[ad_1]

High inflation will force the Federal Reserve to raise U.S. interest rates at least twice by the end of 2023, according to a new survey by leading financial economists in the Financial Times.

He inaugural survey conducted by the FT and the Global Markets Initiative at the University of Chicago’s Booth School of Business points to a potentially more baffling path for monetary policy than Fed Chairman Jay Powell points out.

Economists ‘views are closely aligned with the “points plot” of Fed officials’ own forecasts of when and how quickly rates will have to rise from their current level to near zero, as the US economy is recovering from the pandemic and inflation is advancing in the medium to long term forecast by the Fed.

The post of the last dot plot has been sent shaken through the markets earlier this month as policymakers increased the expected time for the planned exit, but Powell and other members of the Fed’s leadership he intervened later insist that they would be patient to keep monetary policy very accommodating.

The FT-IGM Survey of US Macroeconomists surveyed 52 academic economists on the likelihood that the Fed’s main policy rate would be 0.50 percentage points higher by the end of 2023, as indicated by the plot of points. A majority said the probability of a measure of this size or higher occurring was greater than 75%, and a large minority placed it at up to 90%.

Three economists said it was a certainty.

The survey highlights the challenge in front of the central bank to convey a clear message about its evolution of monetary policy. Powell warned that forecasts of points for future rate hikes should be taken with “a grain of salt,” but other officials have begun to float the earlier deadlines for the first rate hikes.

“As inflation rises and the economy improves, the traditional differences between the pigeon hawk and the Federal Open Market Committee will begin to resurface,” said Alan Blinder of Princeton University, who was vice president of the Fed. nineties and participated in the survey. “Now you see it and you’ll see more.”

Blinder said he predicted an interest rate hike as early as 2022.

Respondents in the FT-IGM survey see inflation as the main driver of the change in Fed officials’ thinking about the timing of the rate hike, citing it as the main factor more often than improving the prospects of the U.S. labor market or rising house prices.

Consumer prices have risen this year beyond some of the highest estimates. Core PCE, the Fed’s target inflation measure, was operating at an annual rate of 3.4% in May, the highest in 29 years, as strong demand for goods and services in the booming economy collided with widespread supply chain constraints.

The FT-IGM survey, which was conducted between June 25 and 28 and will be conducted regularly throughout the year, shows that economists are well aware of the risk of high inflation. The median forecast of respondents for the core PCE later this year was 3%, the same prediction as the average Fed official.

But two-thirds of respondents said it was “somewhat” or “very” likely that this metric would still exceed 2% year-over-year by the end of 2022. The average forecast for Fed officials is 2.1 by the end of next year.

“It’s hard to think of a more inflation-friendly environment,” said Nicholas Bloom, an economist at Stanford University who participated in the survey. “The Fed has been as aggressive as it can be to promote growth, fiscal policy is incredibly relaxed and there are supply restrictions.”

Despite the “perfect storm” Bloom said has been formed to drive up consumer prices, he dismissed concerns that inflationary pressures will get out of hand in the long run, especially because the Fed is on its own. willingness to act.

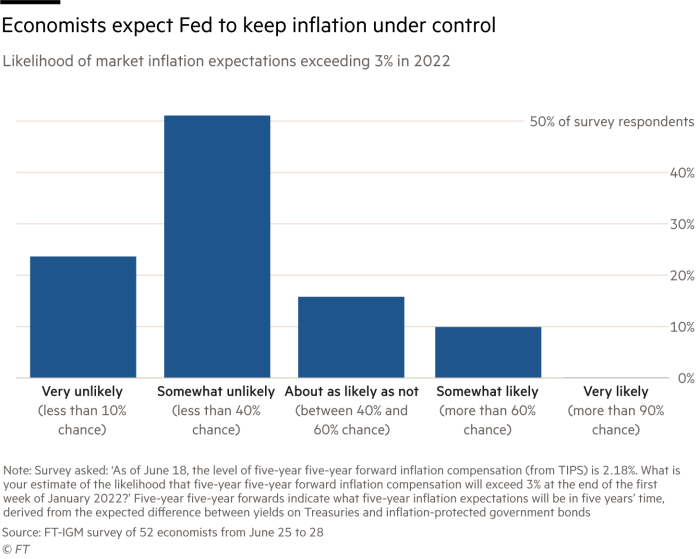

Three-quarters of FT-IGM respondents said it was unlikely that market expectations on long-term inflation would rise significantly to more than 3% early next year. Long-term inflation of 2.3% is currently expected.

