[ad_1]

Key events

Filters BETA

Full story: Gas prices soar and pound and euro fall as Russia shuts Nord Stream pipeline

Gas prices surged on Monday and the pound and euro slumped after Russia shut down a big pipeline indefinitely.

Russia has used its control of gas supplies to exert pressure on European countries in retaliation against sanctions imposed after its invasion of Ukraine. Gazprom, the Russian state-controlled gas company, closed the Nord Stream 1 pipeline from Russia to Germany on Friday, saying it had found a leak requiring repair.

The threatened cuts to supplies of gas from Russia have prompted a scramble by European countries to store as much gas as possible before winter, as well as efforts to find alternative supplies.

However, the prospect of Russia cutting off an important pipeline completely caused prices to increase on Monday, as investors brace for severe shortages. The contract for gas delivery next month in the UK soared by 35%, to 550p a therm. That was an increase from the 410p a therm cost on Friday afternoon, and approaching the five-month high of nearly 650p set last month.

Winter gas prices were also up sharply. The wholesale UK gas contract for November jumped 27% to 638p a therm on Monday morning, while the December contract rose 26% to 720p a therm. Both are near last month’s record highs.

The benchmark Dutch TTF October gas contract rose by 30%, up €62 to €272 a megawatt hour.

Here’s the full story:

Rupert Jones

Motorists received a “raw deal” at the pumps despite a record petrol price drop last month, according to the RAC.

The average price of a litre of unleaded dipped below 170p (169.8p) at the end of August for the first time since May, with price cuts made by retailers in recent weeks resulting in the typical cost of filling a 55-litre petrol car falling from £100.16 at the start of the month to £93.39 at the end.

But the motoring organisation said it believed average forecourt petrol prices should be about 161p based on current wholesale costs.

Back in the energy markets, oil is rising as Opec and its allies hold their monthly meeting to set production limits.

Brent crude is now up 3.5% to $96.50 per barrel, following reports that Opec+ will consider whether to make a small cut to output, and that Russia might support the plan.

Nothing official yet, but the Opec+ Joint Ministerial Monitoring Committee is said to be supporting a 100,000 barrel/day cut.

OPEC+ JMMC said to support a 100kbpd production cut for the month of October #oott

— Giovanni Staunovo🛢 (@staunovo) September 5, 2022

OPEC+ panel discusses 100kbpd cut as main proposal – Delegate

— DailyFX Team Live (@DailyFXTeam) September 5, 2022

We should hear more soon….

Pound unmoved by Truss victory

The pound is little changed, hovering around $1.15 against the dollar, on the news that Liz Truss will become the UK’s next prime minister.

She’s beaten Rishi Sunak, as expected, to become the next Conservative Party leader, by 81,326 votes to 60,399 – closer than some forecasts.

But that’s still left sterling close to the 29-month low hit this morning.

The Truss victory over Sunak at 57%-43% is closer than expected after a bruising battle within the Conservative Party that lasted as along as Game of Thrones and was more brutal.

Truss: 81,326

Sunak 60,399— Kevin Maguire (@Kevin_Maguire) September 5, 2022

Truss will become PM tomorrow, and take on an in-tray bulging with serious problems, Including the energy crisis.

Truss is speaking now, and says she will deal with the crisis in people’s energy bills, as well as delivering a bold plan to cut taxes and grow the economy.

Our Politics Liveblog has all the details.

Our daily liveblog on the Russia-Ukraine war has all the details on the conflict, including Ukrainian president Volodymyr Zelenskiy reporting progress in the counter-offensive in the south, and the Kremlin blaming Western sanctions for the closure of the Nord Stream 1 pipeline:

Surging gas prices have hammered investor confidence across the eurozone, as recession risks rise.

The closely followed Eurozone Sentix investor confidence index plunged further into negative territory, at -31.8 for September from -25.2 in August.

This was the lowest reading since May 2020, at the height of the pandemic.

