[ad_1]

Investors are pouring into global equity funds with a fervor never seen before.

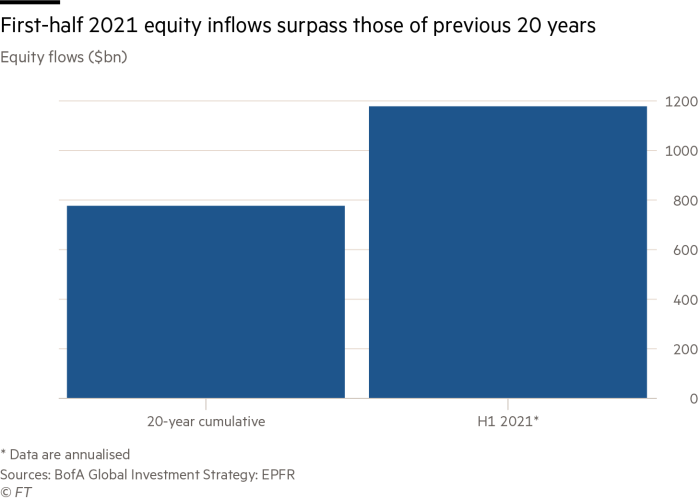

The first half of 2021 has added about $ 580 billion to the sector, which put the category on a good record, according to data provider EPFR.

Bank of America strategists estimate that if the rate of inflows continues at the same rate for the rest of the year, equity funds will get more money in 2021 than the previous 20 years together.

Equity funds have launched these entries into a steadily growing stock market, with major indices rising to a record high last week as the pandemic’s economic recovery gains momentum. The S&P 500 is up more than 15% this year, while the FTSE all world index has gained just over 12%.

Relatively low bond yields and the fact that more than $ 12 million in debt are operating at below zero yields have amplified the attractiveness of the global stock market by $ 117 million.

“There has been a real seismic shift in the economy and where profit growth comes from,” said Diane Jaffee, portfolio manager with TCW asset manager. “Even with the most conservative estimates of inflation, your real bond yield is negative.”

Entries have been wide, with large additions to both global funds and funds that buy American, Japanese or European stocks. Investors have also shown in recent weeks a preference for growth and technology stocks in the United States, as they debate how long inflation will hold and whether the so-called inflation trade he continues to hesitate.

Incorporations into sovereign bond funds, by contrast, have been relatively off this year at $ 33 billion, according to EPFR data.

Jaffee said he hoped investors would continue to favor stocks this year, especially in the United States where the country has deployed vaccines against Covid-19 at a much faster rate than most developed markets. But she and others have warned that the shake-up of bond yields (e.g., due to a policy error by the U.S. central bank) remains the big risk.

“While we run little risk of straining too much, the problem of poor policy communication is very much on the table,” said Nicholas Colas, co-founder of DataTrek.

Colas noted that U.S. stocks were doing well even after the 2013 outrage, when the Federal Reserve chair sparked market volatility by saying the central bank would at some point reduce its buyout program. good.

But Colas added: “While the 2013 rage period was good for stocks, we can’t completely rule out the possibility that this time it could be different.”

[ad_2]

Source link