“An essential part for the Fed to maintain its credibility is to respond to incoming data,” said another respondent, Karen Dynan, of Harvard University.

The central bank has already begun discussing when it will begin reducing its $ 120 billion monthly asset purchase program, which officials have pledged to maintain until substantial progress is made on its inflation targets average of 2% and full employment.

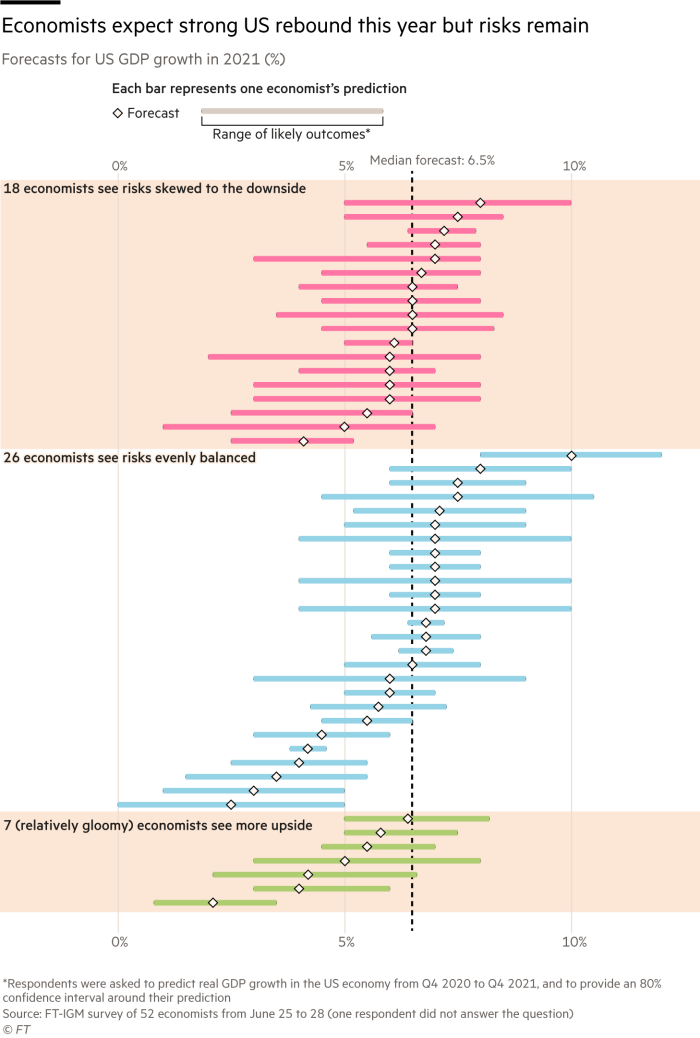

The FT-IGM survey showed substantial disagreement over the outlook for economic growth in 2021, even with almost half of the year in the rearview mirror.

The median forecast was for a 6.5% rise in gross domestic product, after the economy contracted by 3.5% last year. But economists were also asked to establish a plausible range of results, which were more often distorted downward than upward.

The high degree of variation suggests that “there is considerable uncertainty about how quickly the service sectors will recover, whether the lack of a labor market will hinder growth and how savings [and] consumption will respond once the fiscal stimulus is set, ”said Allan Timmermann, a professor at the University of California at San Diego, who helped design the survey.

[ad_2]

Source link