[ad_1]

Just_Super

Investment thesis

Our current investment thesis is:

- Darktrace looks to be a fantastic business, with a wide range of highly popular cybersecurity products.

- Demand for cybersecurity will continue to remain strong in the coming years.

- Revenue growth is strong, with the company’s trajectory looking positive.

- Margin improvement will come in the medium term.

- The QCM short report and high spending on S&A have us concerned, and so we suggest patience until the EY finding are released.

Company description

Darktrace plc (OTCPK:DRKTF) develops and sells cybersecurity solutions globally. The company offers a range of products including

- Darktrace PREVENT, which monitors and identifies risks, vulnerabilities, and external threats to an organization’s attack surface.

- Darktrace DETECT analyzes various metrics to detect evolving threats, unknown techniques, and novel malware.

- Darktrace RESPOND autonomously disarms attacks, reacts to threats in seconds, and relieves the burden on security teams.

- Darktrace HEAL assists in restoring assets and systems affected by cyber-attacks, helping organizations make confident decisions to keep their business operations running smoothly.

Darktrace received disproportionate market interest when it was listed in London due to its infamous co-founder Mike Lynch. For those who do not remember the name, Mike Lynch co-founded Autonomy, the company that was sold to HP (HPQ) for $11bn and was subsequently discovered to have falsified financials (among other issues). He continues to fight extradition to the US.

Share price

Darktrace share price (Google Finance)

Darktrace has experienced a consistent share price decline following an impressive start, reflecting difficult trading conditions and underwhelming financing results.

Financial analysis

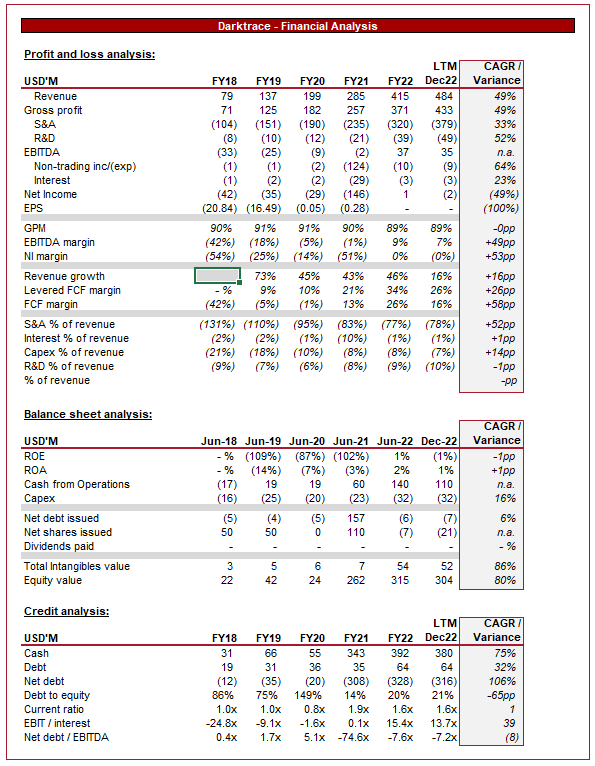

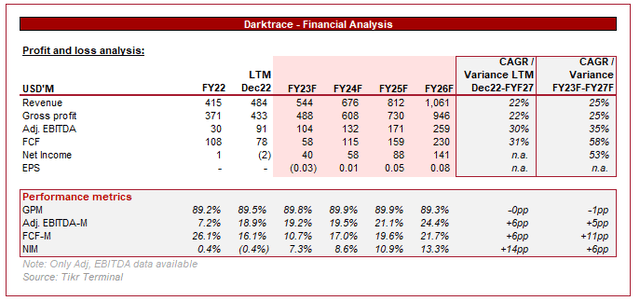

Darktrace financials (Tikr Terminal)

Presented above is Darktrace’s financial performance for the last decade.

Revenue

Darktrace has grown revenue at a CAGR of 49%, reflecting what has been a period of significant new customer acquisitions and upselling.

