[ad_1]

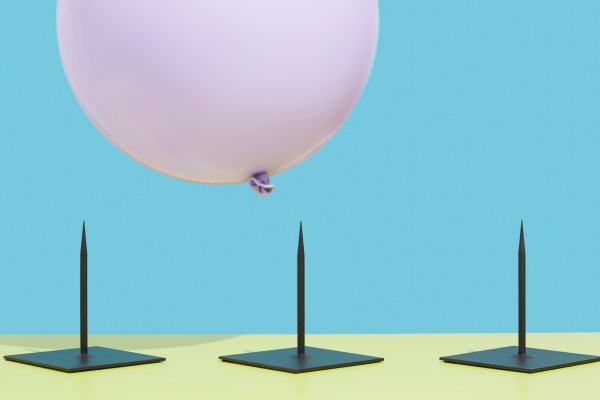

Things appear Not good for beginners these days.

Low rounds, or funding in which a startup raises capital for less than the final investment, have become more common than the venture community has seen in half a decade. According to the map data, rounds have almost quadrupled in number in Q1 2023 compared to a year ago.

Low rounds are bad because they result in excessive dilution, unhappy investors, employees worried about equity value, and other less than winning events. They are new to many startups and were very few during the most recent venture boom when so many startups were raising so much. up Rounds in the same year when it was a mini-trend.

The exchange examines startups, markets and money.

Read it every morning on TechCrunch+ or get the Exchange newsletter every Saturday.

It’s not surprising to see more and more rounds, but it’s surprising that they accounted for nearly a fifth of the venture investments Karta saw in the first quarter. Things got worse for starters sooner than we expected.

Also, according to Karta, a Low “40% of investments in Series A and Series B companies were bridge rounds in Q1, the highest figure of the 2020s.” The same forces driving the transfer boom are at play here: Venture capital deal speed and value are retreating, and as public markets resume, so do valuations for startups at all levels.

Also, according to Karta, a Low “40% of investments in Series A and Series B companies were bridge rounds in Q1, the highest figure of the 2020s.” The same forces driving the transfer boom are at play here: Venture capital deal speed and value are retreating, and as public markets resume, so do valuations for startups at all levels.

Down rounds, flat rounds and more complex business terms

As we completed our first take of Q1 2023 data from Mapa, we found that the dollar was underperforming.

That may seem like an odd combination of events. Above all, if you are a beginner Cheapwhy don’t venture investors invest. More To make capital? Because venture capital investing is essentially a fast-paced business, rising prices for startup stocks allow investors to raise more capital, which in turn allows them to spend more money to operate at higher prices.

Yes, it’s a self-reinforcing cycle. In the euphoria, they say why they move so fast and skip the so-called intelligent investment methods as due diligence, when VCs press on to play the game on the field.

[ad_2]

Source link