[ad_1]

Henrik 5000

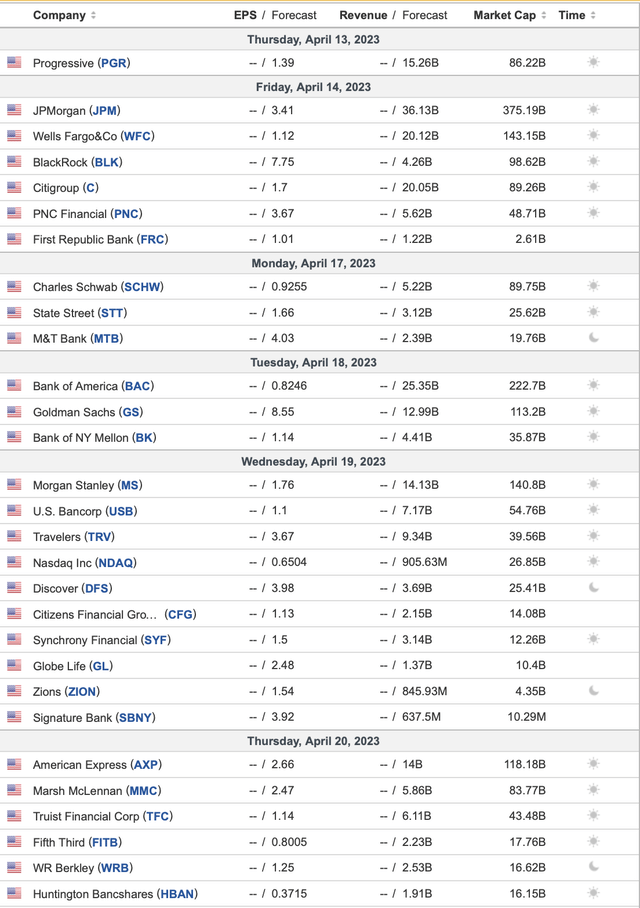

The SPX (SP500) remains remarkably resilient here, and upcoming earnings announcements will play a critical role in determining the direction of the stock market, especially in the near term. Major corporations, including high-profile banks, are likely to report market activity in the coming weeks. Unfortunately, regional And less bank exposure to “risky” vehicles could mean the financial sector continues to weigh on overall market sentiment.

If smaller banks begin to experience increased losses, it may indicate that the effects of the disease will continue, and other banks may begin to see additional losses on their bond portfolios. Also, it’s more than just bond portfolios that people should look at. For decades there has been an abundance of accessible capital, and the derivatives market has grown to enormous proportions.

Bank income – can be a disaster.

Bank Income (Investing.com)

Note: Tesla (TSLA) will report on April 19, and other important companies will report in the coming weeks. Technology should look much better than finance.

I’m not saying that JPMorgan ( JPM ) , Goldman Sachs ( GS ) and other major Wall Street banks should miss their mark significantly. However, unfortunately, some small banks may fail in the first wave of defaults and poor risk management practices. Many experts (including the Fed) say we could see a significant default and credit crunch cycle. Indeed, this is the most important “such” event since the Great Fall.

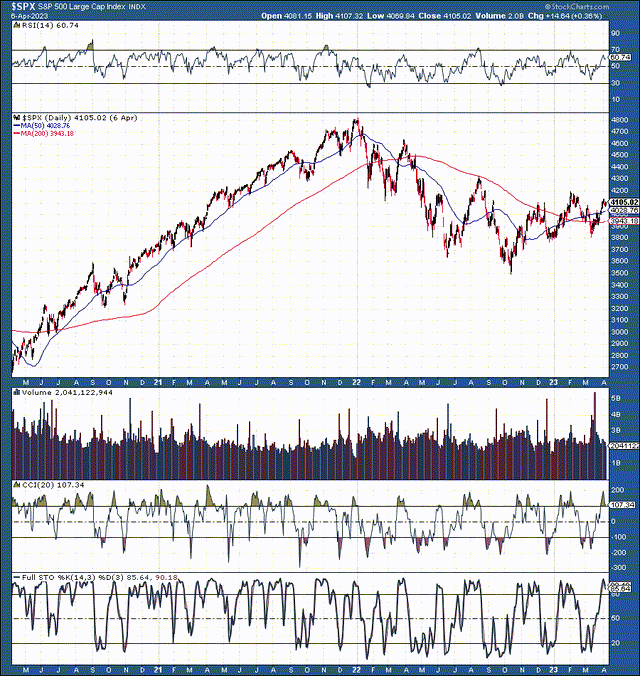

This volatility could cause future selling prices to accelerate, pushing the SPX lower than current levels. My immediate base case target for the SPX is 3,800. However, the major moving average at 3,500 or below could turn into a retest at worst. We should first see signs of earnings deterioration or significant losses in the banking sector in the coming quarters.