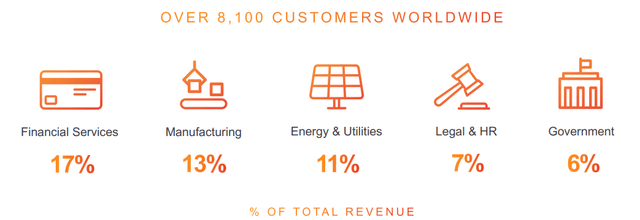

Darktrace currently boasts c.8100 customers, diversified across a range of industries worldwide. This is a reflection of Darktrace’s target market, with the business developing a range of products applicable to different industries.

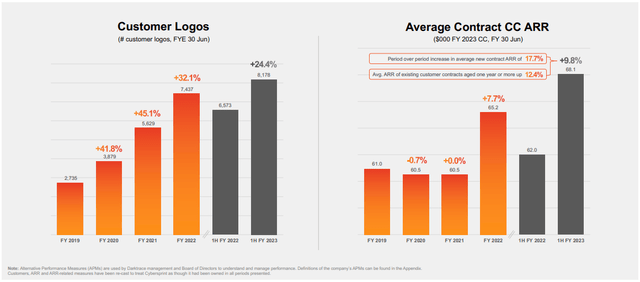

Customers (Darktrace)

Cybersecurity backdrop

Before assessing Darktrace in detail, it is worth understanding why the Cybersecurity industry has been propelled into prominence.

We have seen a rise in sophisticated ransomware attacks and APTs, which require advanced cybersecurity measures. This is a reflection of developing computing power and greater education and research. The average data breach cost has reached an all-time high of $4.25m, which has forced businesses to significantly upgrade their cybersecurity infrastructure as a means of defending their data. Further, given the increasing cost to businesses, we have seen a consistent rise in the cost of cybersecurity services.

It is not just breaches that are encouraging improved cybersecurity. Stricter data privacy regulations, such as the EU’s General Data Protection Regulation (GDPR) and California’s Consumer Privacy Act (CCPA), require businesses to implement robust security measures or face fines and client backlash.

In addition to the core factors explained above, changing market conditions are encouraging the development of cybersecurity infrastructure.

With the increasing prevalence of remote working, businesses are facing greater challenges with protecting client data. For this reason, we are seeing increased solutions tailored to securing remote endpoints, network connections, and collaboration tools. This is a service Darktrace has looked to develop in order to target this segment.

Further, we are seeing organizations continue to migrate their infrastructure and data to the cloud. This is a structural shift across almost every industry globally, as the benefits provided are significant. This is especially the case given we are in a data era, where businesses are collecting and analyzing record levels of information in pursuit of profitability. Once again, this creates increased demand for Cybersecurity services to protect against intrusion.

Data is not the only item that needs to be protected. Technology is increasingly part of human life, with Internet of Things devices creating new vulnerabilities. This is in addition to the traditional devices owned. Darktrace has developed an IoT-specific security solutions in response to this that protect connected devices and networks from emerging threats.

Advances in AI and machine learning technologies are continually shaping the cybersecurity landscape, as they are used to test, develop, and innovate the quality of protection provided. Darktrace has stressed the importance of AI in its real-time development and protection. Our view is that AI is currently the hot topic and so a large pinch of salt is required when assessing who is truly gaining significant unique value from AI relative to their peers.

Darktrace performance

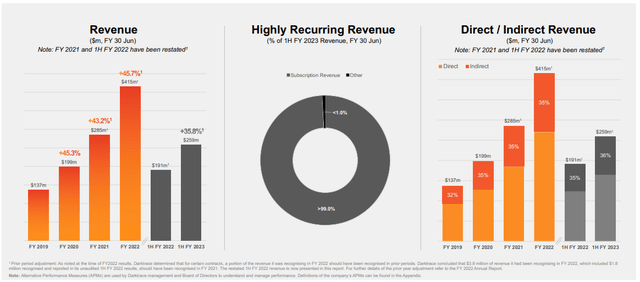

Darktrace’s revenue is recurring in nature, as clients pay a subscription to access its products. This is highly valuable for the business as it creates certainty of future income generation and also allows for price increases over time.

H1’23 revenue growth has dipped below the c.45% Darktrace achieved in the last 3 years, suggesting it is experiencing a slowdown.

