[ad_1]

After the world’s largest technology companies enjoyed a boom during the coronavirus pandemic, hope was that life would return to normal.

Certainly not.

This week, Big Tech reported an increase in growth and profits that surprised Wall Street, providing powerful evidence that forced digital dependence on much of the world’s population over the past year could have a lasting effect.

Some technology investors and analysts said the oversized figures equate to a resurgence in the business world. According to this view, the major digital powers have consolidated their gains over the past twelve months and have become an even more indispensable part of work and personal life.

“It’s been an amazing tech reporting season for the biggest of the big ones,” said Jim Tierney, fund manager at AllianceBernstein.

The growing impact of Big Tech in the business world can be best summed up with just two numbers.

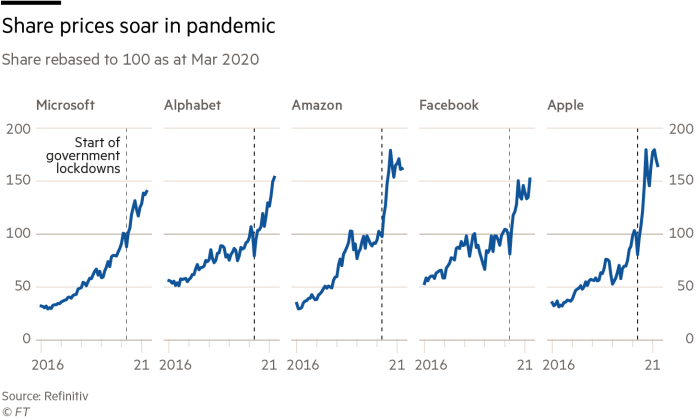

One is the combined revenue of Alphabet, Amazon, Apple, Facebook and Microsoft, which jumped 41% in the first three months of this year, to $ 322 billion. This points to a rapid acceleration of growth that the major technology companies have not seen in years, although they have become some of the largest companies in the world.

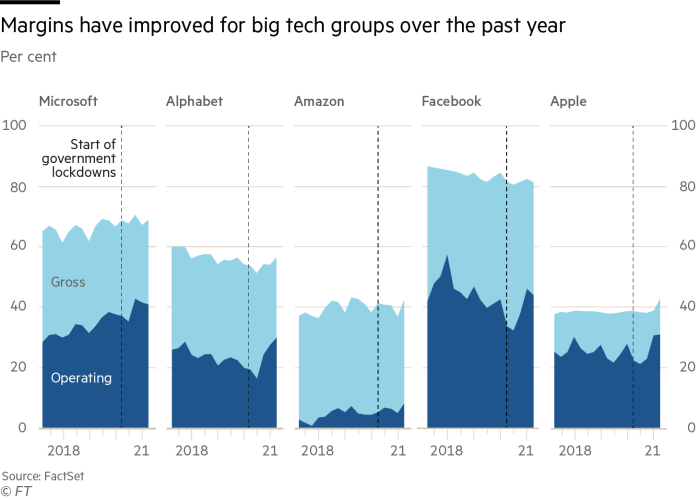

The other is the growth in corporate profits, which has been even more spectacular. Profits after taxes for the five increased 105% from the previous year, to $ 75 billion. Profit margins rose sharply across the sector, as larger firms benefited from economies of scale, while watching the expansion of costs during the pandemic.

Wall Street already had an appreciation of the defensive power of technology stocks, believing they would be resilient to the worst of the recession, Tierney said. Less understood until the last days, he added, was the fact that Big Tech is about to lead the way also to get out of the recession, as the activities of consumers and businesses increase on their digital platforms.

It’s not even as if Big Tech’s latest performance has flattered itself compared to a weak quarter a year ago. All but Apple grew by more than 10% before the pandemic arrived, although their growth rates had slowed.

Gene Munster, an investor at Loup Ventures, added the spectacular financial performance released this week by a subtle shift in the role Big Tech platforms play in everyday life.

“Consumers used to value choice, but what they value now is reliability,” he said. This has led them to focus their attention more and spend on a handful of familiar and easy-to-use platforms, such as the iPhone, Google’s search engine and Facebook’s Instagram, he added, habits that took root. deeply as the screens came to play a central role. part of all facets of life.

Whatever the reason, the first anniversary of the pandemic has been marked by a cross-cutting leap in both activity and revenue on the largest digital platforms. If no investment is made as the world reopens, this has set a new and higher bar for measuring technology companies.

“The question is, to what extent is the new plateau?” said Brian Wieser, head of business intelligence at GroupM, which is part of the WPP advertising group. “It’s definitely higher than we expected two weeks ago.”

First-quarter stellar performance can be clearly tracked across a handful of areas. Digital advertising, which for years has been constantly impacting traditional forms of commercial messaging, has jumped sharply.

The most widely used mobile and cloud computing platforms, from the iPhone to Amazon’s cloud services, have experienced a new explosion of activity. And some leading technology companies have taken advantage of the extensive use of their platforms to mount a foray into a wider range of highly cost-effective services.

“Before the pandemic, we saw a slowdown in the growth of digital advertising, but the pandemic has juggled a lot of things,” Wieser said. Brand owners developed a new appreciation of digital advertising during the pandemic as they relied more on online sales, he added, while the numerous new businesses formed over the past year have naturally become online channels to find a market.

Google and Facebook recorded their strongest ad growth for years, with Google’s advertising revenue up 32% and Facebook’s 46%. The jumps are facing a context of recovery for global advertising markets, although they far exceed the 10% rise expected for the industry at large this year, according to GroupM.

Meanwhile, the time and money consumers are willing to spend on their most important handsets was seen with a 66% jump in Apple’s revenue from selling iPhones. Even the PC market, which had fallen, experienced a sharp rebound, with unit sales jumping about a third in the first quarter, increasing Microsoft’s profits.

In comparison, the steady expansion of cloud computing platforms led by Amazon, Microsoft and Google, which have become a key pillar of corporate IT departments, have made fewer headlines. But the rise in remote work, learning and entertainment allowed the three cloud operators to maintain the growth rates they were recording this time last year, even as they get much bigger and some of its customers were hard hit during the pandemic.

Meanwhile, technology companies have taken advantage of their deep links with millions of users to expand their reach in some of the services provided through their platforms. Apple’s move to services, once scorned by Wall Street as an uninteresting bandwidth for its devices, contributed to a profit jump that raised its gross profit margin to more than 42%, a break with respect to the level of 38% approximately many neighborhoods.

Meanwhile, at Amazon, newer services have transformed the company’s profit profile. This includes the growth of Amazon Web Services ’cloud platform, as well as advertising, as seen in a 73% jump in the company’s“ other revenue ”category, which consists primarily of ads, at first quarter.

The result was a quarterly profit record for a company, once known for its persistent losses. Amazon’s after-tax earnings in the quarter were equivalent to the company’s net earnings during the first 22 years of existence.

Amid Wall Street euphoria, concerns about the possible intervention of regulators to curb Big Tech’s power and profits were briefly forgotten. The shares of everyone except Apple were or were very close to all-time highs as a result of the latest figures.

There were few other concerns to spoil the party. The end of strong secular growth trends that have elevated Big Tech could be planned before too many years, Tierney said. But he added: “How many years can Microsoft grow 50% in the cloud business and how many years can Google advertising continue to grow at 30%? There’s still no sign of them hitting the wall.”

[ad_2]

Source link