SPX 3-year chart

SPX (StockCharts.com)

We’ve seen an impressive rebound from the lows associated with the coronavirus, with the SPX gaining more than 70% in less than two years in this short period of time. The SPX hit a mid- or long-term low roughly six months ago. Now, the question at $64,000 is where the market is headed next. Let’s assume that the SPX has rallied about 19% from the “bear market” lows and is now at a critical awareness point from a technical, fundamental, and psychological perspective.

The leaders, of course, were our favorite tech stocks:

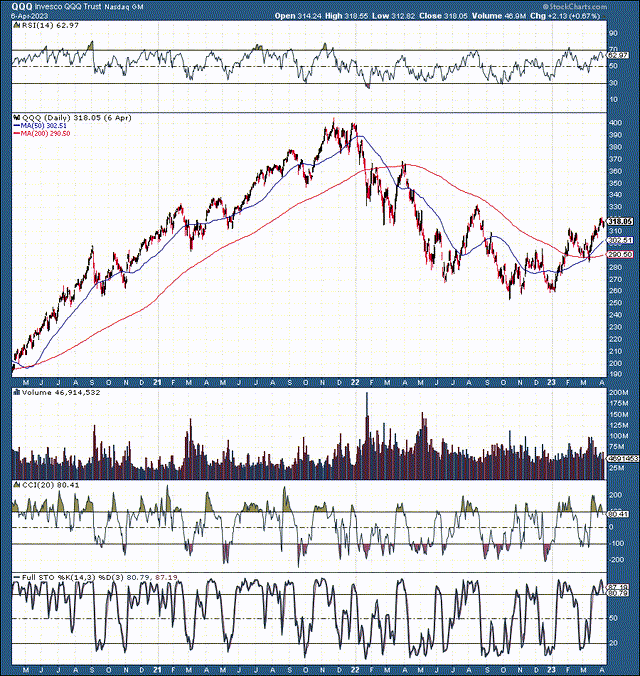

The “Nasdaq 100” ETF (QQQ)

QQQ (StockCharts.com)

QQQ had a roughly 125% run over a 1.5-year period, but when the super bubble burst, many stocks fell sharply. The QQQ bear market lasted for 11 months, during which time the underlying average dropped by a staggering 40%. In addition, many well-known, high-quality tech stocks have broken out, selling at high volume, leading to significant buying opportunities.

My favorite tech stocks remain

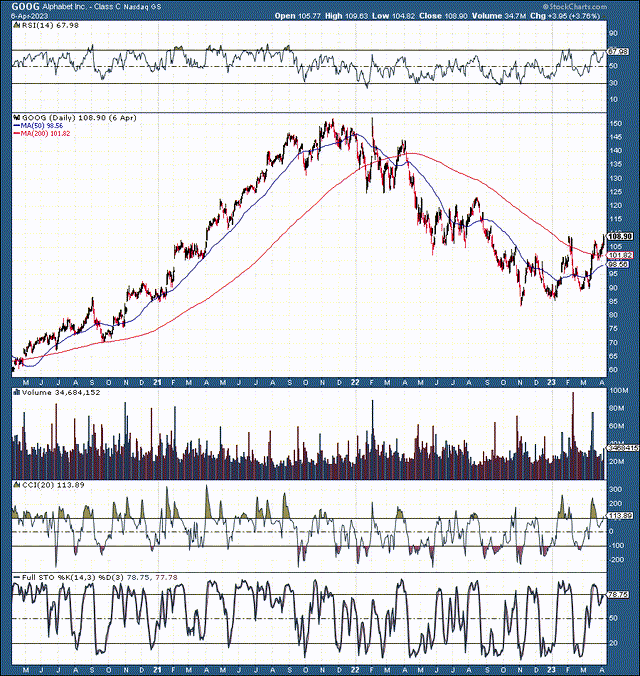

Alphabet (GOOG) (GOOGL):

- It is up 30% from the October low.

- But still 28% below ATH.

- Forward P/E My estimate: $7 in 2024

- Forward P/E ratio: 15.42

GOOG (StockCharts.com)

Google looks good from every point of view and is the second largest stock in my portfolio. The stock’s decline ended in late October, and GOOG has made constructive highs and significant lows since then. This technical trend indicates the re-establishment of a new bull market. There will be corrections, and we could see more pullbacks, but the lows will likely be in stocks like GOOG, Amazon ( AMZN ) and other tech titans.

