[ad_1]

The approval of Biogen’s Alzheimer’s drug has rekindled investor interest in a contested hypothesis about what causes the disease, despite years of failures in the field and acceptance of the theory by many scientists and doctors.

Biogen’s Medicine $ 56,000 a year it was the first Alzheimer’s treatment in nearly two decades to be granted green light by the U.S. regulator last month. Called adducanumab, it is the first treatment that aims to slow the pace of cognitive impairment, rather than helping patients control symptoms.

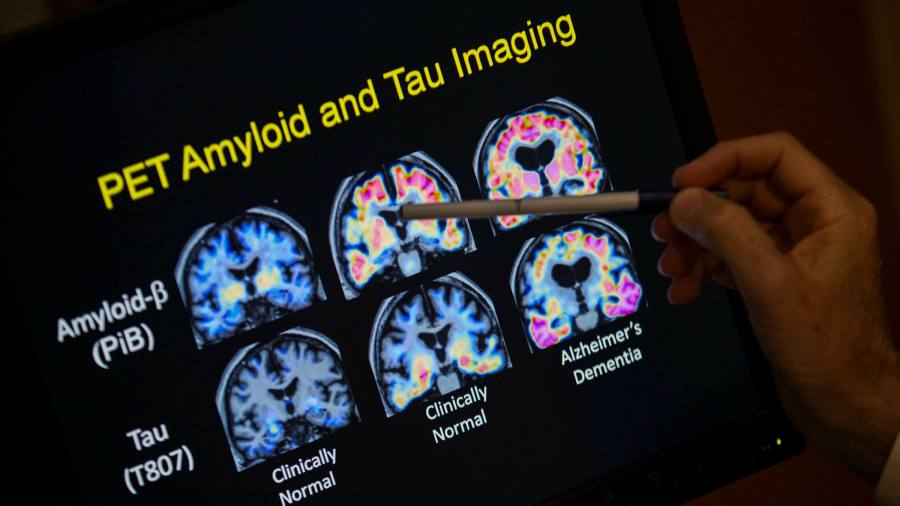

The drug is designed around the amyloid hypothesis, proponents of which believe that groups of proteins accumulated in the brain cause Alzheimer’s. Biogen says the drug removes amyloid plaques from the brain and in turn alters the course of the disease.

The amyloid hypothesis is divisive, and some scientists argue that there is little evidence that removing plaques delays the development of Alzheimer’s.

Alberto Espay, a professor of neurology at the University of Cincinnati, said that “literally, all the studies we’ve done” had disproved the amyloid hypothesis, but “it has survived all the evidence to the contrary.”

Several pharmaceutical companies, including Merck and Johnson & Johnson, have tried and failed to show that cleaning amyloid plaques is directly related to improving cognition. But drug manufacturers have persevered, attracted by the large size of the market and patients facing few effective treatments. About 35 million people worldwide live with Alzheimer’s disease, with approximately 6 million people in the US.

In approving aducanumab, the Food and Drug Administration said it was only “reasonably probable”That the treatment would demonstrate a clinical benefit for patients.

Despite this, the FDA decision has rekindled interest in this sector of Alzheimer’s research and has given hope to other pharmaceutical companies that have spent billions on similar treatments.

“FDA approval will spur new investment on a hypothesis that should have been falsified a long time ago,” Espay added.

Last week, the regulator gave the new test stage the designation of advance drugs for amyloid removal, meaning the agency will expedite reviews of its development and approval.

The American pharmaceutical company Eli Lilly said it would apply for approval of its drug, donanemab, later this year, an announcement that sent its shares 9%.

Japanese drug maker Eisai, which partnered with Biogen for both aducanumab and its latest Alzheimer’s drug, lecanemab, is also intensely following this area of research, without opposition l emotions.

“We have always believed that the amyloid pathway is a definite underlying pathology for Alzheimer’s disease,” Ivan Cheung, president of Eisai, told the Financial Times.

“It simply came to our notice then. . . the FDA decision will reaffirm investment not only in amyloid therapies but also in other therapies for Alzheimer’s disease, ”he said, adding,“ We strongly believe that deep amyloid clearance will have a positive impact on terms of disease progression for these patients if they are treated early enough ”.

While it’s still early to see if money is invested in new anti-amyloid treatments, those on both sides of the argument believe the FDA decision will stimulate investment in the area and encourage drug manufacturers to move on. overlook historical failures in attempts to grab a share of the market, which is estimated to be worth billions in the US alone.

Swiss pharmacist Roche is currently testing a treatment for the disease. Bernstein analysts expect Eli Lilly, Biogen and Roche to achieve a 50, 30 and 20% share of the Alzheimer’s treatment market respectively in the long term, if the FDA approves all of the companies ’drugs.

“History has shown that FDA actions such as aducanumab approval often lead to greater investment,” said Rebecca Edelmayer, senior director of scientific collaboration for the Alzheimer’s Association.

Others are concerned that focusing on amyloid cleansing treatments will draw attention to research into other Alzheimer’s treatments that could potentially be more effective.

“Taking the results of research and bringing them to patients means having capital. How will we be able to raise money when all the money will be on amyloid related things? asked George Perry, a professor of neurobiology at the University of Texas San Antonio.

He said the likely increase in amyloid cleansing drugs would do nothing to significantly develop Alzheimer’s research. and that “the best case scenario is for all these companies to get approval and then go on to investigate other things.”

Analysts expect Biogen to get up to $ 10 billion in maximum annual sales of aducanumab and the company’s shares will be maintained for up to two years despite two House committees saying they will investigate the approval and price of the medicine.

“Aducanumab approval should not be seen by investors as a validation of the amyloid hypothesis,” Espay said. “This is the success of a corporate strategy that was brilliant but not science-based.”

[ad_2]

Source link