[ad_1]

metamorworks

By William Nicol, Analyst, Sustainable Investment Research

Few industries can rival the growth of the technology sector, which has seen its investment-friendly market value grow fivefold over the past decade.[1] – But as the investment landscape becomes more blurred, more than the wind Interest rates increase on the horizon, the green economy emerges as a candidate. The development of the green economy parallels the technology sector as fast-growing, diversified and green products and services are proliferating in all markets.

Growing fast

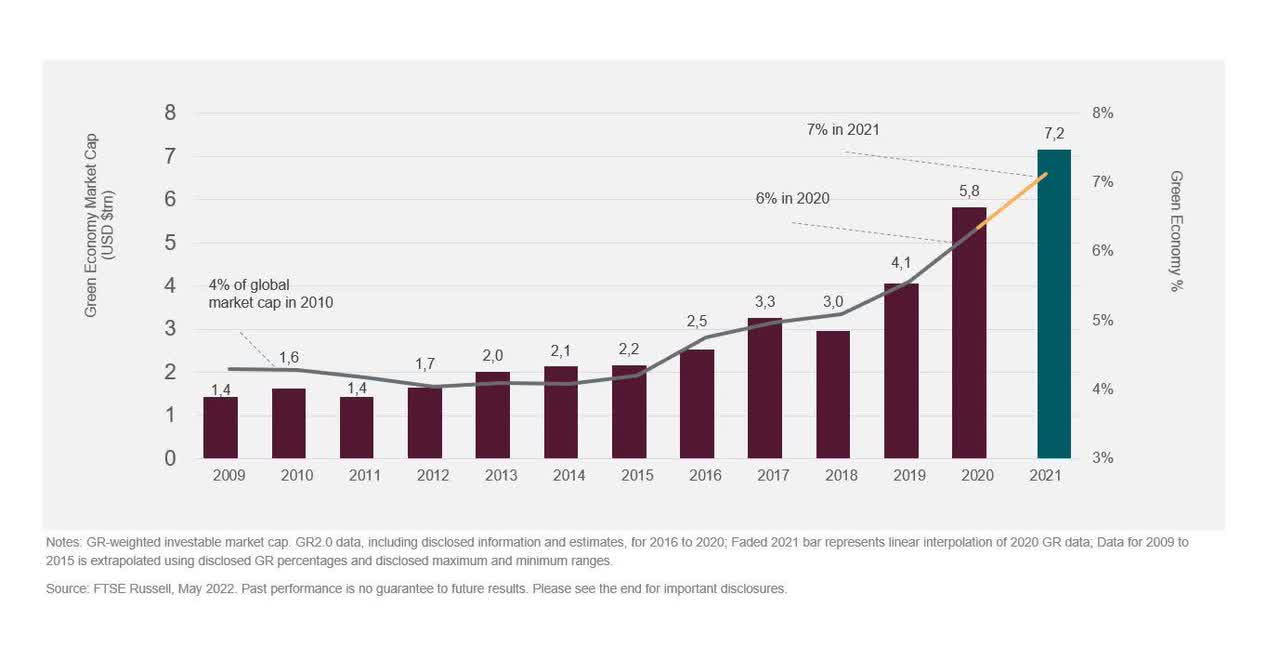

As mentioned in our recent article. Investing in a green economy 2022, The capitalization of green stocks grew from less than USD 2 trillion in 2009 to more than USD 7 trillion in 2021, doubling its share of the global investment market from 4 percent to 7 percent (Figure 1).

Figure 1. The green economy has doubled its global market share over the past decade.

