[ad_1]

AJ_Watt/E+ via Getty Images

Booking (NASDAQ:BKNG) has been a major player in the online travel industry. With a portfolio of well-known brands including Booking.com, Kayak and Agoda, the company has a strong presence in the travel market. However, AirbnbNASDAQ: ABNBThe home-sharing platform that has disrupted the traditional hotel industry has recently sought to expand its presence in the broader travel market. The question on many investors’ minds is whether Airbnb can take the travel crown from Booking Holdings.

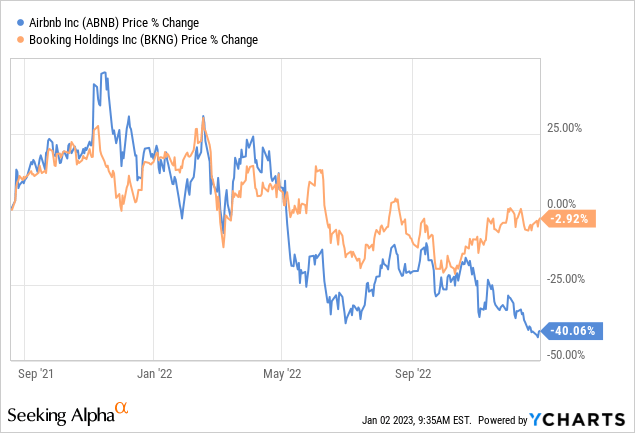

In the past, we preferred to invest in bookings on Airbnb, mostly because of the more attractive reviews. Since then, Booking Shares has surpassed Airbnb, and perhaps it’s time to reconsider if switching to Airbnb is warranted.

Competitive advantages

In order to understand Airbnb’s potential to overtake Booking Holdings, it is important to consider the strengths and weaknesses of both companies. On the one hand, Bond Holdings has strong brands and a large customer base. Booking Holdings has a diverse portfolio of brands that cater to various segments including luxury travelers, budget travelers and business travelers. On the other hand, Airbnb has several strengths that could give it an edge over Booking Holdings. Airbnb has a very large inventory of properties available for booking. This gives travelers a wider range of options and makes it easier for the company to capture a larger share of the market. The company has made several strategic acquisitions, including Luxury Retreats and Hotel Tolit, which have helped expand its reach in the travel market.

In terms of competitive engines, both companies have similarities in that they benefit from network effects, economies of scale and intangible assets. The effects of the network are two-sided marketplaces of both companies, travelers on the one hand and accommodation providers on the other. Travelers tend to go to the platform with the most accommodation options, while property owners prefer to list more travelers on the platform. The two successfully run their business, scale is critical, which makes it incredibly difficult for smaller companies to compete with them. Finally, their strong branding, app, user interface and technology differentiate both companies from smaller players.

Financial

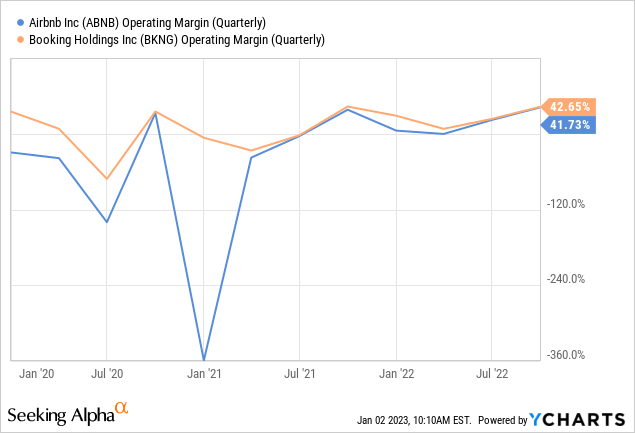

Given their fierce competitive edge, it’s no surprise that both companies benefit from terrific financials. Both currently have operating margins of over 40%, a level that few companies have been able to surpass.

