[ad_1]

Industrial companies often rely on migrant labor, with data from the International Labor Organization estimating that some 169 million workers travel abroad for work. But moving away from their domestic power and financial infrastructure poses many challenges, including what is most important to the worker himself – how much they can earn.

According to the company, employees from multiple locations may have to manage payroll, most of them in temporary or short-term assignments.

Managing all of this and making sure the workers are compensated in a timely manner is more difficult than most outsiders realize. And it is a challenge for German start-up Cadmos to tackle a top-notch platform that will help employers avoid the cost of cross-border labor and cross-border labor costs.

Four months after announcing $ 8.5 million in seed support, Cadmos announced today that he has invested an additional ሚሊዮን 29 million ($ 29.5 million) in Blossom Capital-led tranche and Atlantic Labs.

The problem

Immigrant workers – by definition – should be able to spend the money they earn because they are away from home for a specific work purpose. Sometimes they can be paid in cash, which means you can withdraw the money locally, but they may face higher transfer fees when they want to take the money home. In addition, many migrant workers have to send money home to their families, which is often the main reason they work abroad – again, they may have to pay high prices for cash transactions.

Alternatively, a company may choose to pay its employees through intermediaries such as local banks, transfer agencies, agencies or other third parties, which include not only large fees but also significant paperwork and delays.

With just over a year to go, Cadmos has been working with shipping companies to pay for his services.

How it works

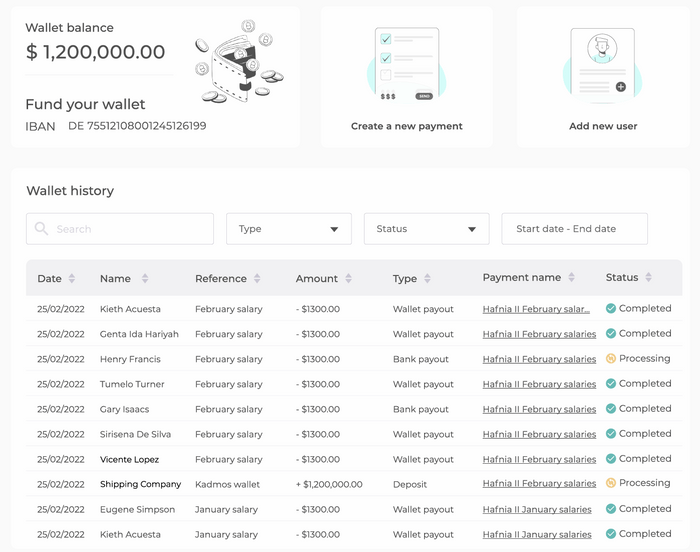

For employers, Cadmos provides a centralized payroll platform to process and monitor payments wherever an employee comes from.

Cadmos for employers

How all of this is set up An employee must actually work for a company that decides to use Cadmos. The employer inserts them into their own dashboard, and the employee receives a link to download and register cadres.