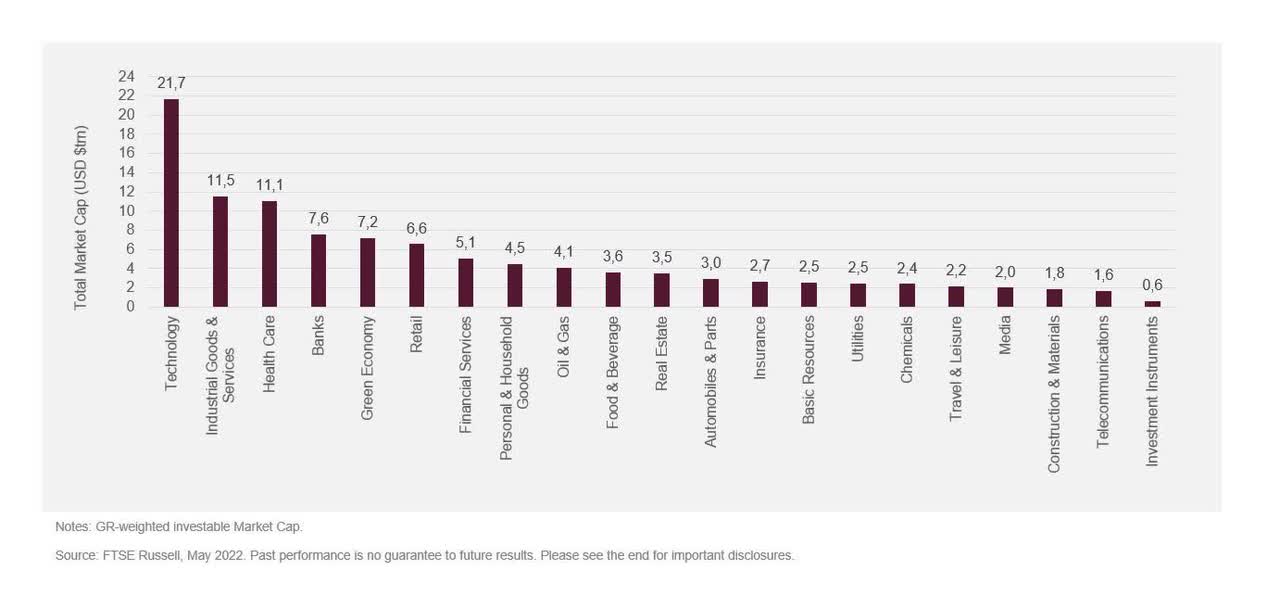

Given this, the green economy is now equal to the fifth largest industrial sector by market value (Figure 2) – bigger than oil and gas, recently overtaking retail and closing banks. The technology sector was at the same level in 2008 and then became the largest sector in 2015.[2]

Figure 2. Size of ICB supersectors versus the green economy.

Multifaceted

Like the various tech subsectors, from demand streaming to fintech, green subsectors are equally diverse, spanning green areas such as renewable energy to energy efficiency, recycling and pollution reduction.