Revenue profile (Darktrace)

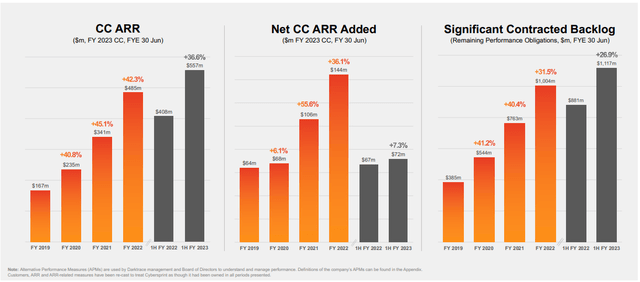

Given the nature of subscriptions, accounting revenue is not the best indicator of Darktrace’s current position. Revenue is recognized based on the delivery of services, so a contract agreed upon in May, for example, would only yield 1 month of revenue. Despite this, the company has essentially secured all future income as billing in advance is commonplace. For this reason “ARR” is used, which is the annualization of a subscription contract.

4 potential factors can move the ARR balance. This is important to understand as a means of assessing how the company is performing.

- New customers – This adds 12 months of value based on the contractual arrangement.

- Upselling / Downselling – which adds / deducts a set % based on price increases, discounts, new services (or users), or removed services (or users).

- Churn – Which is 100% of lost customer value.

As of H1’23, Darktrace’s ARR is $557m, with ARR add slowing to $72m. In Q3, the company achieved a further $27m, slowing further. Assuming the company achieves a similar ARR add in Q4’23, Darktrace would land at c.26% growth in the year.

This is fairly disappointing in our view, reflecting sensitivity to current market conditions. Although some may suspect this to be the case, we believe a market-leading cyber offering will continue its current growth trajectory due to the rapid development in the market. A slowdown implies greater competition.

Regardless of slowing ARR growth, the contracted backlog continues to increase, which should support revenue growth in the coming year.

ARR (Darktrace)

Darktrace has seen the number of customers continue to increase at a similar level to prior year. Further, average ARR per customer has increased by almost 10%, reflecting impressive upselling. We are far more impressed by Darktrace’s second bucket, as this reflects customer satisfaction and stickiness. Gartner is a highly regarded provider of insight into cybersecurity capabilities. Darktrace currently holds a 4.7/5 rating.

Rating (Gartner)

If we consider buckets one and two in conjunction, Darktrace is likely onboarding slightly lower-value customers on much higher-value contracts relative to the year prior, while also achieving strong genuine upselling/price increases.

New customer adds (Darktrace)

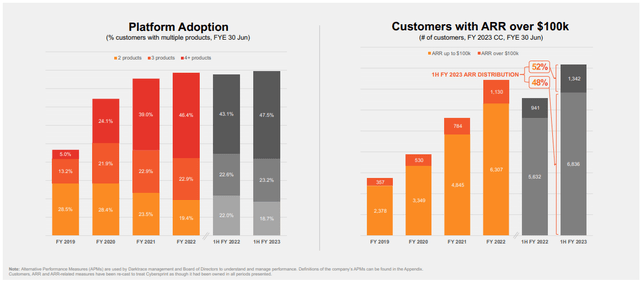

These upselling/price increases look to be weighted toward upselling, with 4+ products being sold to 47.5% of customers. This is an impressive achievement and reflects Darktrace’s ability to integrate its products to achieve a compelling holistic offering.

Upselling (Darktrace)

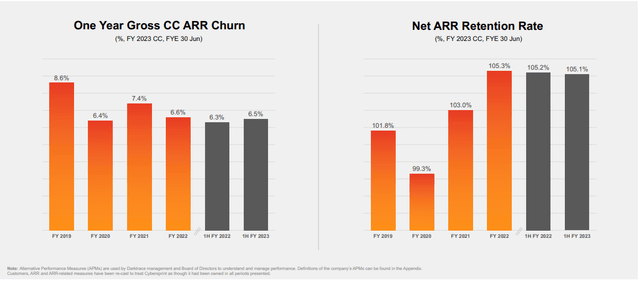

Finally comes churn. Darktrace’s churn has declined over the last few years, suggesting the company’s offer has gradually improved through innovation, making it more competitive.

In Q3’23, churn increased to 6.9%, suggesting again that the company is beginning to feel the impact of economic slowdowns. This is not just from a new customer perspective, but also existing. This implies clients are able to find cheaper options with a better price/quality trade-off. Cybersecurity is not a cost that can be foregone but Management can scrutinize their costs to find areas of saving by shopping around. If we compared Darktrace to Fortinet (FTNT), a market-leading cyber business, its ARR growth has remained consistent, suggesting customers are unable to switch and new customer growth continues to be strong.

