[ad_1]

A sustained market decline is a good opportunity to look for beaten-down names that could be big winners during the next bull market.

Travel could be a good place to start – an industry survey of travel agents has indicated hopes that travel and tourism will return to pre-pandemic levels next year.

Airbnb (Father B -3.38%) It was announced at the end of 2020, months before many growth stocks hit their highs. After rising to $200 a share from its ’68 IPO price, the stock has tanked, but buying Airbnb now may make it look like a genius later.

The company is a cash cow.

Airbnb provides a platform for homeowners (“hosts” in the company’s parlance) to rent out their homes and other properties or offer experiences to travelers. Users can book a stay from a listing on the Airbnb app or website. The company has a worldwide reach of over six million listings in 220 countries. 150 million people use Airbnb.

When you think of travel, you probably think of airlines, hotel chains, or cruise lines. But most of these businesses require price competition and constant investment. For example, airlines must acquire and maintain multiple aircraft, while travelers are only concerned with finding the lowest ticket price.

Airbnb is more like a technology business than a traditional travel company. It doesn’t have many tangible assets like planes, buildings or ships and because of that it is making tons of cash profits.

Airbnb generated $2.9 billion in free cash flow over the past four quarters, including $795 million in the second quarter. The company generated $0.38 of free cash flow for every dollar of revenue last quarter — a stellar free cash flow margin. In addition, management announced a $2 billion buyback program to generate more cash than is needed to grow the business organically.

The travel recovery is already in motion.

Airbnb also bounced back from COVID-19 as authorities shut down travel to prevent the virus from spreading. The company’s second quarter results showed that nights and booked experiences were at an all-time high of 103.7 million during the quarter, the second straight time it has exceeded 100 million.

Booking volume (the total value of all bookings) was up $2.1 billion on total revenue of $17 billion, up 27% and 58% year-over-year, respectively. Both parameters exceeded pre-pandemic levels.

Growth could slow further if the economy, now recovering from Covid-19, creates a travel bottleneck. However, this does not mean that the gas is running dry in the Airbnb growth tank.

Remember that 150 million people sounds like a lot, but Airbnb is a global business with listings in over 100,000 cities. The world’s population is about eight billion, which leaves a lot of room for long-term growth. Airbnb has become a category descriptor, like Kleenex facial tissues. The company faces competition from hotels and other travel websites, but the company has amassed significant brand power as a pioneer in the industry.

The stock is attractively priced

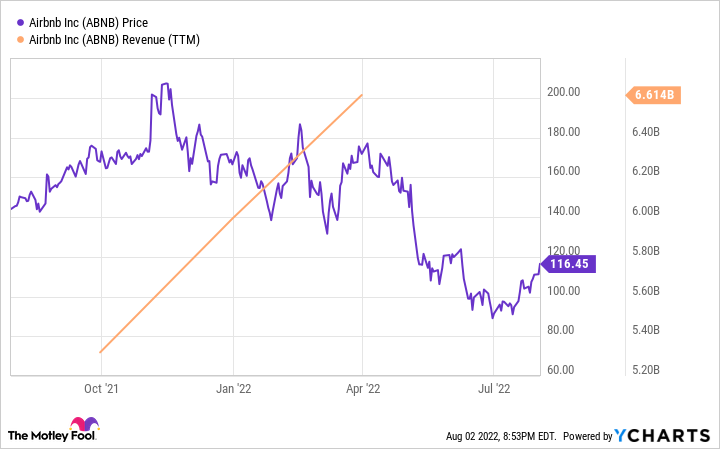

I love a good treasure hunt; Sometimes X marks the place. You can see in the chart below that despite rising earnings, investors have been selling stocks for fear of broader market volatility.

Data by YCharts.

The stock’s price-to-sales ratio (P/S) has fallen from over 20 to just 11. It’s still not the cheapest stock, but Airbnb’s very high free cash flow makes a lot of sense, especially in market research. Profitable companies.

If one realizes that Wall Street is holding its head and that the company is a cash cow with a long-term growth runway, one might suspect that Airbnb will start to feel aggressive. Consider buying this winner now — you might be bragging about it to your friends down the road.

Justin Pope has no position in the mentioned stocks. The Motley Fool has places and recommends Airbnb, Inc. Motley Fool has a full disclosure policy.

[ad_2]

Source link