[ad_1]

A titan of consumer electronics Apple (A.P.L 2.62%) Most of the dividends are not counted; Its correlation with other FAANG stocks makes it look like a growth stock. But Apple has evolved from millionaire high flyer to cash cow thanks to its profits.

Why dividend investors should buy Apple stock today and earn passive income for decades to come.

Generates cash profit.

Apple’s growth stock portfolio comes from decades of delivering life-changing returns to investors. In the year It has returned an astounding 2,530% from 1990 to 2010 and another 1,960% from 2010 to date.

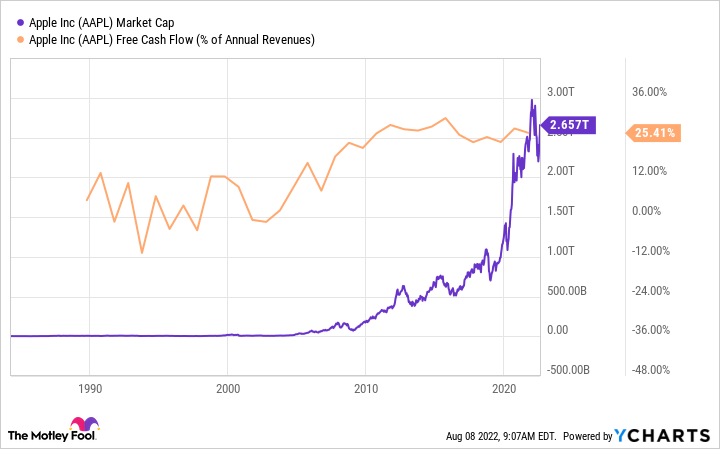

Two positive trends have been consistent over the years: First, the company has become more efficient at generating cash flow, now turning $0.25 of every dollar of revenue into free cash flow. Second, Apple is now a giant with a market cap of $2.6 trillion.

AAPL market cap data by YCharts

With how big Apple is getting, it will be difficult to generate these high capital gains. But shareholders own a company that generated $107 billion in free cash flow last year, more than most companies make in sales.

Establishing a commitment to dividend

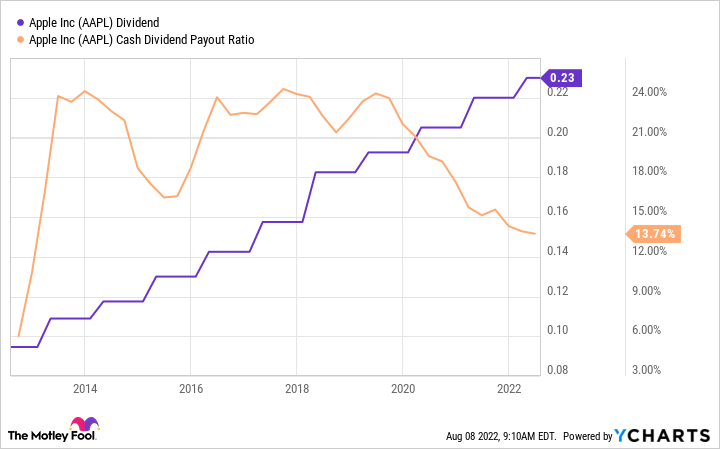

Apple is one of Wall Street’s wealthiest companies, so it only makes sense to distribute profits to shareholders. Apple’s significant share buybacks grab a lot of headlines, but the company has quietly paid out and raised its dividend for the past 10 years in a row.

AAPL data distributed by YCharts

It’s nothing to be proud of today; Investors get only 0.5% dividend. But it’s the future potential that deserves your attention. The dividend payout ratio is just 13% of cash flow, giving it as much flexibility as it needs to raise the dividend in the future.

Apple could stop growing immediately and still have money to grow its payout for years. But growth hasn’t stopped — annual revenue growth has averaged about 12 percent over the past five years. The company’s outstanding shares also fell by 21% over the same period, allowing it to pay the dividend for fewer shares.

The combination of growth and fewer shares means Apple can raise its dividend per share and not hurt its payout ratio that much. The company looks like a future Dividend Aristocrat, an S&P 500 company with at least 25 years of consecutive dividend increases.

To be a more consistent company

The iPhone has been Apple’s primary revenue driver for years, making it a cyclical business. Revenue growth may pick up when a new model comes out as people rush to upgrade their phones, but sales may slow for the rest of the year.

AAPL earnings (quarterly YoY growth) data at YCharts

Apple’s services business, which includes the App Store and additional subscriptions such as Apple TV, music, news and gaming, has become an increasingly important part of the stack and now ranks second among the company’s products.

Source: Statesman

Services is also Apple’s fastest-growing business, which means the ongoing segment will grow larger to offset some of the volatility in Apple’s growth. Services are subscriptions that users pay for each month, so they should be more stable than hardware sales.

Apple’s massive balance sheet and billions in cash flow have helped the company weather various product sales cycles, enough to boost its share each of the past 10 years.

Services could eventually help moderate Apple’s year-over-year growth, and a more stable business would make it a stronger dividend stock.

Investors shouldn’t expect Apple to deliver thousands of points in total returns anytime soon. Those days may be over. But Apple can be the type of blue-chip stock that adjusts the long-term portfolio. It has enough growth to build wealth for shareholders, and the dividend looks poised to generate active income for years to come.

Justin Pope has no position in the mentioned stocks. He has spots in the Motley Fool and recommends Apple. The Motley Fool recommends the following options: long March 2023 $120 calls on Apple and short March 2023 calls on $130 on Apple. The Motley Fool has a disclosure policy.

[ad_2]

Source link