[ad_1]

PressureUA

Big Tech has never been more relevant. In the current quarter, investors are retreating from delinquency in specialty names and investing in broad market ETFs as well as large tech stocks. When you invest in the former It has the advantage of widening risk diversification, and the latter have benefited from depressed earnings estimates, which, after being beaten, have pushed their stock valuations higher than the broader market.

However, this is by no means a recent phenomenon.

Historical Trends: Big Tech vs. Marketing

Consider ten equally weighted tech stocks: Meta Platforms (META), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), Microsoft (MSFT), Alphabet, Class A (GOOG), Tesla (TSLA). , Nvidia (NVDA), Salesforce, Inc. (CRM), and Advanced Micro Devices (AMD). This ten ticker basket is broadly described as the “FAANG+” theme. The market can be represented by the S&P 500SPX In the form of an index or Spy in the form of an ETF).

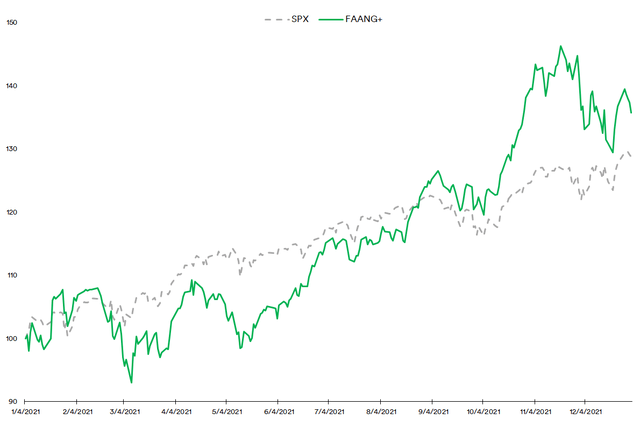

In the year Around the start of the fourth quarter of 2021, FAANG+’s net performance for the year began to outpace the broader market.

Source: Created by Sandeep G. Rao using data from Yahoo!

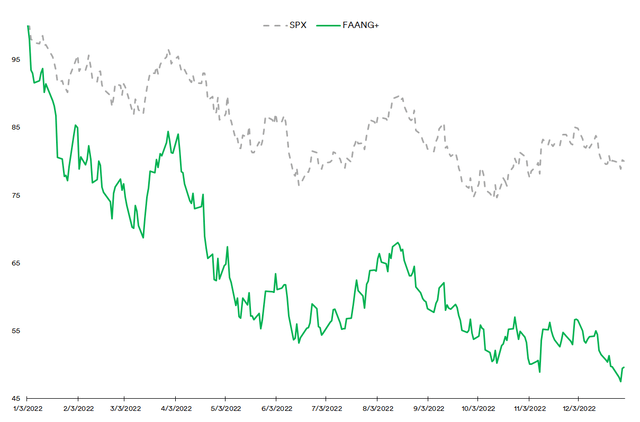

While the market took on an exceptionally bearish outlook shortly after the second quarter, the FAANG+ showed strong evidence of directional cues from the market, albeit with mixed performance.

In the year In 2022, the market is down 20 percent compared to the beginning of the year. At the same time, FAANG+ read the same event to close higher 50% lower than the beginning of the year.

Source: Created by Sandeep G. Rao using data from Yahoo!

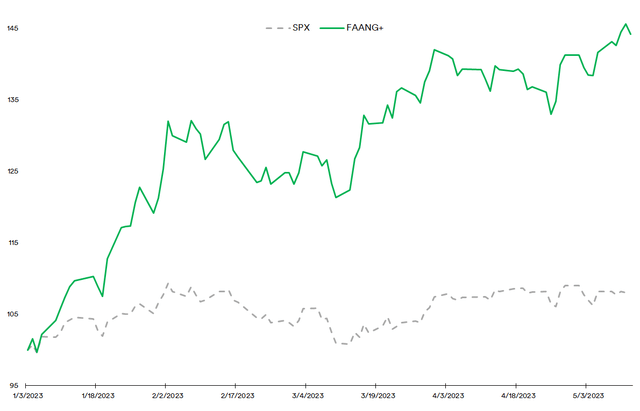

By 2023, up to 12Th Performance comparisons in May are even. More Distorted. While the market is down a modest 0.5% since the start of the year, FAANG+ is up More than 45%.

