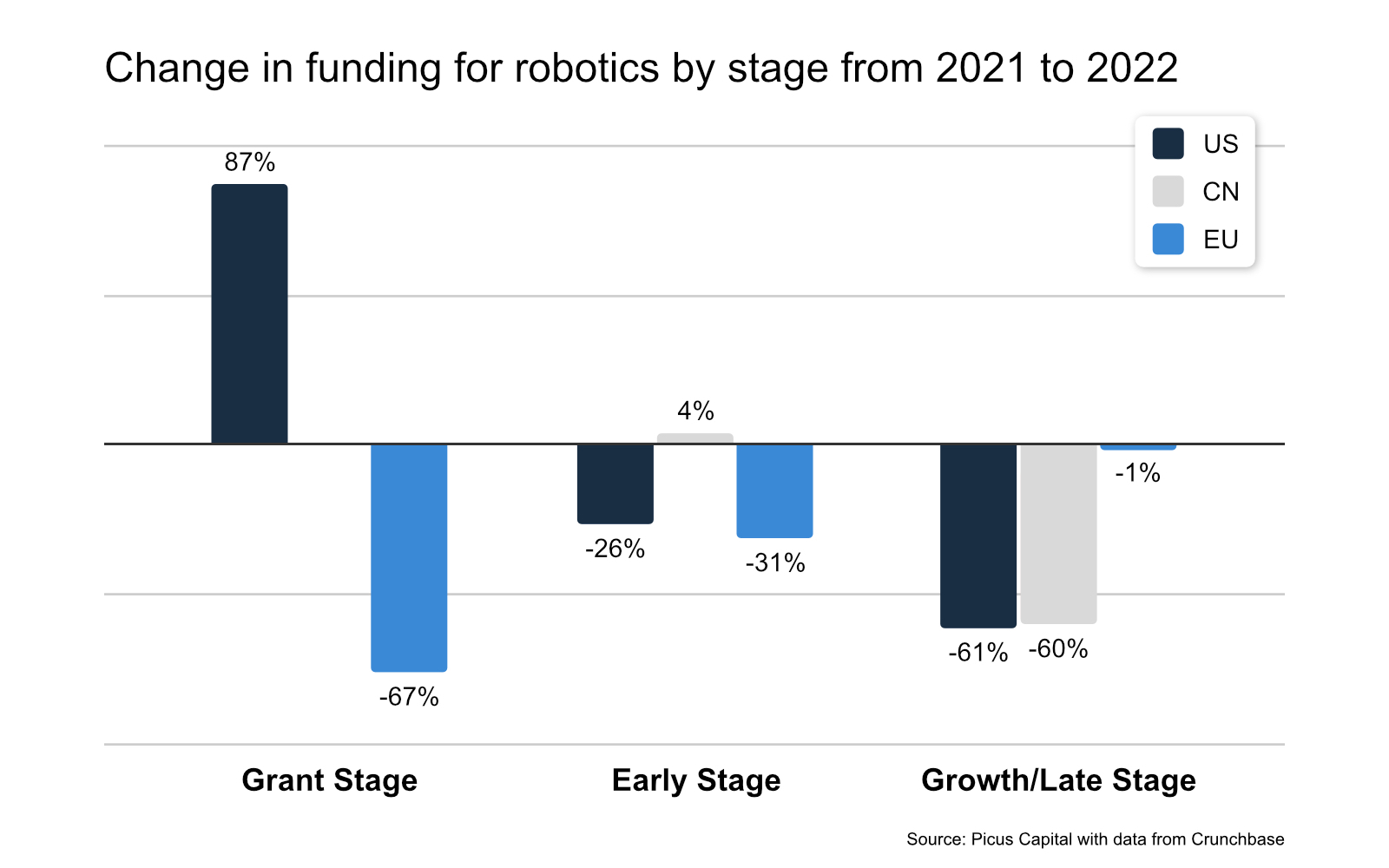

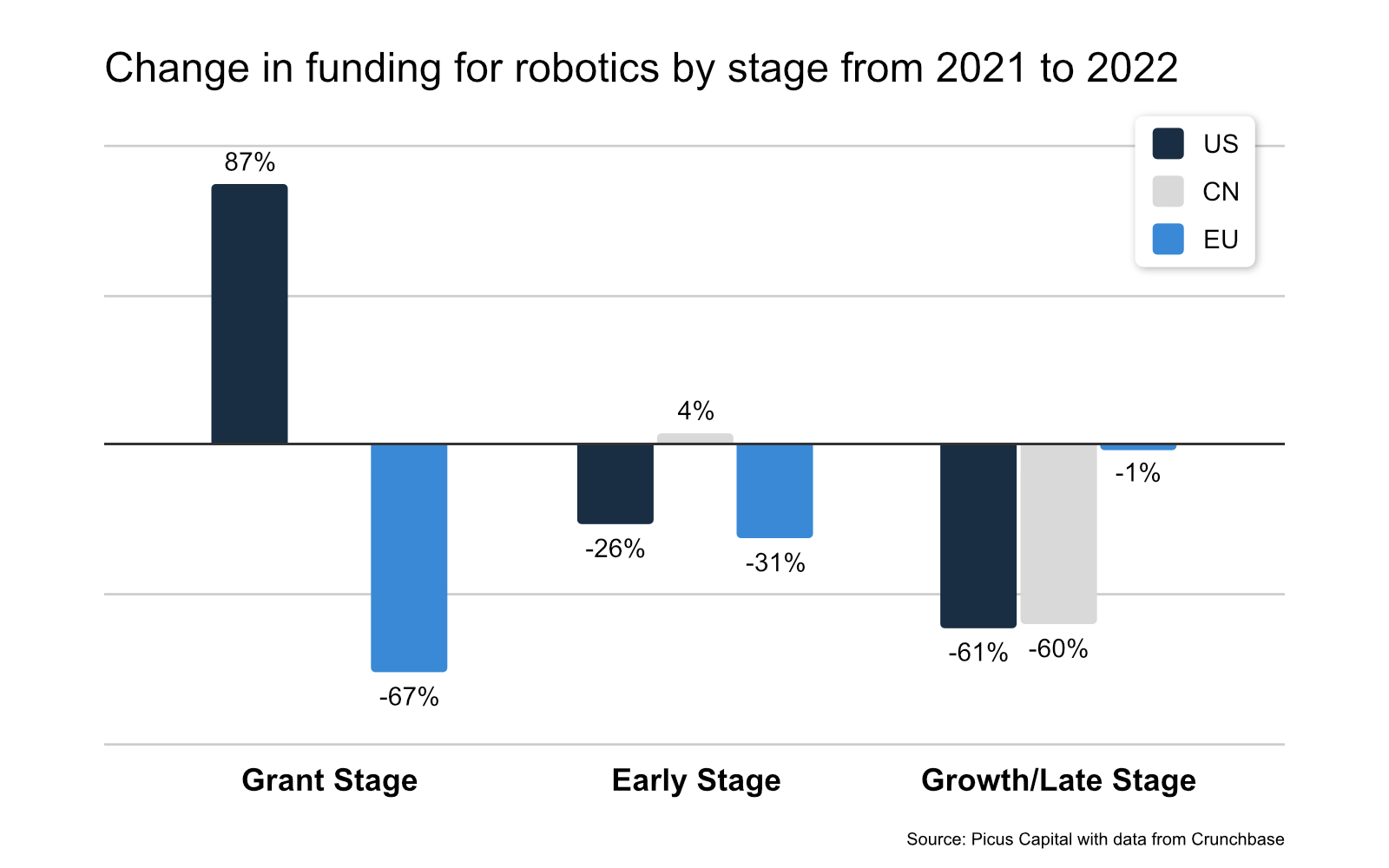

China and the US experienced a 60% slowdown in growth/late-stage financing.

To better understand these market shifts, we need to dive deeper into the fund landscape and explore the state of play in funding rounds.

Breaking down our data by grant, early-stage (pre-seed to Series A) and growth/late-stage (Series B and beyond), we observed a significant slowdown in growth and late-stage investment rounds across all US and Chinese robotics funds. .

The US and China saw a 60 percent growth/decline in robotics investment compared to 2021. Meanwhile, looking at the European market, overall growth and investment for late-stage deals was slightly lower. 2021.

Interestingly, China saw a 4% growth in early-stage investments, while Europe and the US followed a similar downward trend – a sign of new ventures brewing. The trend towards growth/late-stage funding areas, which account for the lion’s share of investment volume, helps to understand the relative stability in Europe.

Comparison of investment rates between geographies between 2021 and 2022. Image: Picus Capital via Crunchbase

On the surface, 2022 has seen more European robotics companies raise capital in a row – 20 growth/back-end rounds – and drive investment volume. In comparison, European robotics investments in 2021 averaged $108M across 13 growth/late-stage rounds. Meanwhile, the US and China have seen declines in a number of agreements and average and median investment volumes.

Development/late stage funding is complex. However, one variable influencing the difference in investment rates between the US, China and Europe is the shift in priorities for growth and late-stage funds – from growth to profitability. Funding for European robotics companies at these levels indicates that these companies are able to meet the growth stage requirements better than US companies. We believe this will continue to be relevant in 2023.

[ad_2]

Source link