[ad_1]

China’s e-commerce giant Alibaba has failed to submit audit data to PCAOB regulators in 2018. It was among more than 100 companies at risk of bankruptcy in the US by 2024.

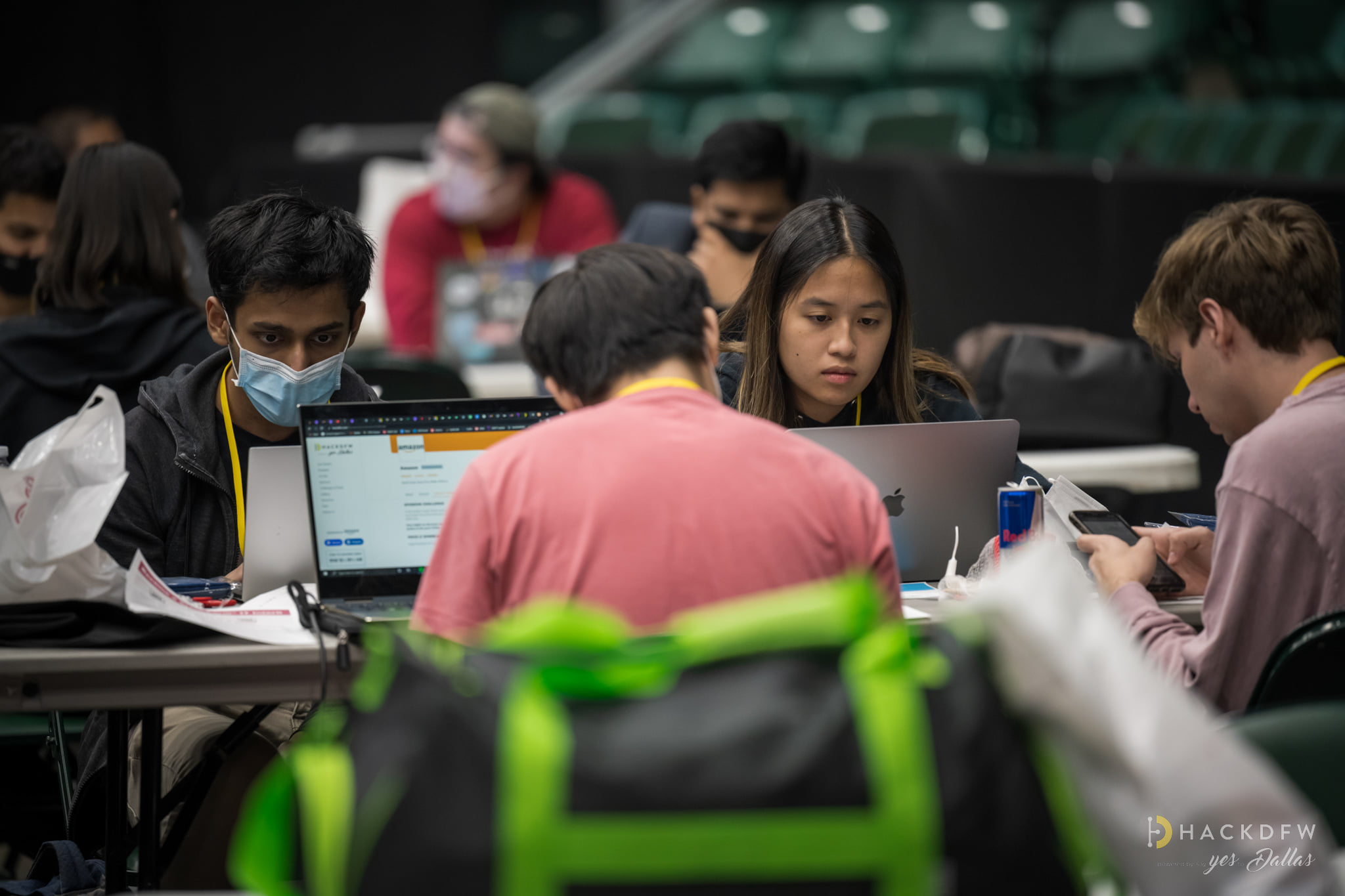

Budrul Chukrut | SOPA Images | Lightrocket | Getty Images

One investment manager said investors could regain confidence in putting their money into Chinese tech stocks as these companies avoid delisting from US stock exchanges.

Last week, the U.S. accounting watchdog State Company Accounting Oversight Board announced that it had full access to investigate and investigate Chinese companies for the first time.

Related investment news

More than 100 Chinese technology companies such as Ali Baba, Don’t go And JD.com If their audit data is not submitted to PCAOB regulators, they are at risk of delisting in the US in 2024.

Investors often lack transparency in Chinese stocks.

“It allows institutional investors to come back. Professional investors were very afraid of this disclosure risk, which is why they stayed on the sidelines,” Brendan Ahern, chief investment officer of US-based investment manager Crane Shares, told CNBC’s “Squawk Box Asia.” “On Wednesday.

In the year As of Sept. 30, there were 262 Chinese companies listed on U.S. exchanges with a total capitalization of $775 billion, according to the U.S.-China Economic and Security Review Commission.

“Based on the PCAOB announcement, with that risk gone, you’re going to see investment dollars go back to these names,” Aher said.

“When these giant Internet companies come to China, that’s where investors want to invest,” Ahern said.

But he said it’s still “days, weeks, months” before he sees that capital back in space.

But he also pointed out that policy support will help these companies grow. China has pledged to boost domestic consumption next year as it moves to boost growth after announcing its zero-covid policy last week.

“2023 is the year we will get support from government policies such as increasing domestic consumption,” Aher said. “About 25% of all retail sales go through the companies.”

“The Chinese government really wants these internet companies, which explains why we’ve backed away from some of the regulatory scrutiny we’re facing in 2021,” he said.

[ad_2]

Source link