Source: Created by Sandeep G. Rao using data from Yahoo!

Now, the entire FAANG+ is represented in the S&P 500 as well. This highlights an important fact: these 10 stocks now represent the “top of the line” of the market and account for the vast majority of the market that is limited by the weight limits in the index.

- If any company’s total market capitalization (FMC) weight is greater than 24%, the company’s weight is set at 23%.

- The sum of companies with a weight of more than 4.8% cannot exceed 50% of the total weight of the index, otherwise the weights are adjusted starting from the smallest company until this rule is true.

Without these rules, the S&P 500 would both be dominated by the likes of these ten companies and outperform. This is in no way a criticism of the indexing method; In fact, “buying the index” shows the benefits of risk diversification. That it’s not doing so well shows how overrated Big Tech’s valuation is.

Price and volatility trends, quarterly

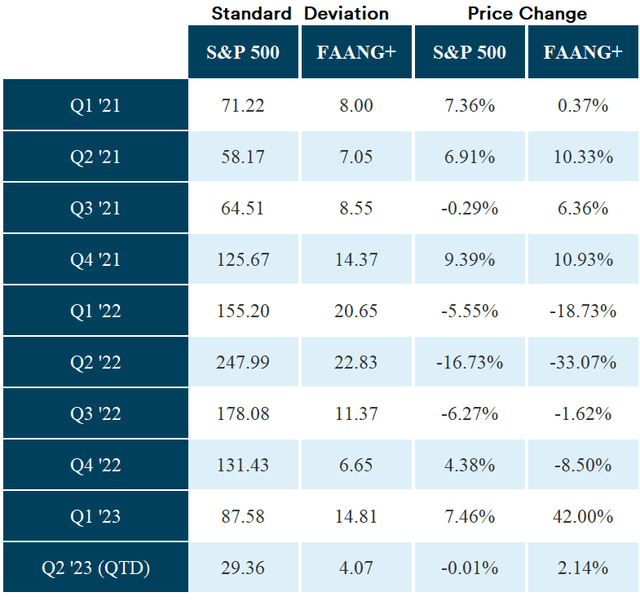

Volatility and changes in the price level play a role in estimating net performance. For each quarter, the volatility chart (as represented by the standard deviation) and price changes show some of the changes from the beginning to the end of the quarter. Interesting Trends:

Source: Created by Sandeep G. Rao using data from Yahoo!

Overall volatility trends indicate that the market is 7-9 times more volatile than the FAANG+. The low is around 6X this past quarter and the high is in the 10-20X range from Q2 to Q4 last year. In terms of value, there is a wide variation in favor of trend statements as opposed to volatility. However, from a market perspective, it can be seen that the rate of change tends to be quite extreme.

Overall, it has a FAANG+ theme. It is inclined Being less extreme and more bullish than the market in terms of price performance.

The results

As noted in a recent article on Tesla and other US electric car makers, there is a distinct element of “survival” in these stocks that is selling above the fundamentals. In fact, small companies (mid-cap and small-cap) find it more difficult to secure capital and growth given the low valuations. Downstream, privately held firms face mounting obstacles to similar efforts. This particular focus on “market trust” has devastating consequences for companies outside of the small group: as a result, it raises the barriers to wealth creation for everyone outside the circle.

Note: A similar phenomenon was observed during the banking crisis, as reported at the end of April and subsequently in the author’s opinion of MarketWatch and several other publications. The full author’s reasoning for that position can be found here.

The consequences for the American consumer (and investor) are even more telling. With limited choices comes limited investor power. There will be some relief if the economy emerges on the other side of the widely heralded recession to make some corrections to this imbalance. However, for that to happen, a deep systemic evolution is in order, which is not a multidisciplinary approach. Only Limited to stock options.

The FAANG+ theme is at least over during a bull run. A change in direction in Q2 this year is a must. is not Consider the signs all in all economic recovery. Therefore, investors are advised to be cautious.

[ad_2]

Source link