[ad_1]

Gearstd/iStock via Getty Images

thesis

Recent price adjustments have brought technology valuations into a reasonable range. The iShares Semiconductor ETFNASDAQ:SOXX) has historically traded at a premium relative to the overall market. For example, in March 2022, SOXX It was trading at about 31.5x and SPDR S&P 500 Trust ETF (P/E).Spy) about 26.5x, according to Yahoo Finance data. However, recent corrections have brought the SOXX P/E to its current level of 15.45x, a 17% decline from the S&P 500’s 18.4x.

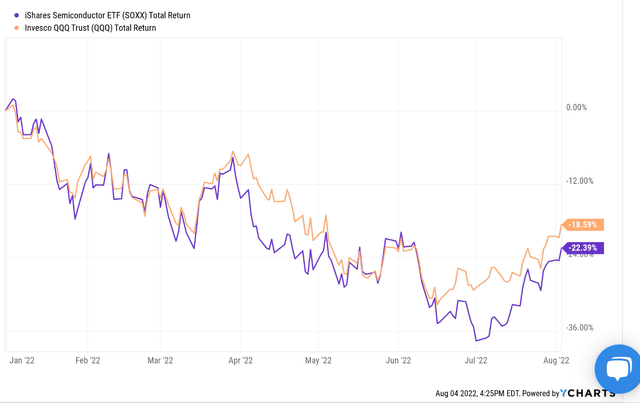

And next you’ll see the discount from the NASDAQ 100 Index, represented by the Invesco QQQ ETF (represented byNASDAQ:QQQ)) is bigger. After all, SOXX has lost 18.6% YTD and QQQ about 22% as you can see from the chart below. Combined with earnings changes, the SOXX price now stands at 15.45x and the QQQ at 22.01x, a 30% discount.

In addition to the valuation squeeze, volatility has been remarkably quiet recently, adding another reason to consider betting more heavily on the tech sector. As you can see from the second chart below, the Volatility Index has outperformed YTD significantly, dropping from the 30+ levels seen at the beginning of the year to the current level of 22.4x. To provide a broader context, the 30 volatility is at 93% of the historical volatility peak. 22 percent is about 71%. The main reason for the bullish volatility is that the Fed’s recent rate moves and comments are in line with market expectations and also provide clarity in the near term. And as detailed in our previous article, it is a good idea to hunt when volatility is high and vice versa.

Against this background, we will take a closer look at the pros and cons of SOXX and QQQ next.

Seeking Alpha Yahoo Finance

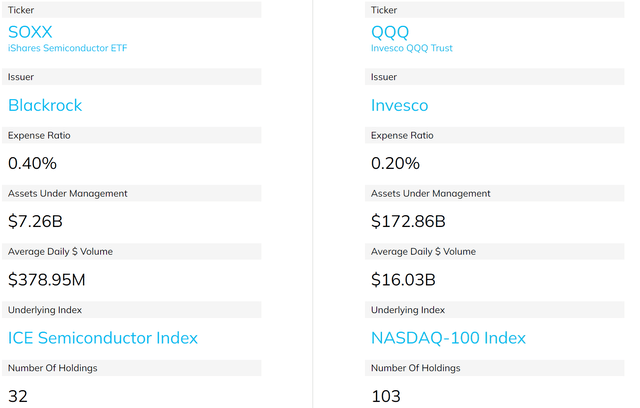

SOXX vs QQQ: Basic Information

QQQ needs little introduction. It is one of the most popular funds tracking the Nasdaq-100 index. However, as mentioned earlier, many investors are unaware that QQQ is not a pure technology play because the NASDAQ 100 index tracks the largest non-financial companies listed on the Nasdaq, and most of these companies are not technology companies. I will leave this for now and come back to this point later.

SOXX, on the other hand, is a pure technology play focused entirely on the semiconductor sector. As detailed in the fund statement:

The iShares Semiconductor ETF seeks to track the investment performance of an index composed of US-listed stocks in the semiconductor sector. Provides exposure to US companies that design, manufacture and distribute semiconductors and targeted access to domestic semiconductor stocks. It is used to describe the sector view.

Source: ETF.com

SOXX vs QQQ: Past Performance and Risks

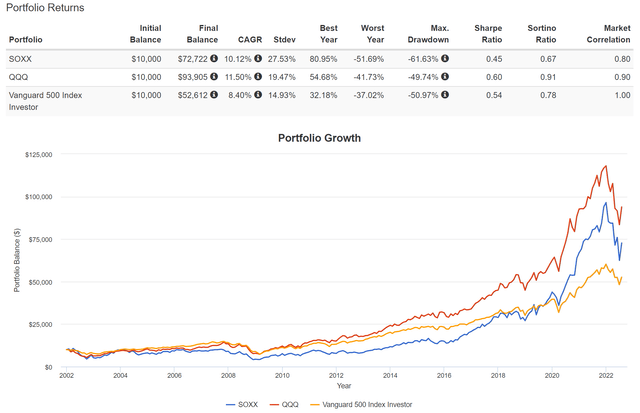

As you can see from the chart below, both SOXX and QQQ funds have made handsome returns in the past. SOXX in 2011 It has delivered an annualized return of 10.12% since inception in 2022, and QQQ has delivered a slightly higher CAGR of 11.5%. Both outperformed the S&P 500 by a healthy margin of 2 to 3 percent.

