[ad_1]

In April 2011, Barack Obama invoked the support of Warren Buffett, the billionaire investor, to try to persuade Congress to impose a minimum tax of 30% on Americans earning more than a million dollars a year. A wall of Republican opposition and skepticism by some moderate Democrats rejected his effort.

Ten years later, Joe Biden is pursuing his own version of this mission with a plan to raise even more aggressive taxes on well-paid people to help fund more than $ 1.5 million in health and education spending.

But tax lobbyists warn that the Democratic U.S. president is facing another upward rise, putting the risk at risk of being left-wing as lawmakers fight him in the coming months. One likely obstacle is Democrats in affluent districts, including the suburbs of New York, New Jersey, California, and Illinois, in addition to the predictable Republican opposition.

“Democrats have been dependent and sensitive to a relatively rich support base. So the excessive reach could expose them to political attacks and economic problems, which can alienate these voters, ”said Mac Campbell, a former Democratic congressional aide and senior vice president of the Lincoln Policy Group, a pressure company.

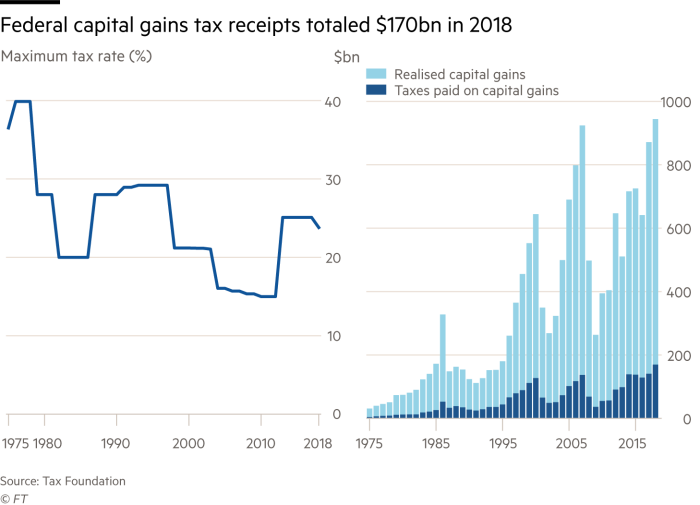

The Biden administration’s plan is expected to contain nearly double the rate of capital gains tax and dividends for Americans earning more than $ 1 million a year, as well as an increase in higher income tax rate up to 39.6%. The moves would affect wealthy investors, including hedge fund managers and private equity executives.

The White House has seen a major recent shift in popular opinion in favor of higher taxes on the wealthiest, after high-income workers have fared well after the financial crisis and during the coronavirus pandemic, while low-income families had problems.

But the White House has already received a taste of the resistance: some Democratic lawmakers have been pushing hard for Biden to fall A cap on federal deductions for state and local tax payments enacted by former President Donald Trump. The policy has increased costs for homes of democratic strongholds such as New York, New Jersey and California.

“Democrats in states with high taxes and living costs have laser-focused on repealing the state and local tax deduction limit. The president’s team will have to affirmatively address or correct this policy if it wants to succeed in increasing capital gains taxes on wealthier Americans, ”said Izzy Klein, a Democratic strategist and co-founder of the Klein / Johnson Group, a strong bipartisan pressure group.

Biden is certainly more likely to raise taxes on the very rich than Obama in 2011, when Republicans had gained control of the House of Representatives and blocked many of their economic policies.

But Biden can only count on the thinner democratic majorities in the House and Senate.

“It will be difficult to keep everyone on board,” a Democratic tax lobbyist said. “I think the administration is being very aggressive, which probably serves their interests, but I’m not sure Congress is that aggressive. You’ll probably see the modulation of what is finally done.”

Matt Bennett, co-founder of Third Way, a center-right Democratic think tank, said he believed there would be an “intra-democratic compromise.”

“One of the things Biden has done a pretty good job of is stating that we don’t do a very good job in this country with our rewarding public work policy and balancing the playing field between earned and unearned ways of making money. ., “He said. “This is a pretty compelling and widely resonant set of arguments.”

However, prominent business groups have quickly questioned the capital gains tax proposal, which is in addition to Biden’s increase plan. corporate taxes to pay a $ 2 million independent infrastructure proposal. Suzanne Clark, chief executive of the U.S. Chamber of Commerce, told CNBC she considered the provision of capital gains “terrifying” and noted that the influential business lobby would campaign against it.

“The idea that we would punish people for investing in the economy right now seems outrageous. I don’t think that can be passed by Congress and we will make sure,” he said.

Asked about the White House’s argument that the tax increase would affect only 0.3 percent of America’s wealthiest households, Clark said it would have a broader impact on the economy. “The data that worries us are the investments in public companies [and] what does that do with middle-class pensions, ”he said.

A duller tone emerged from the Investment Company’s Institute. The fund group trade association said it would analyze the proposal as it unfolded, adding, “With fiscal policy, the devil is always in the details.”

Some investors urged Washington to consider maintaining a different tax treatment for capital gains based on how long they held before selling them.

Colin Moore, chief investment officer at Columbia Threadneedle Investments, said he hoped to increase stock sales that had seen strong gains by wealthy investors before higher capital gains taxes arrived next year. However, equity markets have risen even further into record territory, even as the probabilities of higher capital gains and corporate tax rates increase.

“You definitely have taxpayers looking for a proposed dramatic increase in the capital gains tax rate and they say,‘ If I had a profit, I’ll recognize it soon, in the next six months or a year, I want to take a bath with that? Said Rohit Kumar, co-head of PwC’s national tax services group in Washington.

When the debate begins on Capitol Hill, Democratic lawmakers join at least in the idea of improving the funding of the Internal Revenue Service to better enforce the tax code, which they say could generate revenue of up to $ 700 billion. dollars in ten years. Joe Manchin, the moderate Democratic senator from West Virginia, told CNN Sunday that this option “should be explored before taxes start exponentially.”

After Obama reached the traffic barriers in 2011, he managed to raise higher income tax rates and capital gains after his re-election in 2012. In 2021, hope grows on the Democratic Party’s left flank that Biden you can go ahead with your plans. , although it has not approved its boldest wealth tax proposal.

“A fairer tax system is about making our country better and stronger,” Massachusetts Democratic Sen. Elizabeth Warren said Tuesday. “It’s about allowing us to invest in our economy by asking the richest Americans and the largest corporations to pay their fair share.”

[ad_2]

Source link