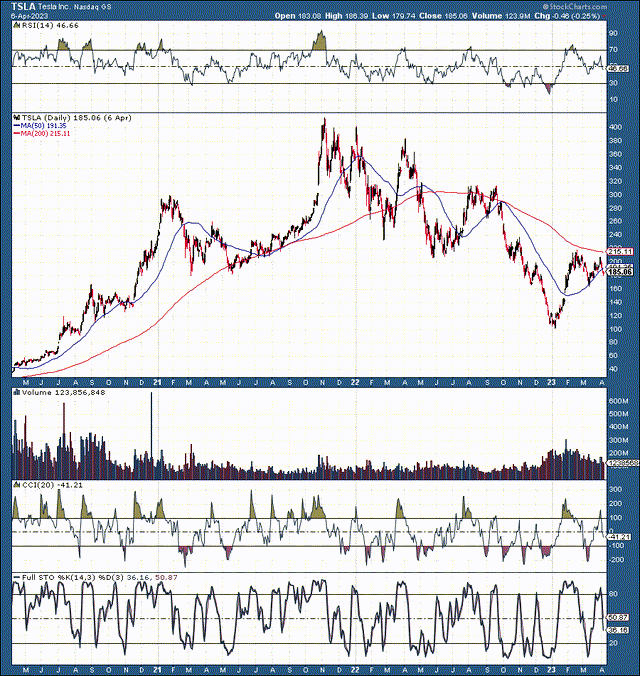

Tesla: Recent violence – high long-term

TSLA (StockCharts.com)

Tesla stock has been a wild roller coaster ride in recent years. Finally, the stock was incredibly overbought during the tech-top in 2021. Then, came a dramatic crash, and Tesla fell more than 75 percent. However, I’m skeptical we’ll see the $100 bottom again, and I’d consider adding to my position if the stock returns to the $150 zone. While there may be more volatility in Tesla shares in the near term, the stock will be much higher in the long term.

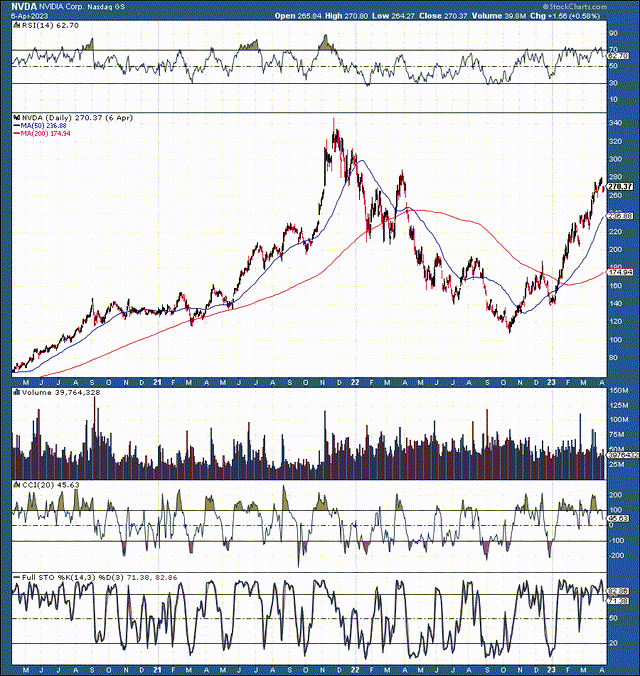

Nivea ( NVDA ) is up more than 165% after calling a bottom in the $110-100 range. Now Nvidia is once again super bought. But, in retrospect, this chart shows just how low Nvidia’s stock price fell during the recent big tech and chip stock crash. Nivea’s share price fell by around 70% and showed signs of selling and panicking at times. I have taken profits in Nvidia and intend to re-increase the pullback to the $200-220 range.

NVDA (StockCharts.com)

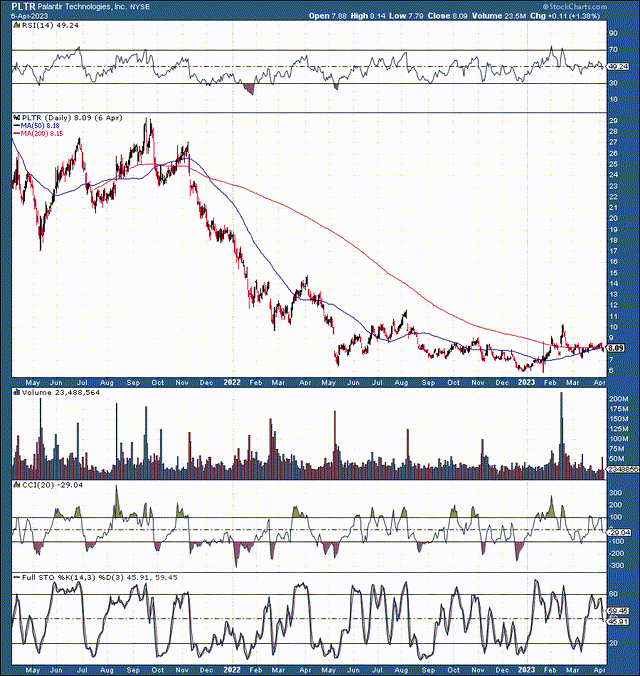

I write continuously Palantr (PLTR), the broadest holding of stocks in my All Weather Portfolio. The market appears to be behind the curve on Palantir. The company is likely to go much higher in its next growth cycle, coinciding with a strong bull market in a particular field.

