[ad_1]

The concept of revenge travel, or people opening their bags and making up for lost time on long-delayed vacations (due to Covid-19), has fueled the armed forces of airlines. The broader travel sector has one shot left. However, it now has to contend with another: inflation. Because of this, I’m a little leery of Delta Air Lines (D.L) inventory.

One of the counter-winners following the start of the Covid-19 pandemic, US-based international carrier Delta Air Lines, has soared in hopes that the global health crisis is finally fading. Even if that narrative plays out perfectly, the current wave of inflation may be too much for air travel to overcome.

When Covid-19 stopped working in the diversified domain and became a very domestic problem in the US, investments like DAL stock were actually toxic. As of 2011 US Bureau of Transportation StatisticsBetween February and April 2020, air revenue passenger miles fell by 97 percent.

At the same time, brave contrarian investors saw an opportunity in the midst of the problems. Eventually, he explained, the pandemic will be in the rearview mirror, creating a boom in DL stocks and their ilk.

In hindsight, as information from well-respected sources UC Davis Health “Covid fatigue,” or the mental, emotional and psychological stress associated with the pandemic’s lockdowns and mitigation efforts, has taken the crisis by mere months, he said. This eventually led to a revenge ride, which still may not be enough to help DAL stock.

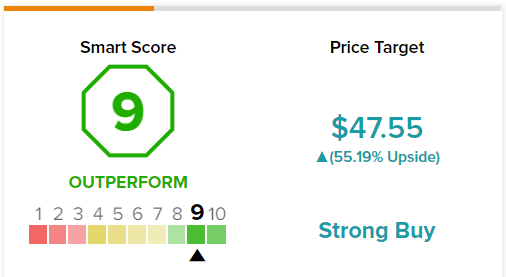

Delta Air Lines’ highest Smart Points rating

On TipRanks, DAL has a Smart Score rating of 9 out of 10. This indicates that the stock has the potential to outperform the broader market.

DAL’s stock and price rise upheaval

While inflation is a problem in both the economic and political arenas, what has many investors choosing to take a shot at DL stock and similar names is the fact that Revenge seems to be largely insulated from inflation.

True, inflation affects the purchasing power of the dollar and affects everyone. However, he noted that peak traffic for Memorial Day and the 4th of July weekend will keep vacation demand outpacing inflation. However, will this narrative continue to hold true for DAL stock? Some doubts are creeping in.

For one thing, the bill doesn’t bode well for air carriers. Since the start of the Covid-19 crisis in the US, the dollar has lost 12.92% of its purchasing power – equivalent to 13 cents on the dollar. Therefore, the average household in America making $70,000 will lose approximately $9,000 over the course of a year.

Considering that a $500 unexpected bill puts most Americans in debt, $9,000 is not something many families can afford to ignore.

Second, despite strong travel demand, evidence is emerging that inflation is taking a toll on airlines. In the latest consumer price index reading, class-tracking airline fares fell 1.8 percent in June from May. This sudden negativity after demand has increased suggests that consumers do not have the funds to float above inflation.

Poor financial forecast

Examining the underlying financial profile of DAL stock, the numbers do not seem to warrant any pessimism. For example, in the second quarter of 2022, Delta reported $13.8 billion in revenue, up 94 percent from the previous quarter. Additionally, net income rose to $735 million, up nearly 13% year over year.

In the year After entering negative territory in 2020, this year’s Q2 free cash flow was $1.58 billion, up nearly 43% year-over-year. If the momentum holds true, Delta has a chance to post one of the best annual FCF stats in some time. Still, investors should be cautious about getting into DAL stock based on past performance.

Basically, financial data as presented is not worth much in terms of estimation. For example, the demand for travel to Asia is very strong, but this market is divided into two. Tourism in Southeast Asia is strong, largely due to the relaxation of Covid-19 protocols. However, in the Far East, China requires a minimum 14-day quarantine protocol for all travelers.

Such restrictions may not be useful for the Delta, which has many routes to the Far East.

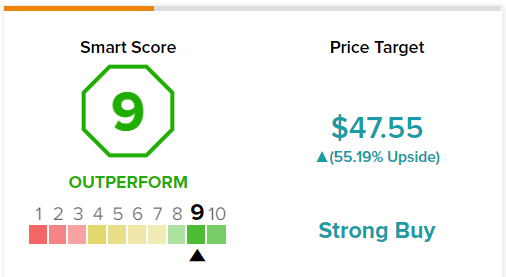

Wall Street’s Take on DAL Stock

Turning to Wall Street, DAL is a strong buy based on nine buys, two holds and no sell ratings. Delta Air Lines has an average price target of $47.55, indicating a potential upside of 55.2%.

Summary: Fact-checking bacon

Although the return of air travel represents a significant social turning point for America, it remains an open question whether it remains economically viable for DAL stock and airline aircraft. The biggest risk investors face is that Delta is flying with a massive reality check.

Of course, this fact is inflationary. While the urge to leave the house following two years of Covid-19 restrictions is an understandable sentiment, at some point, consumers can’t ignore the pain forever. Therefore, investors should approach DAL stock with extreme caution — if at all.

Disclosure

[ad_2]

Source link