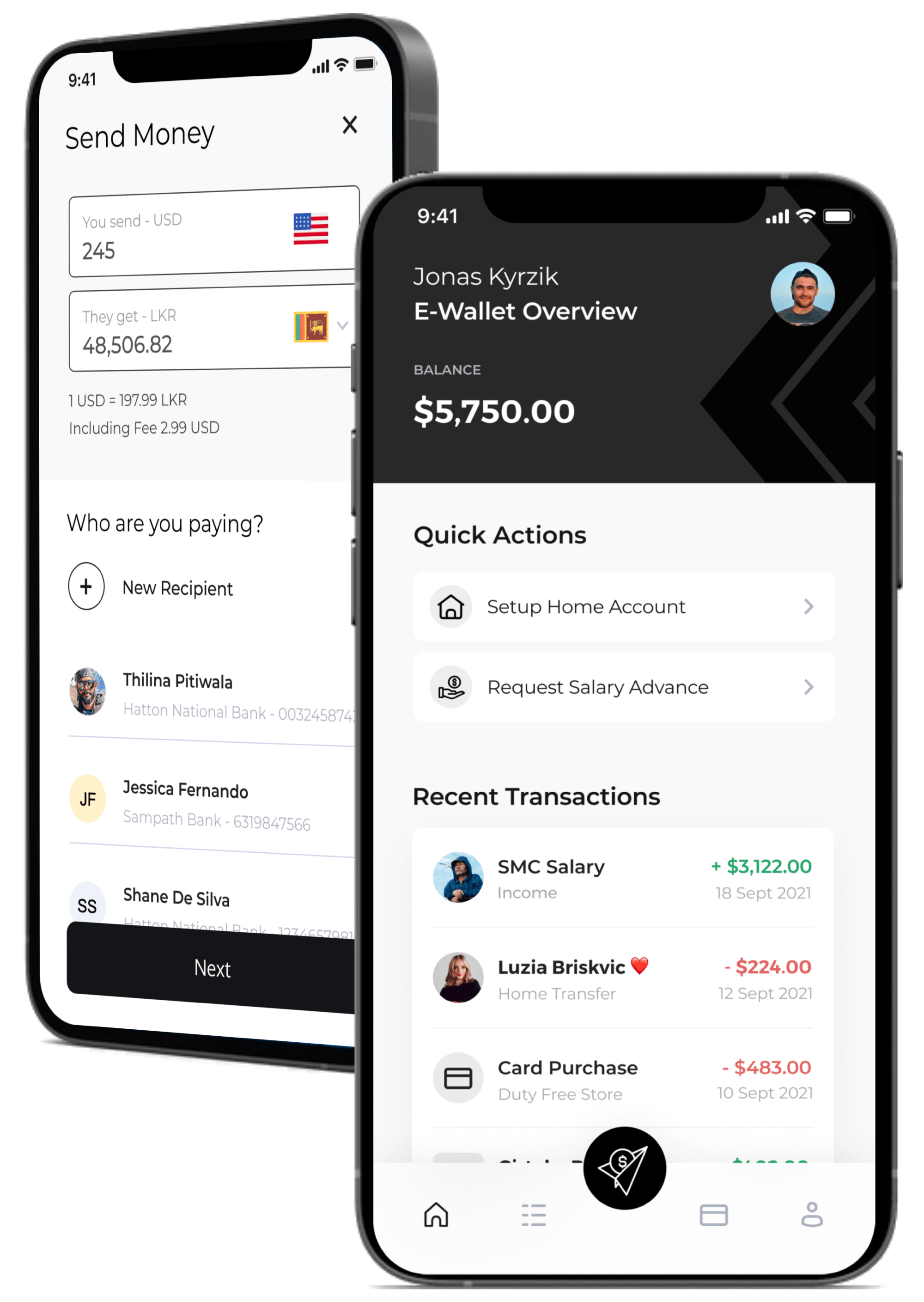

On the part of the employee, Cadmos offers a mobile app filled with US dollars or euros for employees’ wages, allowing them to send money home quickly with predictable payments. And, importantly, Cadmos will provide employees with their own debit card associated with their digital wallet.

Kadmos mobile app

Instinctively, limiting payments in euros or dollars can be a little restrictive, especially since migrant workers can come from any country in the world and travel to many countries. However, founder Sasha Makarovich says the transportation industry is primarily paying for these two funds.

“The current industrial demand is mainly in USD and EUR, because these are the currencies to be paid by the seafarers,” Makarovich told Tech Crunch.

This means that employees really have to spend a lot of time when they spend money or send it home. And this is the sub-1% mark of Cadmos that went into the fray, compared to the 1.5-4.5% that Makarovich traditional banks could charge. Therefore, if you use your debit card and withdraw dollars / euros in different currencies, you will be charged directly at Cadomes.

However, if the company is to expand to other industries in the future, is there a limit to the number of options available to employees to pay in other currencies?

“Yes, we are considering these options,” Makarovich said.

Modern Fintech

In practice, Cadmos incorporates the modern Fintech movement. There are many benefits to a modern challenge bank like Monzo, and in addition to cross-border payment features, it is similar to money transfer platforms such as Wiz or Remitley. But this is the essence of all this, according to Justus Schmutt, another founder of Cadmos. not at all Another B2B or B2C fintech – designed to solve a very different problem.

“The Cadmos approach can be classified as B2B2C,” Schmumer said. “In this regard, our metrics and acquisitions are very efficient, as we have thousands of new users to the Cadmos app, which has a wide range of employers who pay their employees.

By solving two problems at once – helping migrant workers get paid and reducing many of the costs and administrative burdens for employers – Cadmos is in a very strong position as the world continues to emerge from the locks and start a regular business.

“We want to make the payment process easier for companies, and at the same time make it easier for employees to receive and withdraw money,” Schmumer added. “Cadmos’ focus is on using technology to address the severe restrictions on the financial freedom of cross-border workers.”

[ad_2]

Source link