[ad_1]

Chinese billionaires Jack Ma and Joe Tsai have pledged chunks of their combined $ 35 billion stake in e-commerce group Alibaba in exchange for significant investment bank loans, according to company documents.

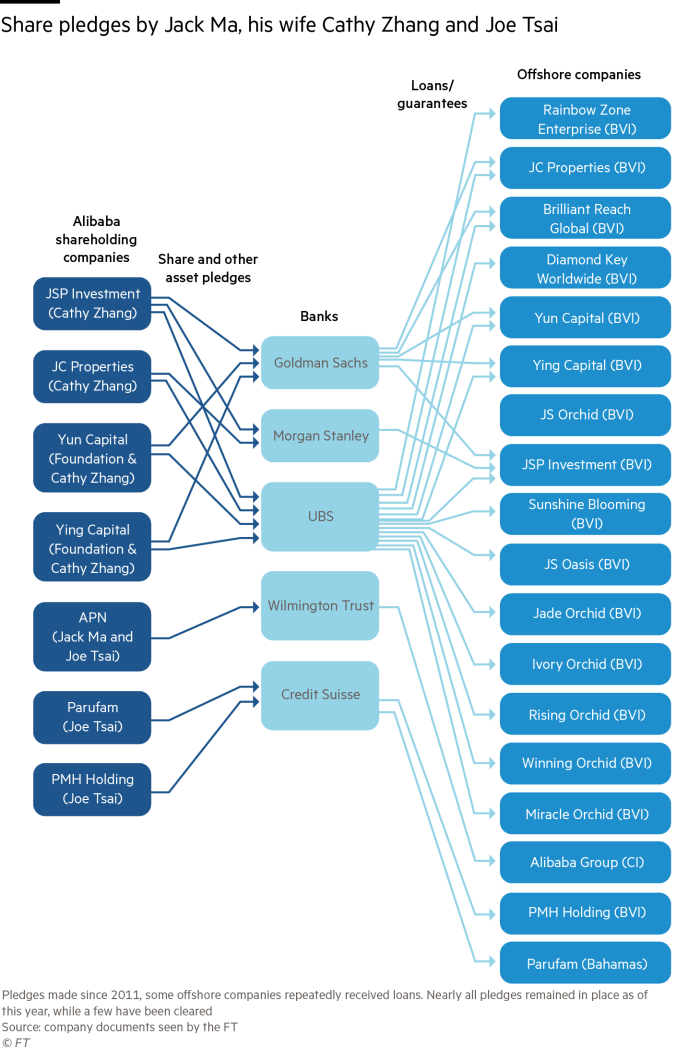

Promises of shares, made to banks such as UBS, Credit Suisse, Goldman Sachs and others, were taken over by offshore companies that controlled more than half of the two billionaires’ stakes in Alibaba, which totaled 5.8% in December. . As a pledge of shares, banks accept shares as collateral for loans, but the borrower retains ownership of the shares.

The amounts of most of the pledges on shares were not disclosed in the documents, but the couple has repeatedly resorted to borrowing against their shares since Alibaba was listed in the US in 2014, according to Financial Times documents.

Ma and Tsai, Alibaba’s two main individual shareholders, have used the loans to unlock huge personal fortunes tied to the group’s shares.

World banks have extended a wide variety of loans to Ma and Tsai. Tsai’s private Gulfstream 650ER jet is mortgaged to Credit Suisse. The Swiss bank, which launched Alibaba on the market, also extended credit during the pre-IPO phase of a shipping company later linked to Ma’s purchase of a luxury home in the elite district. Hong Kong Peak and a new plane of the same model as Tsai’s.

The promise of shares carries risks and is limited by most American companies. Any forced sale of the compromised shares of executives can aggravate the fall in the price of a company’s shares. This can be precipitated with margin calls, when borrowers have to repay loans from brokers or lose shares.

Credit Suisse, Nomura, Morgan Stanley, UBS, Mitsubishi UFJ Financial Group and Mizuho it lost more than $ 10 billion this year when they were forced to liquidate positions in U.S. listed companies occupied by Archegos, a family law firm, after failing to comply with margin calls.

Alibaba said Ma “and its affiliates” currently had no outstanding loans secured by Alibaba shares, while Tsai’s outstanding loans backed by shares were “easily manageable” with “prudent loan-to-value relationships to provide”. [a] substantial cushion against activating a margin call ”.

