[ad_1]

Transparency 86

Fast Embark technology

Embark Technology, Inc.NASDAQ ፡ EM EMBK) Reported its financial results for Q1 2022 in May, continuing the company’s forecast and increasing operating losses significantly.

The company is developing what it calls its own “full stack.” Truck Driving System in the United States.

I have seen significant uncertainties, including control, technology, and economics, so I will stay on board soon.

Overview of the ship

San Francisco-based Emerick was founded in 2016 to create independent truck driving software and tracking capabilities used in the United States.

The company is led by Alex Rodriguez, co-founder and CEO of Wardon Labs and a software engineer at Cann Academy and Nuns Communications.

The company’s main offerings include:

-

Embark Driver – Driving Software

-

Universal interface – OEM integration

-

Guard – Delivery and monitoring system

The company is still in the process of being tested and is not fully licensed to operate in California or other US states.

A.D. In November 2021, the UAE merged with SPAC Northern Genesis Acquisition II in a $ 5 billion deal. Currently, Embark market capitalization is around $ 246 million.

Embark Market and Competition

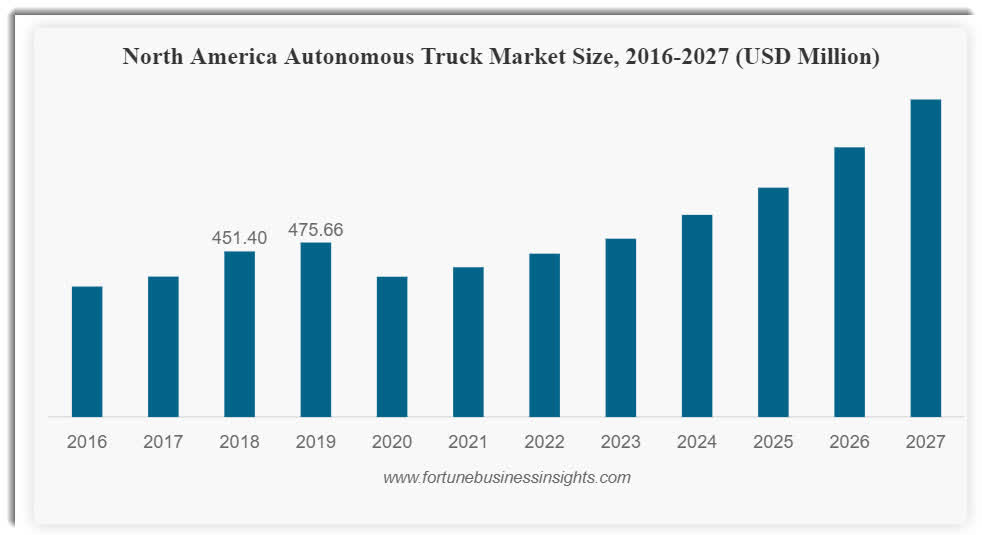

A.D. The global market for automobiles and related technologies is projected to reach $ 1.1 billion in 2019 and to reach $ 2.07 billion by 2027, according to Fortune Business Insights market research report by 2020.

This represents a CAGR forecast of 12.6% for 2020 to 2027.

The key to this growth are rapid growth in sensor technologies and related software processing capabilities, as well as improved wireless network automotive sector autonomy.

Also, below is a chart showing the historical and planned growth direction of autonomous trucking in the US.

N. U.S. Independent Truck Market (Fortune Business Insights)

Leading competitors or other industry participants include:

