[ad_1]

Fat camera

Alpha Pro Tech: The Investment Thesis

In a June 21, 2022 article, “Alpha Pro Tech: Time to Buy,” I concluded Alpha Pro Tech (NYSE:APTThe shares were purchased on June 13, 2022 at the post market price of $4.00. Subsequently, in the year The stock price reached a high of $4.99 on Aug 5, 2022 and a low of $3.88 on Sep 20, 2022. Following that low, shares reached $4.39 on February 7, 2023 and are now close at $4.08 on April 4, 2023. .

This is a nice and well run small family business. The balance sheet is strong, with no debt. Dividends have not been paid and there seems to be no intention to start paying dividends. So the only way to profit is to increase the share price. Idle cash does not generate stock price gains, so it is important to reduce the number of shares and repurchase them. Therefore, the market value of the stock may increase. The current share price of $4.08 is below the value of net assets (shares) on the balance sheet. A large amount of net assets is in the form of assets such as cash and receivables and other net assets that can be converted into cash. It looks like here is an opportunity to buy for long-term holding or short-term trading profit or a combination of both.

Alpha Pro Tech: Long-term holding capacity:

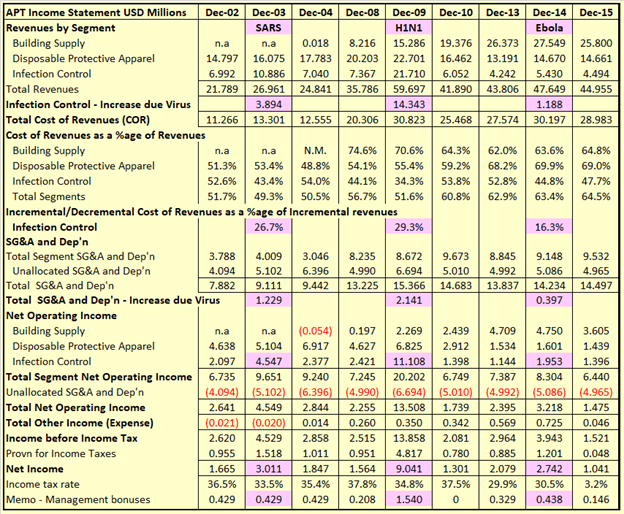

- Additional diseases A compelling reason to buy it for a long time is the possibility of more outbreaks. Table 1 below, from my March 16, 2020 article, “Alpha Pro Tech: The ‘Great Stupid’ Theory Is Alive and Well,” shows three disease outbreaks prior to Covid-19 that sent earnings and stock prices soaring. Before returning to the stairs.

Table 1 – APT income statement – selected years from 2002 to 2015

SA premium and SEC filings

- Sale or Control of Business – Because of the large number of shares held by insiders, including the founders, who may be committed to continuing the business, a 100 percent takeover may require “friendly” control to succeed. However, it is believed that the major parties have reached, or will soon reach, the age at which they wish to retire from active participation. As discussed below, market value is currently below book value, and a sale may be a way to realize full value.

Alpha Pro Tech: Potential Short-Term Trading Stock:

I generally only write about mature stocks, mostly suitable for long-term holdings that provide dividends and income and capital growth. However, Alpha Pro Tech has features that make it ideal for seeking short-term trading profits with a high level of security. The reasons are as follows.

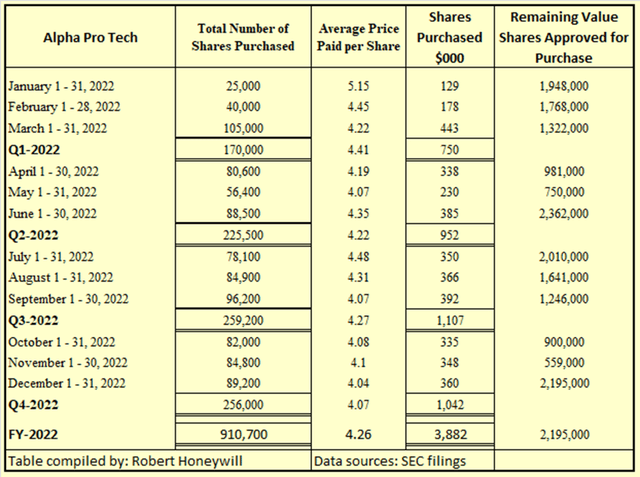

- Stock liquidation – With small cap companies, there is a risk that a trader can leave anyone to buy their shares at any price. This is highly unlikely with Alpha Pro Tech. The company has ~$16 million in cash, which is enough to purchase more than 30% of the shares at the current share price. The Company is repurchasing shares and continuously approving new purchases as per Table 2 below.

Table 2

SEC filings

- Asset support over share price – Alpha Pro Tech’s balance sheet at the end of FY-2022 shows shareholders’ equity of $4.98, up from $4.08 per share. By market close on April 4, 2023. Additionally, the shares have liquidity and current net assets of $4.11 per share. , also above the current share price. Its liquid and current net assets are cash at $1.33, accounts receivable at $0.57 and inventory and other net capital at $2.21 per share. The net asset support balance of $0.87 reflected in the balance sheet consists of tangible productive assets including investments in Indian manufacturing facilities. There is no debt.

- The company will continue to be profitable – FY-2022 earnings per share was $0.26 and TTM P/E ratio at current stock price is 16.15. Income can continue to grow the asset’s support or be used to buy more shares.

- The company is generating positive cash flows: For FY-2022, cash from operations and employee share issues was $4.4 million. Of this, $0.5 million was used for capital expenditures and $3.9 million for stock purchases. It is interesting to note that in Table 2 above, a total of 910,700 shares were repurchased in 2022 funded from current cash flow. This $16 million cash balance at the end of FY-2021 remains unchanged at the end of FY-2022.

- There has been enough volatility in stock prices to provide opportunities to buy low and sell high:

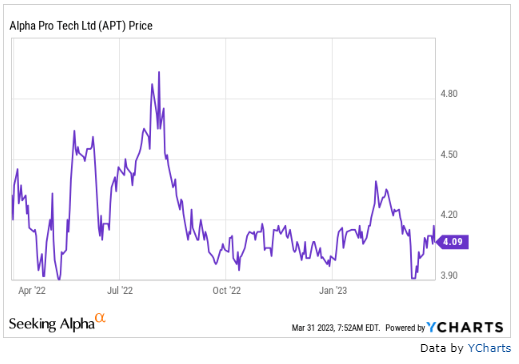

Figure 1

YCHARTS at a premium

Figure 1 above shows that over the past twelve months there have been many opportunities to buy APT stock at or around $4 and sell at a higher price.

Summary and conclusion

Alpha Pro Tech stock appears to offer opportunities as a long-term hold or short-term trade. If there has been enough volatility in the stock price to indicate an opportunity to buy shares at or around $4.00 and go long or sell at a higher share price, this process can be repeated. Whether buying with a view to long-term holding or short-term gain seems likely to switch between these strategies depending on future events. Despite some float, the stock should remain relatively liquid due to ongoing share buybacks, but any reduction or cessation of share buybacks is a concern.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]

Source link