The company said the pledge of shares for loans was part of “ordinary financial planning to provide liquidity and diversification without having to sell shares to Alibaba.”

Ma resigned as Alibaba’s chief executive in 2019, while Tsai remains executive vice president.

Offshore business website

Ma and Tsai’s interests in Alibaba are maintained primarily through five offshore companies: JC Properties, JSP Investment, Parufam, PMH Holding and APN Ltd.

APN has made Alibaba’s largest known single share of action with 400 million shares. But more than in exchange for a loan, this was part of the guarantees made to Japanese SoftBank and Yahoo after Ma sculpted Alibaba’s payment unit, Alipay, which is now part of its fintech Ant Group, the e-commerce company.

Ma’s wife, Cathy Ying Zhang, who has taken Singapore citizenship, has been instrumental in his dealings. Records show that two offshore holding companies, of which Zhang is the sole director, JSP Investment and JC Properties, hold 60% of the couple’s Alibaba stake.

In total, Zhang’s two holding companies for Alibaba shares have made more than a dozen pledges of assets to investment banks for loans granted to a network of offshore companies.

In addition, Zhang is the sole shareholder in a Hong Kong Ma company that used to buy a castle and vineyards in France and has power over the well-endowed Jack Ma Philanthropic Foundation, according to business records. He has also taken out financial loans from Goldman Sachs to Enbao Asset Management, Ma’s family office.

In a deal, an investment in a Chinese online real estate platform in 2015 that was orchestrated by Enbao, Ma used two offshore portfolio companies to contribute $ 20 million. One was Rainbow Zone, headquartered in BVI, which contributed $ 10 million at the same time as it took out a loan from Swiss bank UBS that was secured against unspecified securities pledged to the bank by JSP Investment.

One day in 2019, the couple created three major companies: Miracle Orchid Investment, Rising Orchid Investment and Winning Orchid Investment. Three months later they received loans backed by JSP Investment’s assets.

Records seen by the FT made it clear that Alibaba’s U.S. deposit shares had been pledged with loans from Morgan Stanley and Credit Suisse, while Goldman was referring to pledged U.S. deposit shares and UBS reported of “securities” and other assets.

Diamond Key Worldwide, another Zhang-controlled company based in BVI, has received four separate loans from UBS. Last year, the Chinese subsidiary of the company bought Rmb35m ($ 5.4 million) land in Hangzhou, where Alibaba is located, to develop it for educational purposes.

Unlock liquidity without alarming the markets

Bankers say stock promises are a common method for Chinese executives to raise cash without losing control of their companies or sending negative signals to the market by selling their shares.

“It’s a very good business for banks, it feeds a lot of people,” a former banker said. “These founders are rich in assets but poor in cash.”

American executives as the co-founder of Tesla Elon Musk they have also pledged shares of their companies to obtain loans. But as an American company, Tesla must disclose commitments to shareholders according to the rules of the Securities and Exchange Commission.

But under the looser U.S. disclosure requirements for “foreign private broadcasters,” a category that includes nearly all Chinese technology groups listed in the U.S., including Alibaba, Ma and Tsai, have no obligation to disclose their promises of participation.

The documents show many of the promises about shares and other assets of Tsai, Ma and his wife Zhang remained in place from January, even when they have started selling their Alibaba shares.

Ma and his wife have earned about $ 11.4 billion in stock since Alibaba floated in New York, with the majority sold as of 2017. His charity has sold another $ 4.1 billion. Tsai has sold about $ 5.4 billion.

Alibaba said Ma and Tsai had owned “the company’s shares for 22 years and continue to hold significant stakes in Alibaba, which make up the majority of its wealth.”

Jack Ma, a former English teacher, is one of China’s best-known businessmen and founded Alibaba with Tsai in 1999 before building a fortune estimated by Bloomberg at $ 49.9 billion.

Late last year, however, he largely disappeared from public view after Beijing began to repression against Ant Group, the fintech Ma sculpted at Alibaba in 2011.

Credit Suisse, Morgan Stanley, Goldman Sachs and UBS declined to comment.

Additional reports from Joe Leahy in Hong Kong

[ad_2]

Source link