[ad_1]

Small businesses (and really all businesses in Washington) are seeing a big price increase in business license fees paid by local municipalities. Many cities are charging business license fees based on revenue, number of employees and hours rather than a fixed fee.

The last city to consider raising its fee is Tacoma, raising it to $1,000. This is a 400% increase over last year’s fee ($250) for businesses with more than $1 million in revenue.

Complicating the calculation of paid leave is that some cities only count the hours an employee physically works within the city limits, or count the time a bond is created. State law expressly prohibits a city from requiring a business license when operating outside city limits, as with many remote service providers.

These fees can add up to several thousand dollars for a small business and several million dollars for large corporations.

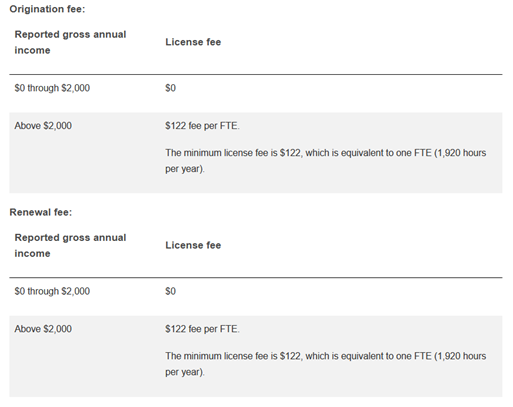

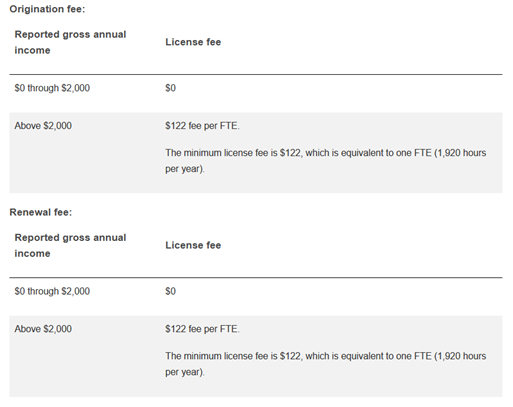

Using the City of Redmond as an example, the cities original business licensing framework was created in 1996 and was recently updated in 2020. For a small business with 5 full-time employees in the city and revenue over $2,000, the annual fee would be 5 x $122, or $610. The original pay was $10 per full-time employee in 1996, and a series of council measures has raised it to $122 per full-time employee by 2022, an increase of more than 1,100%.

For some of the largest employers in Redmond, the payout will be in the millions of dollars.

Source: Washington Department of Revenue

The problem is exacerbated when businesses operate in different regions. For businesses operating only in one municipality, the application is relatively simple. However, for businesses operating in multiple locations, licensing fees can be significant. A business may exist in one city, but is required to pay license fees in every city in which it operates.

The application process, while streamlined by recent requests for municipalities to use the Washington Department of Revenue’s centralized system, is complicated by the requirement to calculate income for each city while physically within city limits.

Business license requirements require the business to track hours and income for operations outside the city limits. In the case of a contractor who does only a small amount of work in the city, this is a huge administrative burden.

Many businesses, because of the cumbersome licensing process, do not bother to apply for a license, especially if the work being done is small, or infrequent within the jurisdiction. As the fees increase, the profits from operating in the jurisdiction decrease and the incentive to ignore licensing requirements increases. Further complicating the process, each municipality has different rules, fees and eligibility procedures.

Licensing fees are hidden costs of business and these costs are added to the products and services provided by businesses, and in some regions, they do not provide any benefits or services because they pay other taxes for essential services in the city.

High license fees disrupt employment and prevent businesses from expanding into new areas and creating new jobs.

[ad_2]

Source link