[ad_1]

Ministries

One segment of the S-Network Global Travel Index (TRAVEL) – ancillary users – has not been discussed as much in our previous reports as airlines, hotels and booking agencies. Most of these elements are focused on luxury retail, which is growing in demand Inflation. As socializing becomes commonplace again, more consumers are willing to spend on luxury goods, luxury services, and premium products (ie, looking good, dressing well), which affects the broader travel industry, especially higher airfares and overall travel costs. .

Many of the top heavy users benefit from travel retail and returning travelers

LVMH Moët Hennessy Louis Vuitton SE (OTCPK:LVMHF) (OTCPK:LVMUY) (MC FP, 5.0% index weight), L’Oréal SA (OR FP, 4.8% index weight) and Estee Lauder Companies (EL) (EL, 4.8 % index weight) are currently the second, third and fourth largest constituents in the Travel Index and contribute 14.6% weight to the index. Index using Natural Language Processing (NLP) to extract keywords from company transcripts. NLP keywords include: road trip, hobby, Vacation timeetc. among many others. All three have exposure to “travel retail”, which is mostly duty-free shops at airports in addition to some sales on board aircraft, cruise ships, border shops and some city centres. L’Oréal refers to customers who see shopping as part of their travel journey as “global shoppers”.(2)

Despite inflation, consumers are spending more on luxury goods and services.

While the companies mentioned above benefit from increased travel and passenger traffic at airports, overall sales help provide color on where consumers want to spend their money. On the one hand, consumer spending has been muted for mass-market retailers — for example, Walmart ( WMT ) recently cut its profit outlook for 2Q earnings, citing demand for general merchandise, including apparel, where the markup had to come down.(3) This makes sense since August 2009. Savings are at record lows, according to the Bureau of Economic Analysis (5.1% of disposable income as of June 2022). (4) But consumers are still willing to buy luxury goods, including handbags. Despite steep price hikes from designer brands, wine and beauty products. As consumers return to socializing in person, they may be willing to spend on better quality and higher-quality clothing, accessories and beauty products that have failed to deliver convincing evidence over the past two years. LVMH, for example, reported a 28% y/y increase in 1H22 total sales, with all six divisions up at least 20%. Almost half of its sales revenue comes from the fashion and leather products segment, which saw a significant increase of 31% y/y. Since 1H19 (pre-pandemic), sales in this segment have increased by 74%. And similarly, L’Oréal SA saw an increase in both luxury goods and consumer goods, but the largest growth in the L’Oréal Luxe segment. In 1H22, the company’s net sales in luxury showed a growth of 33.4% compared to 1H19. This segment includes high end brands such as Lancôme, Giorgio Armani and Prada. Luxury goods now account for the largest share of the company’s net sales (37.4% market share), eventually overtaking the consumer goods segment, which accounted for 37.0% of net sales in 1H22. In 1H19, Luxe accounted for only 36.9% of net sales, while Consumer Products accounted for 42.7% of net sales. The Consumer Products segment includes mass market brands such as L’Oréal Paris, Garnier, Maybelline and NYX.(5)

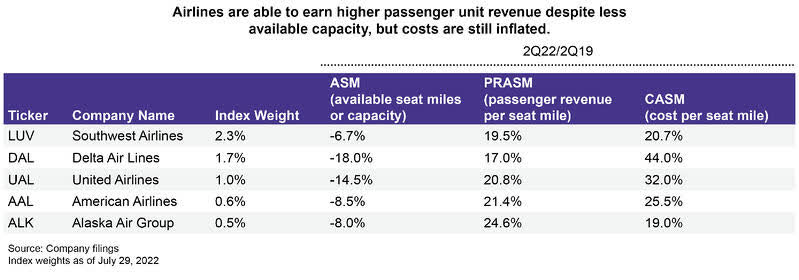

Travel has also become a luxury with higher airline ticket prices, and airlines like the companies mentioned above are still able to sell tickets at higher prices (see PRASM below). But airlines have faced two major issues that have hampered their performance. First, there are capacity constraints as some airlines experience pilot shortages and are forced to reduce schedules. While more passengers were traveling compared to last year, TSA’s passenger volume in 2Q22 was still 10% below pre-pandemic levels, matching the capacity average of major US airlines (see ASM below). Also, cost pressures, including fuel, wages and advertising costs, are increasing rapidly, which is causing profit margins to decline (see CASM below).