Economic expectations tumbled too, to the worst since December 2008 (when the collapse of Lehman Brothers triggered the financial crisis)

Summing up the dire picture, Sentix Managing Director Manfred Huebner says:

Never before in more than 20 years of history, with the exception of the financial crisis in 2008, have investors’ assessments of the euro zone economy been so weak – and at the same time expectations have been so low,”

September Sentix consumer confidence in Europe fall further to -31.8 (est -26.8, last -25.2)

Economic activity decelerating even faster than expected now with both manufacturing and service activities in contractionary territory… pic.twitter.com/5aiIx8ws47

— Mario Cavaggioni (@CavaggioniMario) September 5, 2022

A German government spokesperson has said today’s soaring gas prices (for example) are an intended consequence of the shutdown of Nord Stream 1, Reuters reports.

The spokesperson adds that “we are doing everything” to get through winter even wthout Russian gas, but warned there are “difficult months ahead”.

German Government Spokesperson: We’re Doing Everything to Get Through Winter Even Without Russian Gas, There Are Difficult Months Ahead. Monday’s Soaring Gas Prices Are Intended Consequence of Nord Stream 1 Shutdown.#ONGT #natgas #NordStream1

— CN Wire (@Sino_Market) September 5, 2022

Euro and pound still lower against surging dollar

The euro has recovered some of this morning’s losses, but it still languishing below parity against the strong US dollar.

The single currency is trading around $0.99, having hit two-decade lows in early trading.

Thanim Islam, market strategist at international business payments firm Equals Money, says the gas crisis will continue to hurt the euro:

Whilst Germany has been preparing for a total shut-off of gas supplies from Russia by looking for alternative sources as well as having gas stores at 85% of capacity, the news is likely to weigh in on the euro over coming months. With risks of a recession rising and raising the prospects of rationing in the Winter.

Sterling has nudged back to $1.15, having hit its lowest level since March 2020 this morning. At one point, the pound came to its lowest level against the dollar since 1985.

It’s important to remember that the dollar is at 20-year highs against a basket of currencies, lifted by the prospect of higher US interest rates (and because America is less hurt by the energy crisis than Europe).

Economist Julian Jessop argues that we’re not facing a sterling crisis:

Hat tip to @dsmitheconomics for showing what has happened to #sterling against a basket of currencies, rather than just the usual lazy headlines about the fall vs. the US dollar… 👇

But my own takeaway from this chart is that there *hasn’t* been a slump in the pound… (1/2) pic.twitter.com/GA4w0tKfk5

— Julian Jessop 🇬🇧 🇺🇦 (@julianHjessop) September 4, 2022

… here’s the same Bank of England exchange rate index over a longer period. This index is roughly in the middle of the range since 2016, and the recent volatility is par for the course.

In short, this isn’t a new ‘#sterling crisis’, however much some people may want one! (2/2) pic.twitter.com/D1ZpmKSSCs

— Julian Jessop 🇬🇧 🇺🇦 (@julianHjessop) September 4, 2022

Kremlin blames Western sanctions for pipeline outage

The Kremlin has blamed Western sanctions for a complete shutdown of the Nord Stream 1 gas pipeline between Russia and Germany, Reuters reports.

In a conference call with reporters, Kremlin spokesman Dmitry Peskov said sanctions were “causing chaos” in terms of maintenance work on the pipeline and rejected claims Russia had turned off supplies to Europe as a political move.

Peskov said:

“Problems with gas supply arose because of the sanctions imposed on our country by Western states, including Germany and Britain.

“There are no other reasons that lead to problems with supplies.

Peskov said that if sanctions were lifted, the repair work could be completed easily and gas flows could resume.

Last month German Chancellor Olaf Scholz posed with a Nord Stream 1 turbine which has been serviced in Canada, but was now at a Siemens Energy factory in Muelheim an der Ruhr.

Scholz said there was no reason the stranded turbine couldn’t be returned to Russia, while Moscow blamed a lack of documentation….

UK November and December gas prices jump

The British wholesale gas contract for immediate delivery has jumped 20%, to 360p per therm.

Winter gas prices are rising too – which will bring even more pain to businesses and consumers if they remain at these levels (or rise even higher).

The wholesale UK gas contract for November has jumped 27% to 638p per therm, while the December contract has risen 26% to 720p per therm. Both are near last month’s record highs.