-

Google

-

Ups

-

TuSimple

-

Continental

-

AB Volvo

-

Daimler

-

Caterpillar

-

NVIDIA

-

Awake

-

Tesla

-

Others

Embark’s latest financial performance and metrics

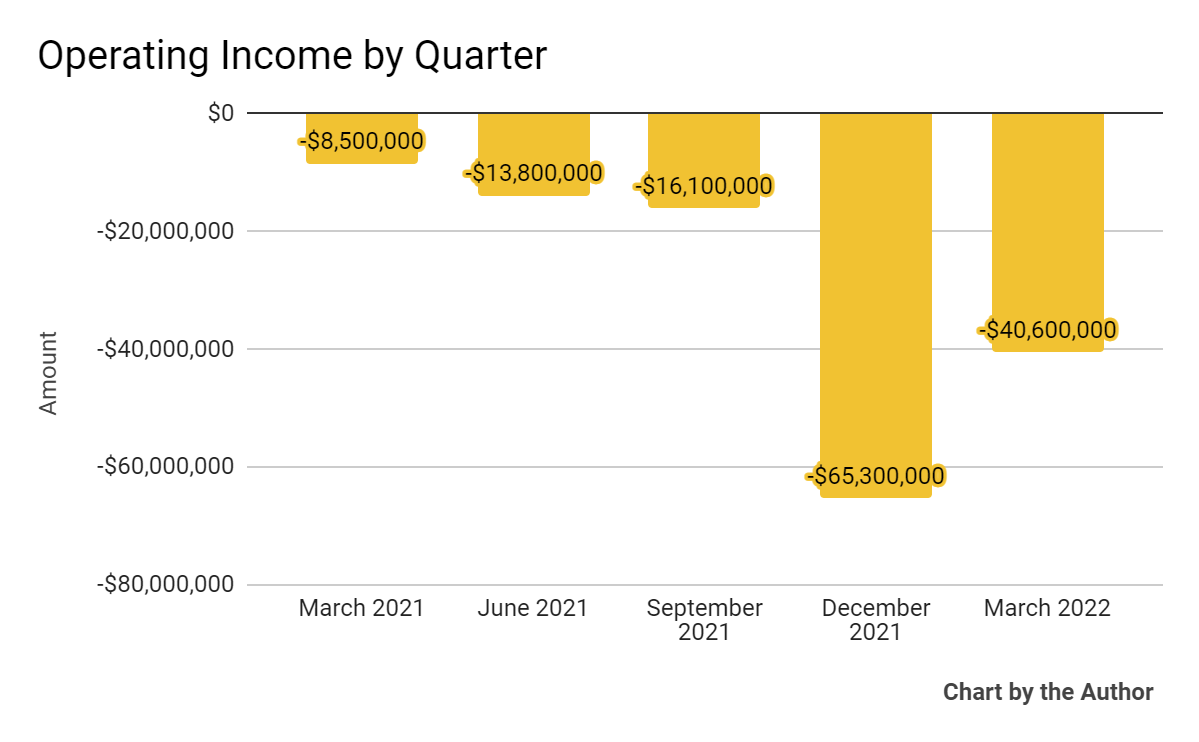

The company has not yet reported revenue.

-

Operational losses have worsened in recent quarters.

5 quarter earnings (Searching for Alpha)

-

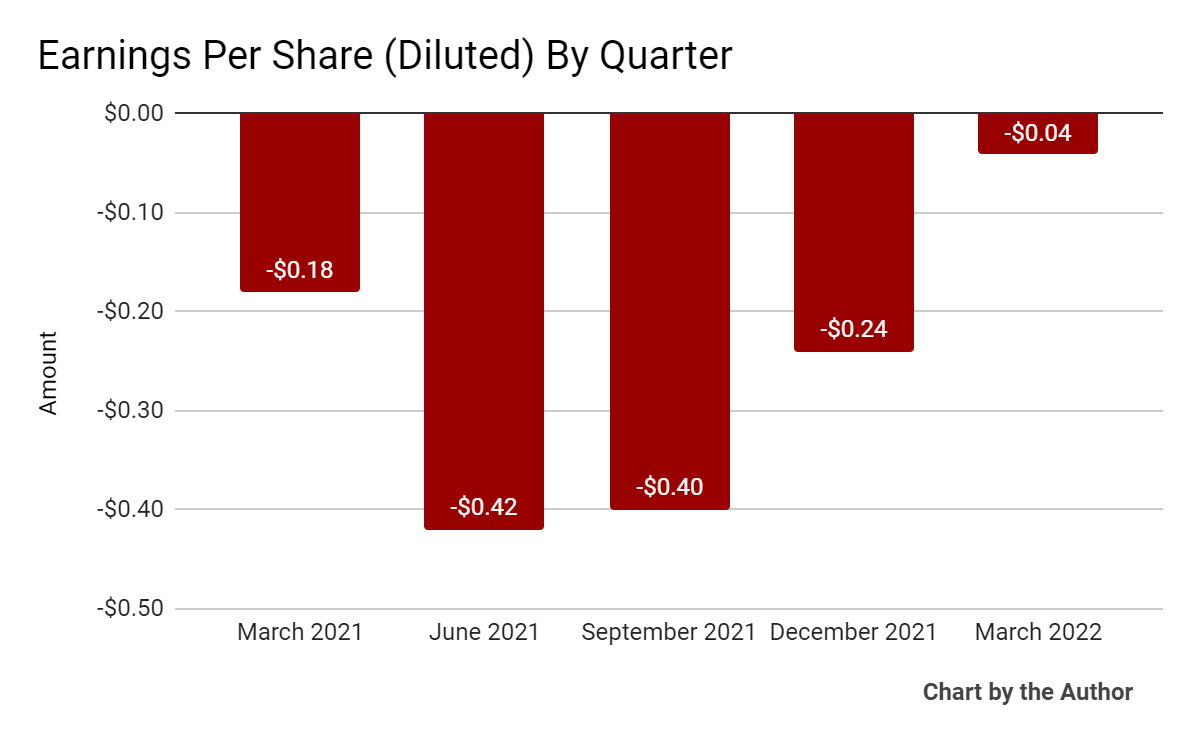

Revenue per share (negative) remains negative

5 quarter earnings per share (Searching for Alpha)