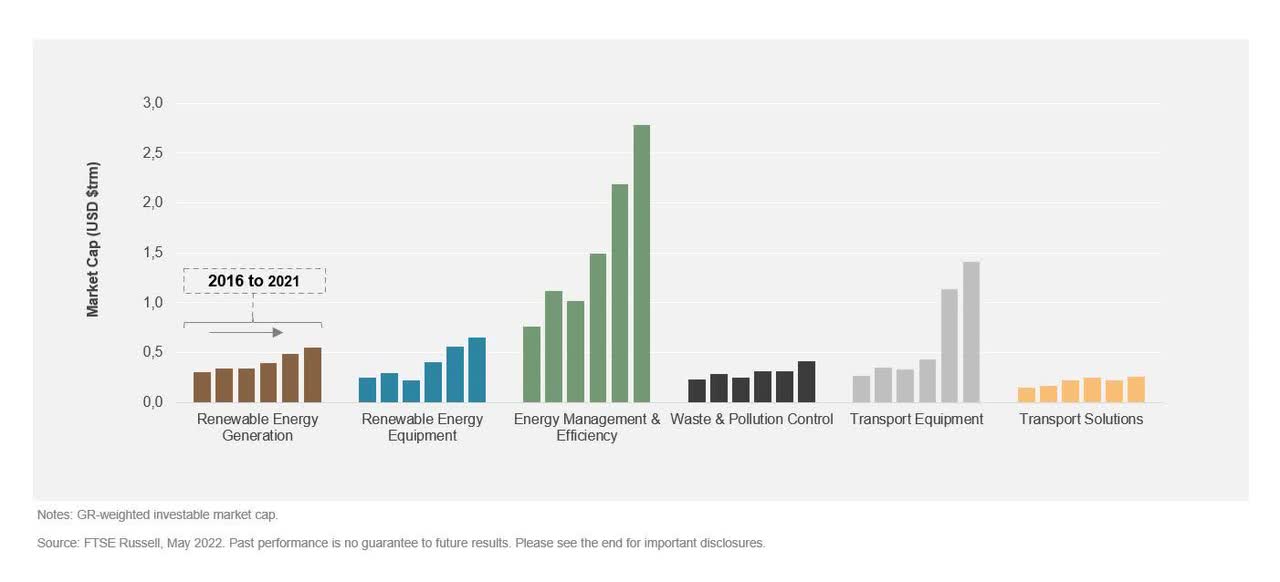

Some are rapidly expanding (Figure 3) markets for green products and services, particularly disrupting the electric vehicle sector with significant growth in transport electrification and companies such as Tesla. There are many other, less headline-grabbing areas too – take energy efficiency, whose rocketing market prices are driven mainly by cloud computing, benefiting the tech giants, but also wider trends in energy demand and the need to cut costs.[3]

Figure 3. Market value growth in selected green sub-sectors.

Wide

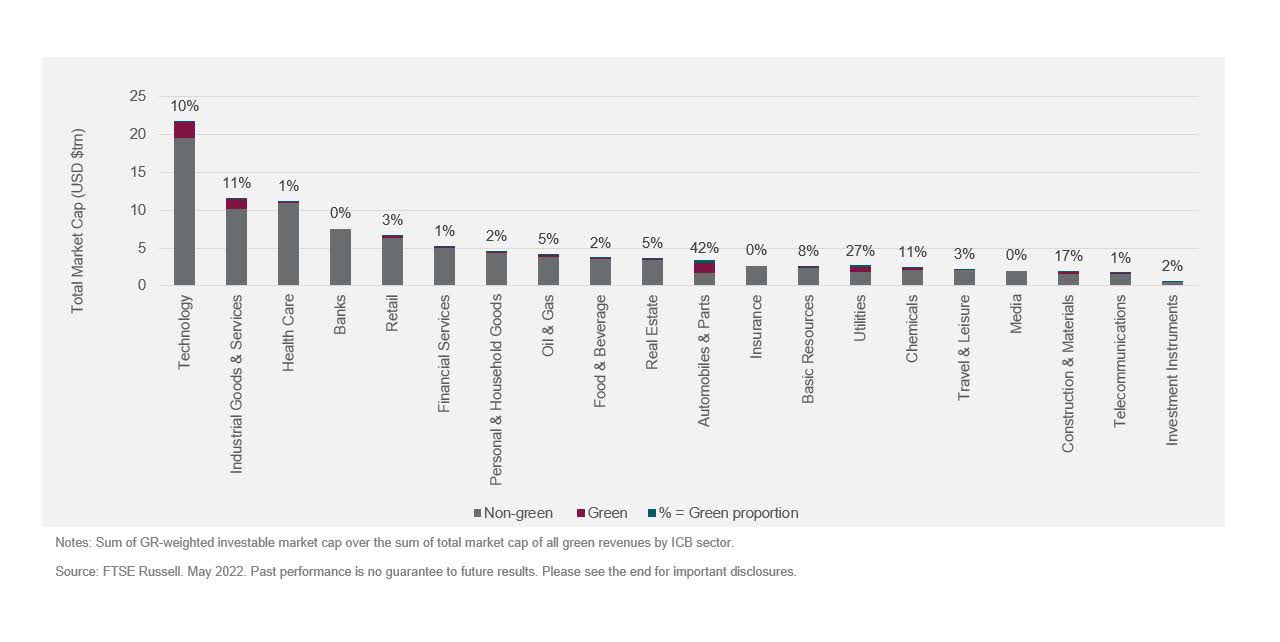

As with technologies, green goods and services are entering various industrial sectors (Figure 4). For example, two-fifths of the auto sector is already green by value, and the rise of electric vehicles will drive growth in the value chain – including EV charger suppliers, battery manufacturers and lightweighting – in other sectors. Utilities and industry also have sizeable green components, driven by the competitiveness of renewable energy and the demand for products and services that reduce pollution.

