[ad_1]

During both downturns and boom times, businesses across industries face the challenge of building sales pipelines and closing revenue. “Account-based” intelligence – that is, research into potential customers – can help in the screening process. But it also requires a complete, proven source of information and contacts in departments such as business development, sales and recruiting.

That’s why more and more businesses rely on Crunchbase, says CEO Jagger McConnell. Designed as a home-grown project by TechCrunch founder Michael Arrington to index startups featured in TechCrunch articles, Crunchbase has evolved over the past 15 years into API-driven startups and financial reports with a growing news section.

Crunchbase now attracts more than 75 million unique visitors each year and recently surpassed 60,000 paying customers, representing more than half of the Fortune 500, McConnell says.

“We find and engage with qualified accounts, while also generating awareness for companies that want to be present,” he told TechCrunch in an email. “From the day of our rotation [as an independent company in 2015] … We’ve built a search platform powered by our proprietary data, which allows deal makers to find qualified accounts and generate insights for companies that want them at the same time.

Investors seem confident. This morning, Crunchbase closed a $50 million Series D round led by Algment Growth, with participation from OMERS Ventures, Mayfield and Emergence Capital. CEO Jaeger McConnell declined to comment on the review, but described it as a “big round.” According to Pitchbook – Crunchbase’s competitor, Crunchbase, surprisingly, had a post-funding valuation of $70 million.

Image Credits: Crunchbase

“Crunchbase’s software-as-a-service platform combines rich and proprietary company data with direct access to decision makers in one intuitive interface – at incredible price points, making it a powerful tool to drive return on investment across a variety of use cases, from sales to recruiting and more,” Alignment development partner Alex Iosilevich said in an email statement. Iosilevich plans to join Crunchbase’s board of directors soon. “We expect Crunchbase to continue to experience accelerated industry adoption and are excited to support the company’s growth momentum with strong participation from our existing investor group.”

Crunchbase’s core is still a research suite for sales teams today. Entries show when a company was founded, its founders and executives, and the financing and debt cycle (and their contributors). Paid Crunchbase plans to unlock information about competitors, history and more.

Crunchbase employs a team of writers who cover funding rounds and other Crunchbase-related content on Crunchbase News. (This author is known to cite their work from time to time.) As for the original database, it is updated manually and automatically through thousands of partnerships and agreements with LinkedIn, Business Insider, and others.

The way McConnell sees it, Crunchbase can reduce the amount of time sales teams spend highlighting companies with “signs of growth” — such as increasing funding or product adoption.

“With difficult economic conditions impacting many companies, knowing whether or not a target account is increasing empowers buyers to focus their purchasing power on decision makers,” said McConnell. “Our tools encourage account-based selling, which encourages dealmakers to prioritize their prospecting efforts based on the companies they need to contact rather than individuals. This is the opposite of the ‘spray and pray’ approach, which relies on huge contact lists and leads to spam that no one likes.”