development

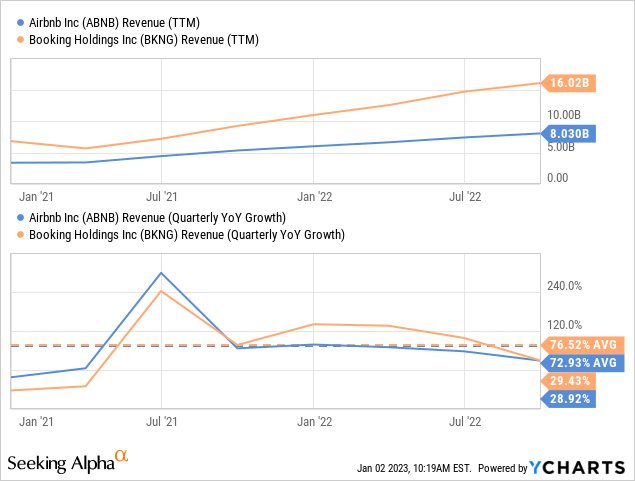

Bookings lags the larger company by a wide margin in revenue, and since both are growing at a relatively similar pace, it will take a long time for Airbnb to catch up on bookings. In that sense, the booking crown is safe for now.

But there are reasons to believe that Airbnb’s growth could accelerate past booking growth. For example, Airbnb has focused on the US market, and if it replicates its success outside the US, it could turbo-charge growth. The new focus on longer stays is also promising, as is the diversification into luxury accommodation, boutique hotels and experiences. That said, bookings are struggling and are also moving into alternative accommodation.

balance sheets

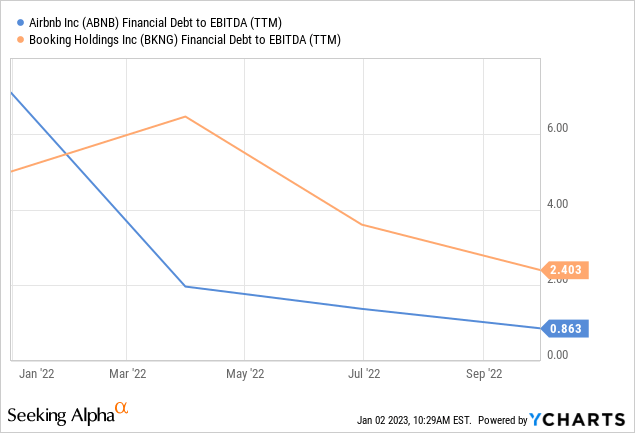

Both companies have strong balance sheets with plenty of liquidity and billions in cash and short-term investments. Airbnb has much less leverage because of its total long-term debt.

Price

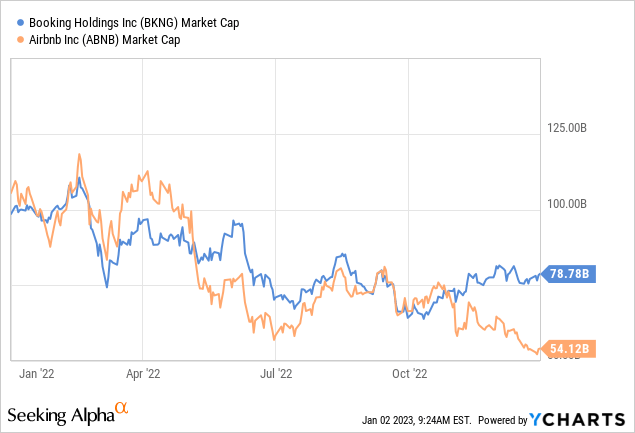

Combined with a low stock price and improved profitability, Airbnb’s valuation has become very reasonable. Booking.com now has a higher market cap than Airbnb, but in terms of valuation, both are trading at relatively similar multiples.