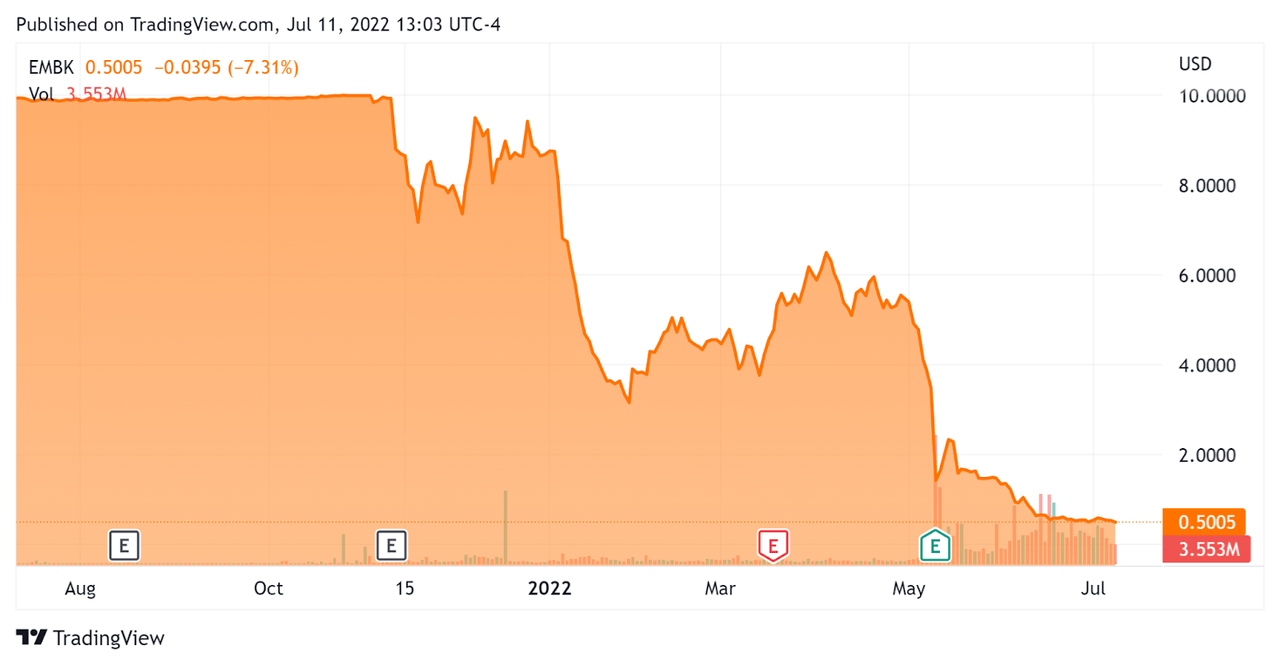

The chart below shows that EMBK’s stock price has fallen 95 percent in the last 7 months or so.

52 week stock price (Searching for Alpha)

Below is a table of capitalization and evaluation data relevant to the company.

|

Measure |

Size |

|

Organizational value |

$ 8,240,000 |

|

Market capitalization |

$ 245,920,000 |

|

Enterprise Price / Sales [FWD] |

30.91 |

|

Price / sale [FWD] |

922.17 |

|

Revenue per share (completely exhausted) |

– $ 1.10 |

(Source – Alpha Search)

Comment on Embark

At the last conference call (Source – Alpha Search), covering the results of Q1 2022, the management highlighted the acceptance of the first trucks from Knight-Swift for trucks, which are owned, operated and maintained by blessed carriers. . “

The company recently began testing its 24-hour technology on I-10 Interstate Freeway in Texas, which will double its test capacity and include night driving.

Chief executive Rodriguez recently reiterated the recent inclusion of US Express in the Partnership Development Program and the preparation of US Express Terminals to ‘board and receive and start automatic trucks’.

In particular, the company is moving towards the 2022 goals of launching the backbone of the system in the Sunbelt region.

However, in California, the company, along with several other industry participants, signed a letter to the governor to lift the state’s ban on self-driving semi-trailers on public roads.

As for its financial results, operating losses have worsened in recent quarters as the company has increased its head count in a challenging employment environment.

For accounting, the company released nearly $ 20 million in cash in the first quarter, ending with $ 245 million in cash and the same quarter.

With a cash flow, the company will have 19 months before it runs out of cash.

In terms of price, the market severely punished the company from the review of the SPAC agreement.

For the company, the first danger is a slow-moving regulation that could see the first commercial activity in various solar states.

In addition, the declining economic downturn in the US may delay the customer / pilot partner cycle, which can lead to longer revenue time, although it does take into account regulatory approvals.

While long-term investors may see the stock price at its current low price, the company faces stiff competition from companies with good capital in the area.

I have seen significant uncertainties, including control, technology, and economics, so I will stay on board soon.

[ad_2]

Source link