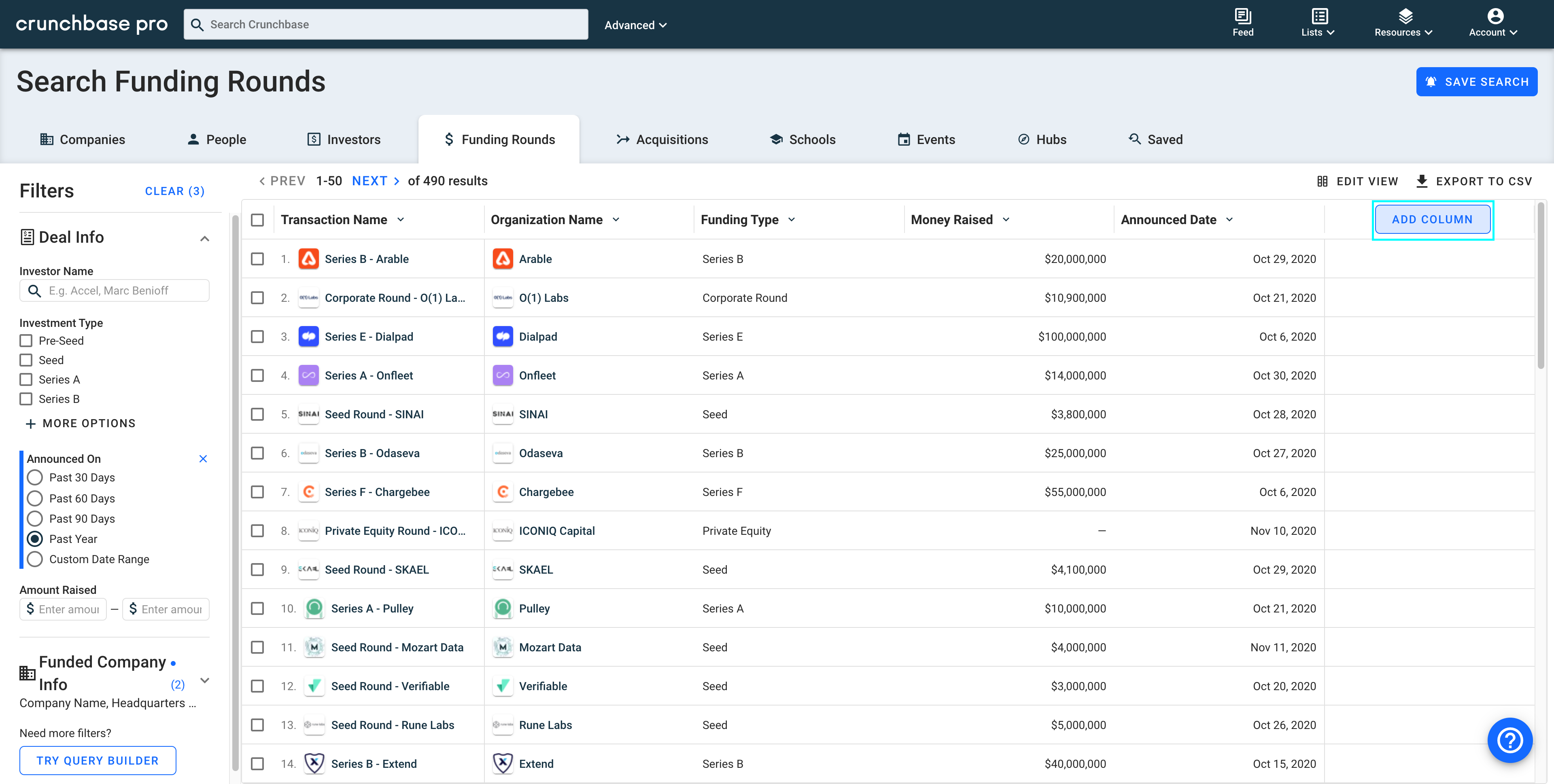

Additions to the platform over the past few months have focused on discovery, such as allowing Crunchbase customers to find companies that fit a profile by filtering for states or attributes such as “uniqueness.” Machine learning-powered recommendations should consider new accounts and similar companies, while customer relationship management data in Search Spotlight accounts may be new to a particular vendor.

Beyond discovery, McConnell drew attention to Crunchbase’s recent qualification and tracking improvements, like a Chrome extension that shows context when researching accounts. Crunchbase customers can now sync new accounts that meet their criteria with Salesforce and receive email alerts on “priority” accounts or created lists, saved searches, notes, and matches accounts.