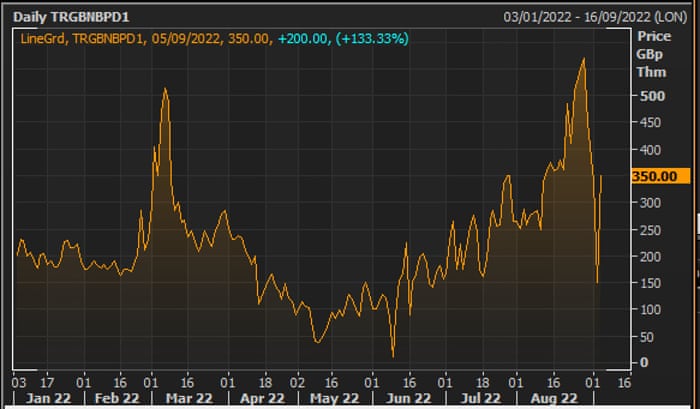

UK next-day wholesale gas prices surges

The day-ahead wholesale UK gas price has more than doubled this morning, as prices surged back towards this year’s record highs.

Gas for delivery tomorrow has surged by 140% to 360p per therm, after Russia’s decision to shut the Nord Stream 1 pipeline intensified the energy crisis facing Europe.

That more than wipes out Friday’s dramatic falls, when the markets were hopeful that Nord Stream 1 would resume operations on Saturday morning, as expected.

This contract closed at a record settlement price of 570p in mid-August, and briefly hit 670p back in March.

Two years ago, next-day gas cost around 30p per therm, before rising demand, energy shortages, and then the Ukraine war all drove up gas prices.

AJ Bell investment director Russ Mould, says:

“Predictably, wholesale gas prices are soaring, raising the prospect of even higher energy bills for businesses and consumers and sending the pound and the euro to new multi-year lows against the dollar.

“The US is in the enviable position of having relatively high levels of energy independence which insulate it from Putin’s proxy battle in the energy market as he looks to punish Europe for its support for Ukraine in the current conflict.

“This step was not entirely unexpected and everyone will be looking for answers to the current crisis, however it seems unlikely investments in new sources of energy will bear much fruit in the short term.”

UK recession looms after private sector shrank in August

More bad new. The UK economy shrank in August, in a sign that Britain’s economy could be falling into recession as energy prices spiral.

The composite Purchasing Managers’ Index (PMI), which covers UK service firms and factories, has fallen into contraction territory, due to a “severe and accelerated drop in UK manufacturing output” and a slowdown in the services sector.

The index, a gauge of activity, has dropped to 49.6, from 52.1 in July, and weaker than the ‘flash’ reading of 50.9 taken during August.

This is the first reading below 50 (showing a contraction) in 18 months, when firms were suffering from Covid-19 lockdowns.

The UK composite PMI (covering both services and manufacturing) moved into negative territory for the first time in 18 months, pulled down by weak manufacturing data in August. 3/3 pic.twitter.com/gmzwEQn6QF

— Mark Magill (@MarkMagill1982) September 5, 2022

The report found that demand for consumer-facing services such as restaurants, hotels, travel and other recreational activities is collapsing, as the cost of living crisis forces consumers to cut back.

Business confidence has slumped, with businesses reporting a drop in new orders – including the biggest drop in export demand since January 2021.

The report warns:

Elevated price pressures remain a worry for service sector companies, notably for energy, as does the prospect of higher interest rates and possible recession.

The report suggests Britain is slipping into recession, as soaring energy costs drive inflation into double-digit levels – highlighting the challenge facing the next prime minister.

S&P Global Market Intelligence’s Chris Williamson says there is an “increasingly broadbased malaise” across the economy:

“Jobs growth is already starting to weaken and, with hiring tending to lag changes in order books, the recent slump in demand alongside surging energy prices points to a growing reticence to employ staff in coming months.

“Although the survey data are currently consistent with the economy contracting at a modest quarterly rate of 0.1%, deteriorating trends in order books suggest the incoming prime minister will be dealing with an economy that is facing a heightened risk of recession, a deteriorating labour market and persistent elevated price pressures linked to the soaring cost of energy.”

