[ad_1]

Passive investing in an index fund is a great way to ensure that your own income correlates with the overall market. When you buy individual stocks, you can get high profits, but you can face the risk of underperformance. Investors in Brookfield Business Corporation (NYSE: BBUC ) has tasted that bitter decline, with its stock price down 35% over the past year. This compares favorably with the market’s decline of 8.3%. We don’t rush to judgment on Brookfield’s business because we don’t have a long-term history to look at. Worse, it fell by 12% in one month, which is not exciting. However, during that period, the broader market declined by 5.9%, and we note that this may weigh on the stock price.

After losing 8.6% last week, it’s worth examining the company’s fundamentals to see what we can learn from past performance.

Check out our latest analysis of Brookfield’s business

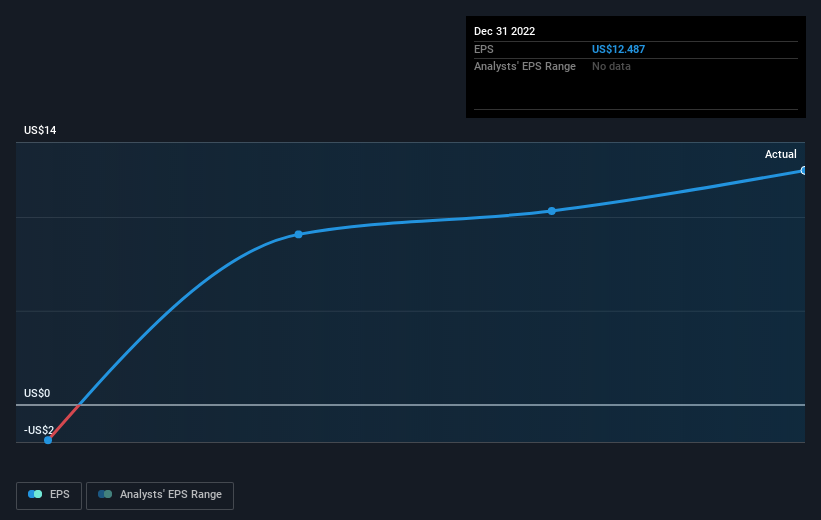

While markets are a powerful pricing mechanism, stock prices reflect investor sentiment, not just business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a sense of how much investors’ perceptions of a company have changed over time.

Brookfield Business has grown earnings per share from a loss to a profit over the past 12 months.

The company nearly broke even last year, so earnings per share of $12.49 are less than impressive to us. Looking at the share price, it seems that investors are expecting better from the company. Despite the newfound profitability, sentiment looks negative – so contrarians may want to watch the stock.

The image below shows how EPS tracks over time (click on the image to see more details).

This free Brookfield Business’s interactive report on earnings, revenue and cash flow is a good place to start if you want to further examine the stock.

A different perspective

We doubt Brookfield Business shareholders will be happy about losing 34% in twelve months. That’s lower than the market, which fell 8.3 percent. That’s disappointing, but keep in mind that sales on the market are useless. In the last three months, the stock has fallen 6.7 percent, the market does not seem to believe that the company has solved all the problems. Given the relatively short history of this stock, we are very cautious until we see some solid trading. While it is worth considering the various effects that market conditions have on stock prices, there are other factors that are more important. For example, consider the ever-present investment risk. We have identified 1 warning sign with Brookfield’s business, and understanding them should be part of your investment process.

But note: Brookfield Business may not be the best stock to buy.. So look at this free A list of interesting companies with past earnings growth (and further growth forecasts).

Please note, the market returns quoted in this article reflect the average returns of market balances currently traded on US exchanges.

Have a comment on this article? Concerned about the content? Connect directly with us. Alternatively, email editor-team (at) simplywallst.com.

This Simply Wall St article is general in nature. We only provide opinions based on historical data and analyst forecasts using an unbiased methodology and our articles are not intended to be financial advice. It does not provide advice to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide you with long-term analysis driven by fundamental data. Note that our analysis may not include recent price-sensitive company ads or quality content. Simply put, Wall St has no position in any of the listed stocks.

Join a paid user research session

They receive a. $30 Amazon gift card 1 hour of your time helping us build great investment tools for individual investors like yourself. Register here

[ad_2]

Source link