Figure 4. The green economy is spreading across other sectors of the economy.

Internationally diverse

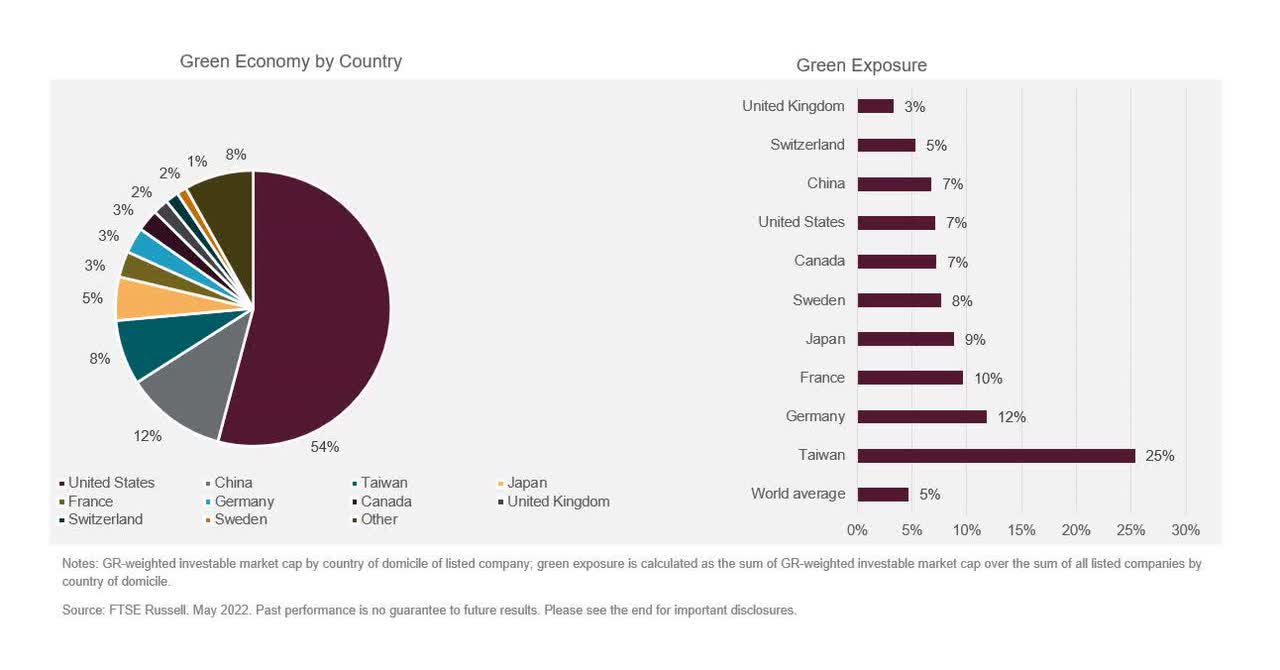

The green economy is globally diverse, although it is found in certain countries such as the US (54%), followed by China (12%). When we look at the green exposure, the picture is different, that is, how is the green economy. For example, despite their relatively small size, Japan and European countries such as France and Germany are highly exposed to the green economy. Indeed, many countries are making green development and green jobs a central pillar of their post-Covid growth strategies – another parallel the sector has with technology. Evidence shows that dollar for dollar, capital-intensive green investment creates more jobs than polluting alternatives.

Figure 5. As with the technology sector, the US and China dominate the green economy by market size.

As the low-carbon transition accelerates, the green economy may continue to follow in the footsteps of the technology sector – green products and services will continue to permeate the economy and secure a place in the new industrial growth sector.[4]

[1] The technology sector has more than quintupled its investable market value over the past decade. Total market value of companies included in the Technology ICB supersector in the FTSE Global Equity Index Series between 2012 (USD4.0 trn) and 2022 (USD19.2 trn).

[2] The total invested market capitalization (year-end) of all companies included in the ICB supersector classification as ‘Technology’ in the FTSE Global Index Equity Series (end 2021) has grown from US1.9 trn in 2008 (5th largest ICB supersector at investable market value) to USD21.8 trn by 2021 (the largest ICB supersector).