The energy crisis, soaring inflation, and recession worries have dragged down Eurozone business activity for the second month running.

The services sector contracted in August, the latest survey of purchasing managers shows, following a drop in manufacturing output reported on Friday.

The decline was particularly marked in the euro area’s largest economy, Germany, reports data provider S&P Global.

It found that the eurozone services sector shrank at the fastest pace in 17 months, pulling the wider euro economy into its biggest decline in 18 months.

This increases the risk that the eurozone has fallen into recession this quarter, explains Chris Williamson, chief business economist at S&P Global Market Intelligence.

The deterioration is also becoming more broad-based, with services now joining manufacturing in reporting falling output. Having led the growth spurt earlier in the year, consumer-facing services such as travel, tourism and recreation are now reporting falling activity levels as the rising cost of living pushes households to cut back on nonessential spending.

Financial services (notably including real estate) are meanwhile feeling the squeeze from higher interest rates, and industrial services are seeing their manufacturing customers reduce their spending amid the downturn in demand for goods.

Over in Turkey, inflation has hit a new 24-year high…. of over 80%.

Consumer prices jumped by 80.2% in the last year, the Turkish Statistics Institute reports, the highest since 1998.

It’s the 15th monthly increase in inflation in a row, as energy and food prices have rocketed, partly due to the weak lira following cuts to Turkish interest rates last year.

Such high inflation is a heavy blow for consumers and businesses, but Bloomberg points out that it’s slightly lower than feared:

The median forecast of 15 economists surveyed by Bloomberg was 81.2%. Price growth reached 1.5% on a monthly basis, less than anticipated in a separate poll.

“The somewhat lower-than-expected inflation in Turkey in August is welcome news for the government and the central bank,” said Per Hammarlund, chief emerging markets strategist at SEB.

“However, with energy prices set to rise again going into the winter months, the problem of high inflation has not been solved.”

Although European gas prices leapt by 30% this morning, they’re not yet above the record highs set this year.

That suggests that the risk of further disruption to Russian gas supplies to Europe had already been priced in:

European #Gas Futures TTF is jumping 30% this morning to 265€ but now comes the critical point:

🚨Prices remain well below the highs of 346€. It seems like the potential of a complete shutdown of flows from #Russia was to some extent already priced in. pic.twitter.com/LON3PGDcKp— Lukas Kuemmerle (@lukaskuemmerle) September 5, 2022

European natural gas prices open sharply higher after Russia shut downs sine die the Nord Stream 1 pipeline. TTF front-month futures up ~25% to €260 per MWh (equal to >$75 per Btu, or $440 per barrel of oil equivalent) #EnergyCrisis #EnergyTwitter

— Javier Blas (@JavierBlas) September 5, 2022

French day-ahead baseload electricity prices have jumped 19%, touching €590/MWH.

Germany’s wholesale electricity prices have also jumped this morning.

The year-ahead baseload power contract has jumped 24% to €620 per MW hour.

A year ago, this contract traded €75/MWH – before the Ukraine war drove up energy prices so dramatically.

Last month, the contract briefly hit €1000/MWH, a record high, in the scramble to buy up energy.

GERMAN YEAR-AHEAD BASELOAD POWER PRICE UP 24% AT 620 EUR/MWH

— *seven (@sevenloI) September 5, 2022

The options I hear OPEC+ is mulling for today’s meeting:

1) Roll-over current output quotas

2) ~100k b/d cut (reversing last month’s symbolic hike)

3) Roll-over quotas, but keep OPEC+ meeting “in session”, potentially cutting before next month if needed#OOTT #EnergyCrisis— Javier Blas (@JavierBlas) September 5, 2022

UK wholesale gas prices are pushing even higher, as the markets react to Russia’s decision to indefinitely suspend flows of gas through Nord Stream 1 to continental Europe.

The month-ahead UK gas contract has rocketed by almost 35% today to 550p per therm.

That’s up from 410p/therm on Friday afternoon, when gas prices had fallen on hopes that Nord Stream 1 would resume operations as planned.

[ad_2]

Source link