This is not to argue Darktrace is a bad business but instead to highlight its relative position in the market.

Churn (Darktrace)

Overall, our view is that Darktrace has a compelling offering of products that are addressing the modern-day cybersecurity threat. We see slight weaknesses in the company’s slowdown, which suggests Darktrace is not in a leading competitive position, but instead is a strong player.

Margin

Darktrace’s current margins are disappointing. The company has an EBITDA-M of 7% and a nil NIM.

On paper, this is not overly concerning. The company is still in its growth & proof of capabilities phase, and so significant investment in R&D and sales is required to attract clients. If we consider Fortinet once again, it took the company 3 years post-negative EBITDA to achieve >20% EBITDA-M. This only lasted for 2 years, following which the company experienced another 7 years of <20% EBITDA-M.

The problem, however, is that Darktrace is spending heavily on marketing, with analysts criticizing the company for what looks to be aggressive practices in order to win clients on long contracts. The concern is that if the company’s technology is lacking, churn could spike once these contracts end and its lack of commitment to R&D could leave the offering obsolete. As a Darktrace analyst stated, “There is no doubt that they are extremely good at marketing, their presence is very well known. However, it is harder to realize how good the technology is”.

We would not expect margin improvement until the company crosses c.$1bn, giving its sufficient scale and market recognition to begin transitioning toward profitability.

Balance sheet

Darktrace is conservatively financed, with little debt and a negative ND position. As a software business, the company generates a substantial amount of cash which means liquidity is not a concern.

Outlook

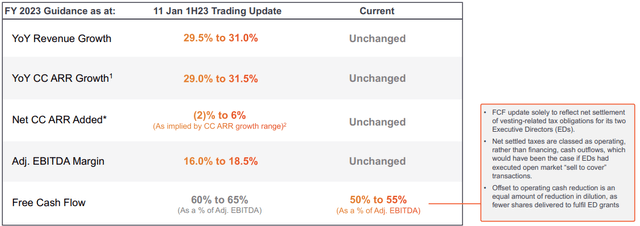

Outlook (Darktrace)

Presented above is Management’s H1’23 guidance update.

Growth is expected to slow further to c.30% Y/Y, although Management now believes the lower end is more realistic. Although we are concerned with a slowdown, we are more focused on churn and net retention.

If Darktrace can continue to net add ARR and minimize churn, new customer growth will develop over time.

Outlook (Tikr Terminal)

Presented above is Wall Street’s consensus view on the coming 5 years.

Revenue is expected to grow at c.25%, which implies a slowdown in ARR growth. This looks to be a reasonable conservative view. We believe 20-30% should be targeted in the medium term.

Margin improvement is ongoing, with Analysts aligning with our expectation that the largest improvement will come post-$1bn.

The short report

The US hedge fund QCM released a short report in Feb23 alleging Darktrace conducted “questionable and aggressive marketing, sales and accounting practices to drive up the value of the company before its flotation in London almost two years ago”.

Darktrace has responded by recruiting EY, the audit firm, to conduct an internal review to calm investor concerns. This report has yet to be published but in our view could offer the reassurance needed to protect the business from this attack.

Our view is that QCM’s warnings are worth hearing. It is not lost on us that Mike Lynch is wanted by the Americans for a similar thing, and Poppy Gustafsson (Co-founder and CEO) is also a former Autonomy employee.

It is difficult not to suggest strong caution until EY’s findings are released, from which time a more informed decision can be made.

Final thoughts

Darktrace looks to be a fantastic business. It is not one of the market leaders, in technology or size, but offers a strong range of products to the public. The company’s financial metrics are incredibly attractive and based on its current trajectory, the company is very cheap at 17x NTM EBITDA.

This issue is that our analysis is rendered (partially) useless if QCM is correct. There is a reality where EY gives a clean report and the stock price increased 20-30% in a day. If this was to occur, I would still not regret issuing the rating I will. Warnings are always worth heeding, especially when history suggests so.

We rate Darktrace a hold until at least the issuance of the EY report.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]

Source link