[ad_1]

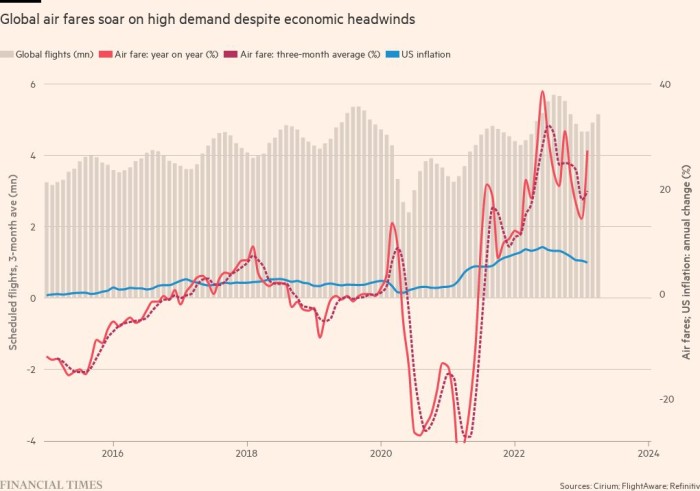

Air fares are rising at more than twice the rate of inflation, as carriers cash in on demand for travel, defying broader economic headwinds.

Ticket prices on more than 600 of the most popular routes rose 27.4 percent in February, the fifteenth consecutive double-digit increase in the latest month for which data is available, the Financial Times reported. Data analysis of the aviation company Cirium.

In contrast, US inflation, the main driver of global inflation among developed economies, grew by less than half over the same period.

The data analyzed prices on popular routes flying around the world and used average one-way fares in economy excluding taxes and fees.

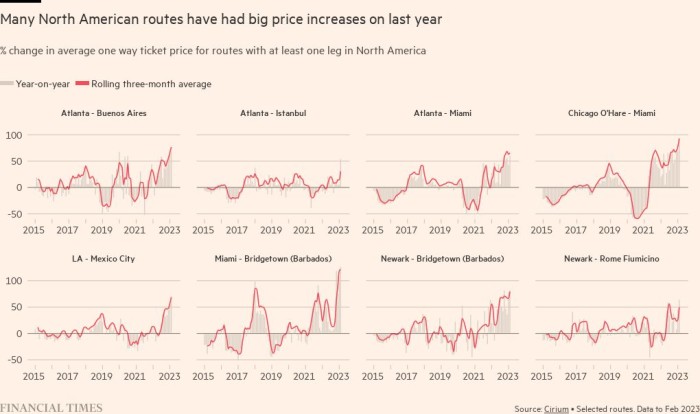

Compared to pre-pandemic levels, many roads have experienced significant price increases this year.

The average one-way economy transatlantic flight from London Heathrow to New York JFK was $343 in February this year, up 23 percent from the same month in 2019.

Fares between New York and Singapore rose 45 percent to $887, while tickets from Dubai to Frankfurt rose 51 percent to $360.

Sixty routes with at least one leg across more than 300 routes in North America have set new record highs over the past 12-months, including seven new record highs in February.

Fares between Miami and Bridgetown, Barbados rose 126 percent in February, and fares from Los Angeles to Mexico City International doubled. Available.

Passengers’ willingness to pay higher fares reflects the frenzy in the desire to fly last year and how airlines are relishing huge opportunities in the wake of the pandemic.

“Airlines are experiencing a lack of awareness to express the strength of demand,” said Bernstein analyst Alex Irving.

American Airlines recently reported first-quarter earnings, while Lufthansa said it expects adjusted earnings this spring to exceed 2019 levels. British Airways owner IAG and Air France both predicted tougher summer seasons this week.

High travel demand comes at a time when airlines are offering customers fuel, labor and a strong dollar for non-U.S. carriers.

Prices have risen because many carriers have been slow to rebuild their flight schedules from before the pandemic, partly due to global aircraft shortages.

Analysts say the comparatively limited supply of seats has supported prices at a time of high demand and stopped a new shortage of capacity from flooding the market and driving down prices.

“Providing competitive pricing is our passion,” said IAG CEO Luis Gallego. But he added that airlines had to pass on rising costs in a “high inflation” environment.

Airlines forecast demand with “reliable accuracy,” meaning they know a year in advance which flights will be full, and can charge higher prices from when tickets first go on sale, said Oliver Ranson, the airline’s director of revenue economics consulting. .

But he said the pandemic has complicated this model because demand patterns are still in flux, meaning airlines often have to raise prices in line with sales and increase prices for last-minute bookers.

Airlines were one of the most affected sectors during the outbreak. After losing nearly $200 billion between 2020 and 2022, they are rebuilding their finances, according to industry body ETA.

The high ticket prices come amid growing scrutiny of companies using high inflation as a cover, a phenomenon dubbed “greedy inflation”.

UK consumer rights group Which? Travel editor Rory Boland said passengers should not run into a repeat of the widespread travel disruptions seen last year.

“In many airlines, prices and profits are increasing, so the least passengers should receive in return is a competent service,” he said.

However, Hugh Aitken, vice president of strategic flights and industry partnerships at price comparison website Skyscanner, said there were still “deals to be had” as fares were not rising consistently.

“Even in peak travel seasons like winter, fares are not increasing on all routes, at the same rate,” he said.

[ad_2]

Source link