PLTR: 2-year chart

PLTR (StockCharts.com)

Palantir’s stock has been brutal during the recent downturn, and that’s especially true when you want to buy a great company like Palantir. Of course, it’s much better to buy before the carnage begins. Palantir stock remains about 80% below ATH and will likely head higher in the coming years. Therefore, Palantir is my most important portfolio holding as a long-term stockholder. Palantir earns my future top stock award, a strong buy rating, and a price target range of $35-50 in 2025.

Here’s why banks can continue to suffer

We need to keep a close eye on the upcoming bank results because if small banks start to increase losses, the effects of the disease may continue. Other banks may start seeing more losses on their bond portfolios. Also, it’s more than just bond portfolios that people should look at. For decades there has been an enormous amount of accessible capital, and the initial market has grown to a large sum. The shadow emanating field is estimated to be worth a mind-blowing quadrillion dollars or more.

Additionally, we should closely monitor default rates at significant banks, including JPMorgan, Bank of America ( BAC ), Citigroup ( C ), and others. Of course, like Capital One (COF) and similar, more focused “credit card” firms have increased risk exposure, and future defaults could, in my view, hurt their bottom lines more than expected by many market participants.

Therefore, we could see much greater credit crunch due to defaults leading to a sharp slowdown in institutional and individual lending. In addition, this volatility can be exacerbated by bank-to-bank lending, which can cause market shocks and wide swings in stock markets. This potentially difficult financial environment will test the future of stock markets in the near term. However, I have a bank shopping list for when the uncertainty fades.

The main three banks in my view list

1. Goldman Sachs – The brightest men in the room. I like Goldman Sachs because the bank is more likely to continue to earn high profits during an economic downturn. Moreover, Goldman is more likely to benefit from the default cycle because of its experience with credit default swaps and other insured debt vehicles. Therefore, we see continued volatility in Goldman stock even as the company accumulates profits, creating a good buying opportunity in the coming months.

2. JPMorgan – While JPMorgan’s stock may be volatile or move slightly lower in the near term, the company’s risk management is mostly at a high level, and JPMorgan is unlikely to sustain any significant losses due to the recent turmoil. Therefore, JPMorgan should offer a buying opportunity at lower levels as the banking sector adjusts to the new reality in the coming months.

3. Key corporation (Key) – Key is only a regional bank, but as a long time customer, I will stick to my local bank. I know Key has strong management and good customer service, and I see no evidence that the company has any toxic assets on its books. So, I see no reason why we shouldn’t own Key, especially after the stock is down 50% since the beginning of the year. The company has an excellent balance sheet and does not pay a dividend of about 7%

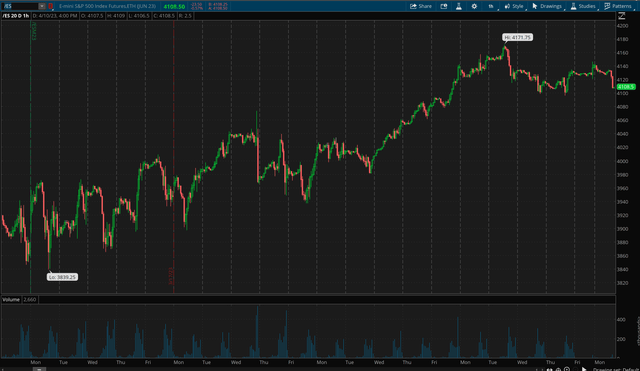

Warning: SPX may turn around here.

SPX (thinkorswim)

Despite some bullish posting in my all-weather portfolio, I’m very cautious here. The SPX could bounce back anytime soon with a sharp drop below critical support at 4,100-4,000. If SPX falls below 4K, it will be very weak, and the major average will retest support at 3,800 and possibly lower at 3,500. Additionally, the SPX could drop to new bear market lows at worst. On the upside, we need SPX to move above the 4,100-4,200 resistance zone. However, there may be more short-term indicators to push the market higher in the near future.

[ad_2]

Source link