Image Credits: Crunchbase

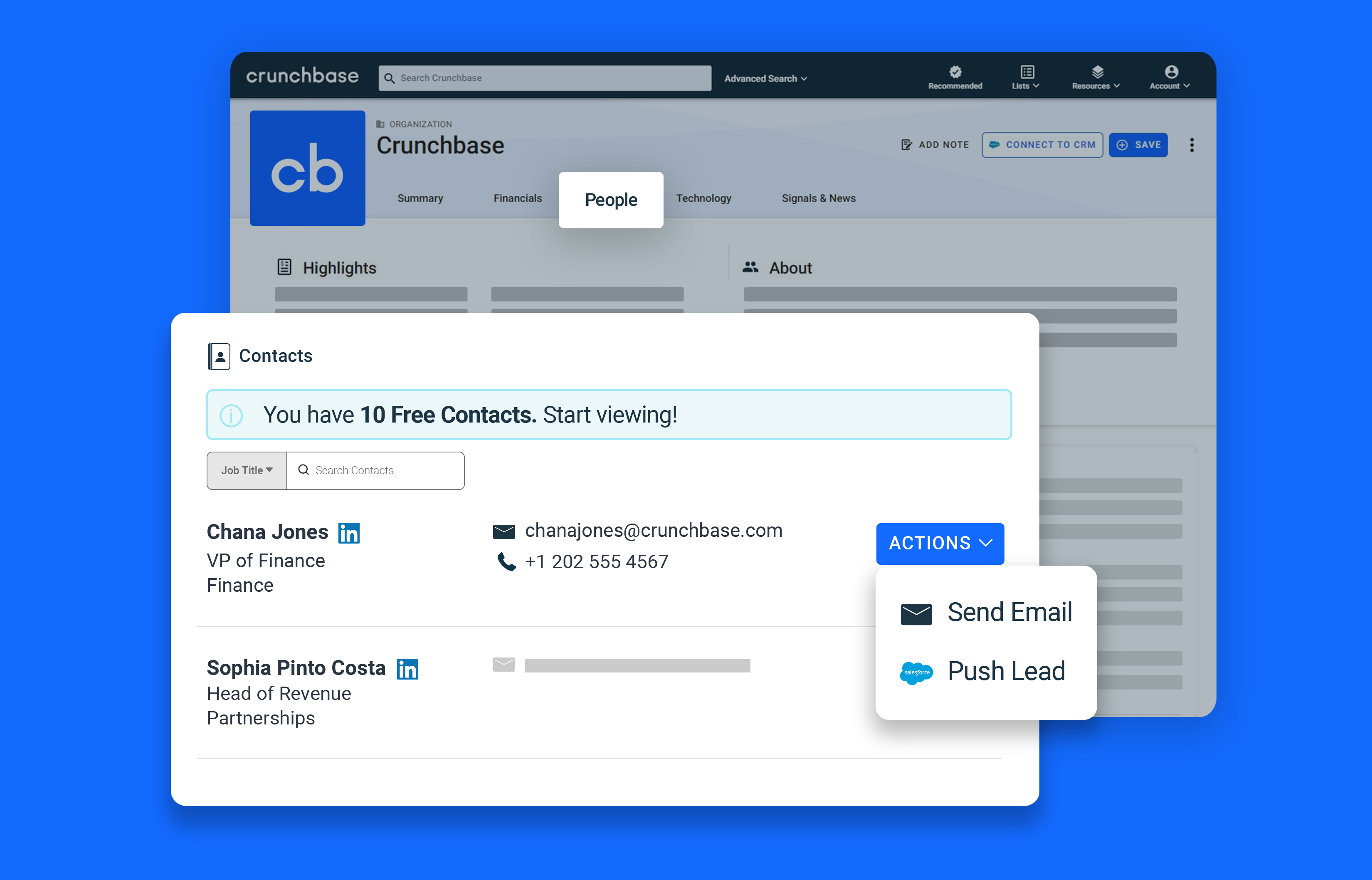

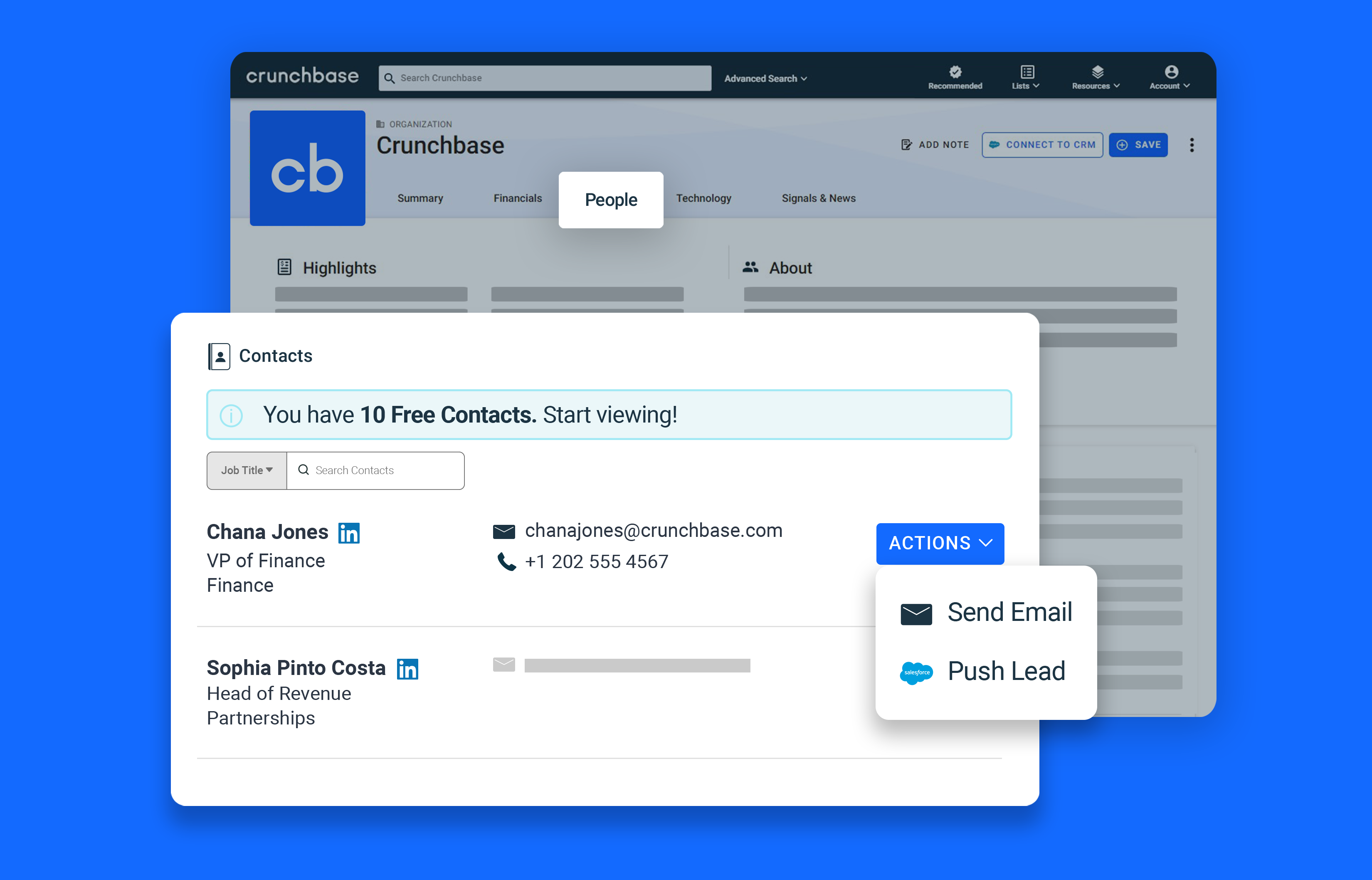

Through the engagement tool, Crunchbase now features “decision maker” contact data — searchable — and integrates with email providers, including Gmail. Customers can use auto-generated email templates that pull in targeted data relevant to special interest prospects.

McConnell said that Crutchbase resisted adding contact information for a “long time” due to privacy concerns, but ultimately concluded that it was “incredibly valuable” to customers. “We’ve gone out of our way to make sure we’re doing this the right way, encouraging informed access and complying with all laws and regulations as they stand,” he said. “Thank you, our business model does not depend on contact information.”

Crunchbase competes not only with the aforementioned PitchBook, but also with CB Insights, Owler, and other search services and databases. Lusha, a crowdsourced data platform for business-to-business sales, recently raised $205 million at a $1.5 billion valuation. Meanwhile, Apollo.io, a sales intelligence platform, landed $110 million as it crossed 16,000 paying companies.

McConnell sees diversity — and raw ambition — as the key to Crunchbase’s continued growth. To this end, Crunchbase plans to launch an integration with Hubspot and improved machine learning-powered recommendations that point accounts, contacts and tasks to various future goals. There are also more sophisticated dashboards in development to help clients track the “effectiveness of activities” on Crunchbase, including Annual Recurring Revenue (ARR) for opportunities found on the platform.

“The recent onslaught of rounds and mass divestments from companies that have reached the unicorn stage show how excessive burn rates can be hidden behind large funding rounds, masking the reality of weak business fundamentals,” McConnell said. “I’m especially proud that we’ve been able to drive growth while controlling our burn rate. In the first half of this year, we drove $9 million in net new ARR on just $2 million — that’s best in class by Bessemer’s efficiency metrics and puts us on track to profitability… our business-to-business We plan to double our software ARR this year, ending at $38 million in ARR for this customer segment.

Crunchbase’s latest round of funding brings its total to $106.5 million. A portion of the proceeds will be used to expand the 220-person team to about 275 by the end of the year, McConnell said.

[ad_2]

Source link