[ad_1]

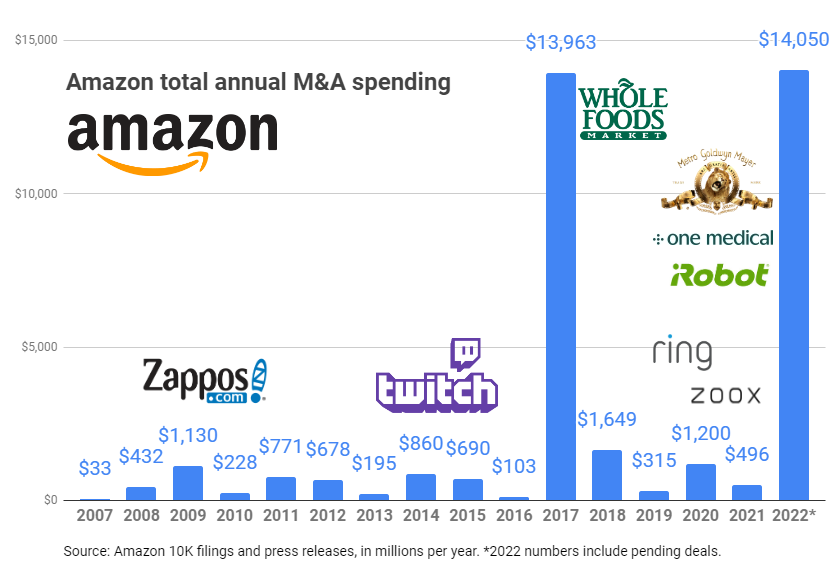

Amazon’s proposed $1.7 billion purchase of Roomba maker iRobot, combined with MGM’s $8.45 billion deal and primary care company One Medical for $3.9 billion, could push annual spending on acquisitions to new highs.

But will US antitrust regulators let it happen?

That’s the key question after Amazon announced Friday morning that it has struck a deal to buy Boston-based iRobot, the company behind the market-leading robotic home vacuum.

As planned, the deal will position Amazon as the leader in home robots. The Seattle tech giant scratched the surface of the market last year with the release of the Astro Home robot.

Amazon made a similar move into warehouse robots a decade ago, buying Kiva Systems.

The U.S. Federal Trade Commission made clear its new stance on tech acquisitions in a July 27 announcement that will try to block Facebook parent Meta from acquiring virtual reality fitness app Supernatural. John Newman, an official at the FTC, accused Meta of trying to “buy the marketplace instead of taking advantage of it.”

Under the deal, Amazon will pay iRobot a $94 million termination fee if the deal is ultimately blocked by antitrust regulators, according to an SEC filing Friday morning.

Boston-based iRobot reported that it sold a total of 40 million units last year after launching the Roomba more than two decades ago. In its most recent fiscal year, iRobot shipped more than 5.6 million units, surpassing the reach of Amazon’s newly introduced Astro Home robot, which was available only in limited previews.

Before the agency’s head, Lena Khan, became FTC chair, her 2018 Yale Law Journal article, titled “Amazon’s Antitrust Paradox,” made headlines and advanced a fundamental argument in the movement to curb the tech giant’s reach.

Amazon’s deal with iRobot also comes with its own set of privacy concerns, thanks to Amazon’s Roomba devices that autonomously vacuum the interior of the home thanks to the data in the home.

One of Consumer Reports gives iRobot high marks for data security. But the massive amount of data could give Amazon a competitive advantage by giving it a foundation to improve and differentiate its efforts in home robotics.

Discussing the iRobot deal, antitrust and competition attorney Ethan Glass of Cooley LLP told Reuters there was a “one in four chance of an in-depth investigation and one in four chance of an examination” by the FTC.

Amazon’s critics were quick to raise red flags. “This could be the riskiest and most risky acquisition in the company’s history,” said Ron Knox, a senior researcher and writer at the Environmental Self-Reliance Institute.

Others pointed to Amazon’s ad as a continuation of the trend.

“It’s clear that Amazon wants to gain dominance in the smart home market and add another intrusive way to track their customers,” Sarah Miller, executive director of the American Economic Freedom Project, said in a statement after Amazon. advertisement.

Miller added, “Whether it’s Amazon Roomba and OneMedical, Facebook acquiring Inn, or Google buying Mandiant, Congress needs to step in, shut down Big Tech acquisitions, and use the FTC temporarily.”

From a congressional perspective, the timing of Amazon’s announcement is memorable, as the U.S. House and Senate adjourn for their August recess Friday morning, with an uncertain future ahead of closely watched antitrust legislation.

According to iRobot’s SEC filing, the Amazon deal sets a deadline of Aug. 4, 2023, to end the deal after one year, subject to two six-month extensions. .

Amazon did not raise potential objections in the deal announcement, other than to say the deal is subject to regulatory review and iRobot shareholder approval among “normal closing conditions.”

[ad_2]

Source link