[3] Green sectors defined under the FTSE Russell Green Income Classification; For more details, see FTSE Russell (2020). Green Income Classification System 2.0.

[4] FTSE Russell (2022); The green economy in troubled waters?

© 2022 London Stock Exchange Group plc and its respective group undertakings (“LSE Group”). LSE Group (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and includes FTSE Global Debt Capital Markets Limited (collectively, “FTSE. Canada”), (4) FTSE Fixed Income Europe Limited (“FTSE FI Europe”), (5) FTSE Fixed Income LLC (“FTSE FI”), (6) Product Book Inc (“YB”) and (7) Beyond Standards SAS (“BR”). all rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield Book®”, “Beyond Standards” and all other trademarks and service marks (whether or not registered); or unregistered) trademarks and/or service marks owned or licensed by LSE Group or their respective licensors and used under the ownership or license of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE International Limited is authorized and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for informational purposes only. All the information and data contained in this publication have been obtained by the LSE team from sources it trusts to be accurate and reliable. Due to the possibility of human and mechanical error as well as other factors, such information and data are provided “as is” without any warranty. Neither the LSE Group nor any of their respective directors, officers, employees, partners or licensors make any claims, predictions, warranties or representations, express or implied, as to the accuracy, timeliness, completeness, merchantability or accuracy of any information. Access to the use of FTSE Russell products, including but not limited to indices, data and analyses, or FTSE Russell products that may be stored for any purpose. Any representation of historical data available through FTSE Russell products is provided for informational purposes only and is not a reliable indicator of future performance.

Neither LSE Group nor its respective directors, officers, employees, affiliates or licensors (a) shall be liable for any loss or damage in whole or in part caused by any fault of any LSE Group member; (NEGLIGENT OR OTHERWISE) OR OTHERWISE PROCUREMENT, COLLECTION, COMPILATION, TRANSLATION, ANALYSIS, EDITING, COPYING, TRANSMISSION, TRANSMISSION OR DELIVERY OR USE OF THIS DOCUMENT OR LINKING TO THIS DOCUMENT OR (B) IN ANY OTHER WAY DIRECTLY, INDIRECTLY , REGARDLESS OF SPECIAL, CONSEQUENTIAL OR INCIDENTAL DAMAGES, EVEN IF ANY LSE GROUP MEMBER HAS BEEN ADVISED OF THE POSSIBILITY OF DAMAGE FROM THE USE OR INABILITY TO USE SUCH INFORMATION.

No member of the LSE Group or their respective directors, officers, employees, partners or licensors provide investment advice and nothing in this document should be construed as financial or investment advice. No member of the LSE Group or any of their respective directors, officers, employees, partners or licensors makes any representation as to the suitability of investing in any asset or whether such investment may pose legal or compliance risks to the investor. A decision to invest in such property should not be taken based on any information contained herein. Indexes cannot be invested directly. The inclusion of an asset in an index is not an indication that any investor may legally buy, sell or hold the asset or an index that contains the asset. The general information in this publication should not be applied without obtaining specific legal, tax and investment advice from a licensed professional.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent actual investable asset trading results. Certain returns observed may reflect back-tested performance. All performances presented prior to the index inception date are back-tested performance. Backtested performance is not actual performance, but hypothetical. Back-test calculations are based on the same methodology that was in place when the index was officially launched. However, back-tested data may reflect the application of the index methodology with a discretionary benefit, and historical index calculations may change from month to month due to changes in the underlying economic data used in the index calculation.

This document may contain forward-looking statements. These are based on a number of assumptions about future conditions that may ultimately turn out to be wrong. Such forward-looking assessments are subject to risks and uncertainties and may be affected by factors that could cause actual results to differ materially. Neither the LSE team nor their licensors assume any responsibility for, and undertake to improve, future assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without the written permission of the relevant LSE team member. Use and dissemination of LSE Group information requires permission from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Original post

Editor’s Note: Bullets for this article’s summary were selected by Search Alpha editors.

[ad_2]

Source link