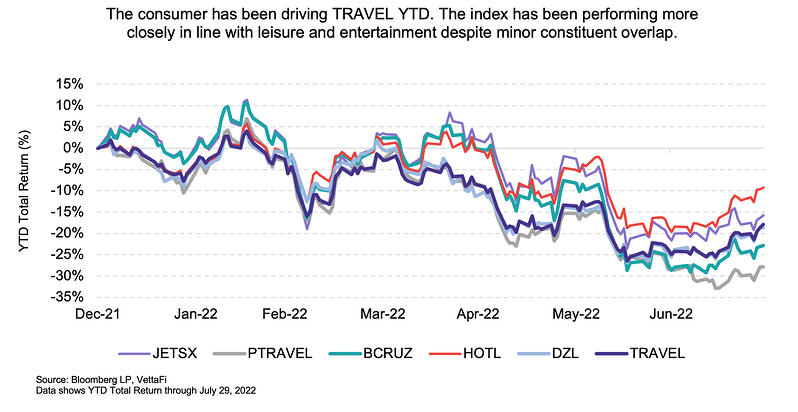

TRAVEL is largely consumer driven.

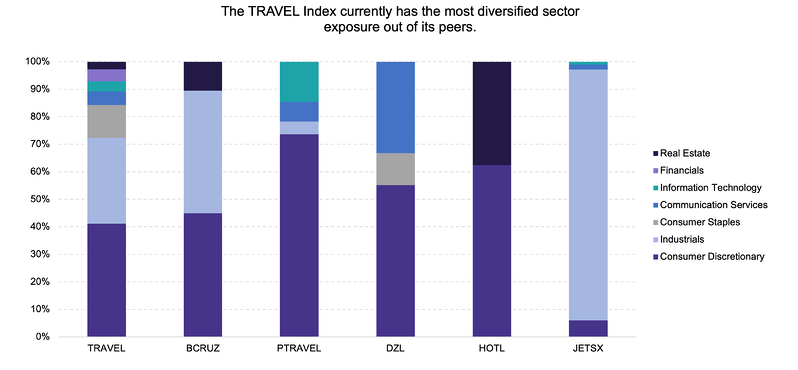

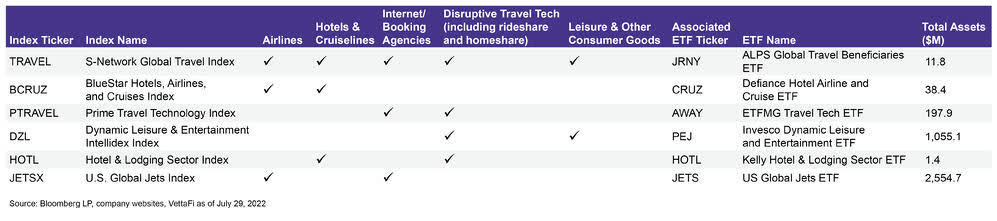

Among its peers, TRAVEL is highly diversified by sector with large allocations to consumer demand, industries, consumer staples and technology. Although 15.6% of TRAVEL’s components overlap in index weighting with the Dynamic Leisure & Leisure Intellidex Index (DZL), the two indexes performed fairly linearly YTD – indicating how much consumer-driven companies are influencing TRAVEL compared to pure-play travel companies. .

at last

Rising luxury spending reflects a shift in consumer preferences toward higher quality, premium goods and services as social interaction becomes normal again. Performance in the broader travel sector has been muted by higher costs, but underlying demand remains strong and consumer-driven.

(1) Weight rate as of July 22, 2022

(2) L’Oreal Group: L’Oreal Travel Retail

(3) Walmart Inc. It provides an update for the second quarter and fiscal year 2023

(4) Table 2.6 Personal income and its characteristics, monthly

(5) L’oreal Finance

Disclosure: © Alerian 2022. All rights reserved. This material may be reproduced with the prior permission of Allerian. It is provided as general information only and should not be taken as investment advice. Alerian employees are prohibited from owning individual MLPs. For more information about Alerian and to view our full disclaimer, visit Disclaimer | Alrian.

Original post

Editor’s Note: Bullets for this article’s summary were selected by Search Alpha editors.

[ad_2]

Source link