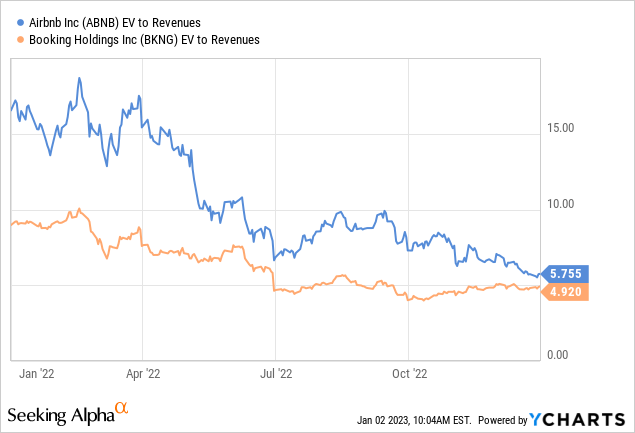

Looking at EV/earnings for example, both are very close to the 5x multiple. Since Airbnb’s valuation was approaching ~15x EV/earnings a year ago, Airbnb’s valuation has increased significantly.

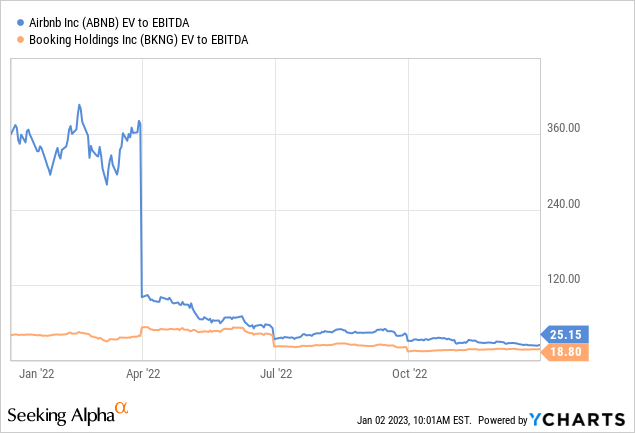

The EV/EBITDA multiple has been accumulating for both companies, with Airbnb at ~25x and Booking at ~18x. These may seem like relatively high multiples, but they are still at a reasonable level given the expected revenue growth for both companies.

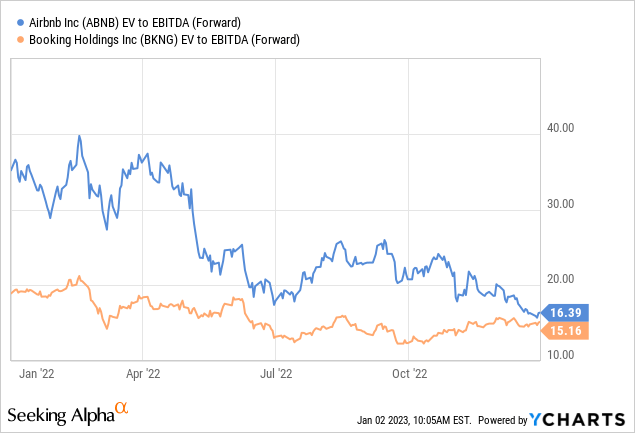

Looking at forward EV/EBITDA, the multiples are even closer to each other, with Airbnb at ~16x and Booking at ~15x. Therefore, evaluation is no longer the main factor in deciding which company to invest in, and we can conclude that other aspects of the business should be given more weight when making a decision.

Accidents

Airbnb still faces several challenges as it tries to take the travel crown from Booking Holdings. One big challenge is the issue of trust. Some travelers are still hesitant to book a property on Airbnb, because they are concerned about the quality and safety of the accommodations. Both companies face regulatory concerns, but these are more important for Airbnb with its focus on alternative accommodations. Another important risk is the new travel restrictions that have had a major impact during the Covid lockdowns.

Conclusion

The last time we compared Airbnb and Booking.com, it was clear that the price of Booking.com was much more attractive. At this time, the prices of both companies are very similar, and deciding which one to choose depends on other factors. Bookings remains the largest company by revenue, and given relatively similar growth rates, it looks set to retain the travel crown for some time to come. We believe there are some factors that could help accelerate Airbnb’s growth past bookings, and that’s why we like Airbnb shares right now. That said, it’s a very close call, and we believe investors will probably do well with both in the long run. Airbnb and Booking Holdings are both high-quality platform businesses that could benefit from the rise of online travel bookings, and both could continue to be key players in shaping the future of travel.

[ad_2]

Source link