[ad_1]

- Basically, both may share more similarities than differences.

- Apple might be better suited for harder innovations and more compelling reviews. Microsoft is known for its balanced business model and a more predictable growth pattern going forward.

(Read more from Apple Maven: (Apple’s Next Big Thing: Analyst Report at CES 2023)

AAPL vs MSFT: More similarities than differences

Apple and Microsoft are two stocks that attract many investors for similar reasons. For starters, they are both the #1 and #2 tech giants in the United States with a market cap of nearly $2 trillion.

Historically, the companies have competed for the same customers. Microsoft is the creator of the Windows operating system, which has powered most personal computers for decades. Apple is the famous creator of Mac, the direct competitor of PC.

Today, Apple and Microsoft’s business models are different across different verticals – including consumers, enterprises, and more. For Microsoft, personal computing has lost its relevance with cloud services. It has become a key pillar of Apple’s mobile communications.

Still, investors who own both Apple stock and Microsoft stock may be exposed to some of the same trends and forces affecting the tech sector as a whole.

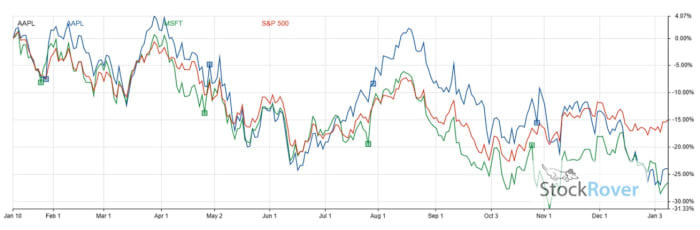

Even the performance of both stocks over the last 12 months is similar – see chart below, provided by Stock Rover. Both names outperformed the technology-rich Nasdaq index in 2022, but underperformed the S&P 500’s gains by ten percentage points.

Looking for an opportunity to buy into the megacap tech space? Both Apple and Microsoft seem to check that box perfectly.

How can AAPL be more attractive than MSFT?

In my opinion, Apple stock may be a more compelling choice for reasons ranging from long-term growth opportunities to valuation.

On the former, I recently discussed how Apple looks to be well-positioned to enter two new businesses that could shape the company’s balance sheets for the next five years and beyond: mixed reality and autonomous vehicles.

While driverless cars may not become a viable business for the Cupertino company until 2025, it could be an initiative that adds the best to Apple’s bottom line. Electric vehicles, for example, are expected to grow 20%-plus per year and reach $1 trillion in market size by 2030.

At a valuation, Apple stock currently trades at a P/E of 21 times – $130 per share with a 2023 EPS estimate of $6.20. In contrast, Microsoft stock trades at 24 times. This can be a factor in equity braking for investors who prefer a higher value play.

How can MSFT be more convincing than AAPL.

When it comes to disruptive innovation that has the potential to shape a company’s financial profile, I think Microsoft’s prospects pale in comparison to Apple’s. This is not to say that Microsoft has no growth potential – quite the contrary.

According to Yahoo Finance, Microsoft is expected to post a 13 percent increase in revenue next year from 2023 levels. Apple’s comparative figure is less impressive, at just 6%.

To put it further, data compiled by YCharts suggests that Microsoft’s EPS should grow 14 percent annually over the next five years. On the other hand, Apple’s bottom line should see a modest increase of 11 percent year over year.

The fuel for Microsoft’s growth will come from Azure and the company’s other cloud service initiatives. The business productivity segment (think Office and Dynamics 365) has been doing well lately, and will likely continue to do so.

Ultimately, Microsoft’s promises may not be as “sexy” or exciting as Apple’s. But maybe this is a good thing. “More of the same” is probably the best outlook for the Redmond-based company, and a good reason to pick MSFT over AAPL in 2023.

(Disclaimers: This is not investment advice. The author may own one or more stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not influence editorial content. Thank you for supporting Apple Maven)

[ad_2]

Source link