When compounded over the past decade, such alpha has accumulated to a significant difference in total return. By reinvesting dividends, the SOXX has generated a total return of 720% and the QQQ over 930%, far outpacing the S&P 500’s 525%.

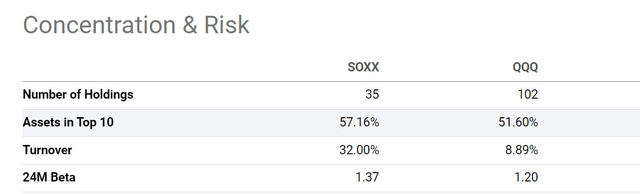

Although the downside is their price volatility. Last year in the previous episode we saw a glimpse of their price volatility in the short term. As you can see, over the long term, both the SOXX and QQQ experienced much greater volatility than the S&P 500. And SOXX in particular has suffered the biggest volatility so far. In terms of standard deviation, 27% is almost double that of the SP 500 (14%) and also 8% higher than the QQQ overall. In terms of worst-year performance, SOXX suffered a 51% loss (which takes more than 100% to break a rally), which was 10% more than the QQQ and 14% more than the SP 500. And finally pulling back from the highs, SOXX’s 62% high decline (which takes a 163% rally to break even) is really nerve wracking. In contrast, both QQQ and SP 500 were in the 50% range.

And then, we will see that the main cause of the changes is in the basic indexing methods.

Portfolio Visual

SOXX vs QQQ: A more aggressive bet on tech

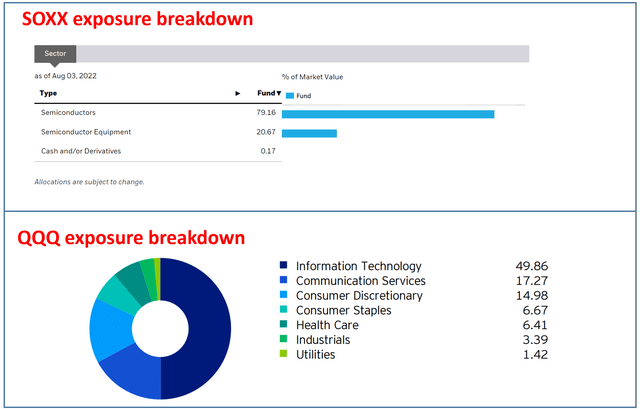

As mentioned earlier, QQQ tracks the largest non-financial companies listed on the Nasdaq, and most of these companies are not technology companies. As you can see from the chart below, information technology represents 49.8% of QQQ’s total assets, followed by communications services at 17.7%, and consumer discretionary at 14.9%. Admittedly, some companies in communications services and consumer discretionary are technology companies. However, information technology represents only the smallest area of the farm. Note that QQQ also contains a good portion of consumer staples, healthcare, industrials, and utilities.

SOXX and QQ fund fact sheets

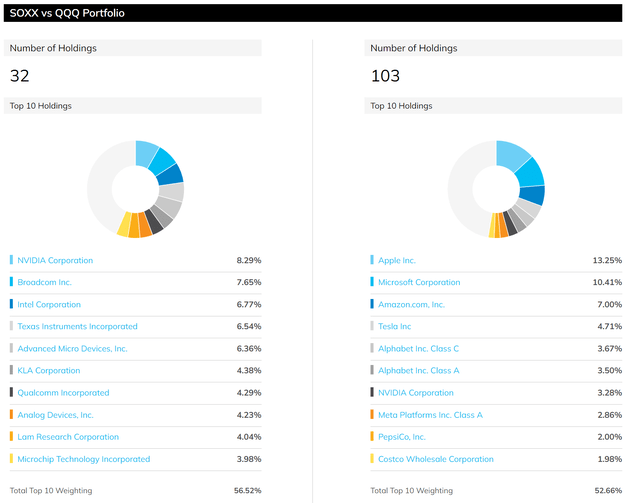

SOXX, on the other hand, is a pure technology play. The money has been invested entirely in the technology sector, particularly the semiconductor sector. As you can see, it invests more than 79.1% of its total assets in semiconductor stocks and more than 20.6% in semiconductor equipment. In addition, his holdings are stronger. SOXX holds a total of 32 stocks and QQQ about 100.

You can also get a good idea of the focus and composition by looking at their top ten holdings. One of the top 10 holdings overlaps: Nvidia (NVDA). But NVDA represents an 8.3% allocation in SOXX, as opposed to just 3.28% in QQQ. Also note that while QQQ’s top holdings include stalwarts like Costco (COST) and PepsiCo (PEP), all SOXX holdings are semiconductor stocks.

To me, this is key to SOXX’s long-term performance. He places a bet on information technologies, one of the most innovative sectors. For this reason and current valuation, I see favorable prospects for SOXX to continue outperforming the S&P 500 over the long term. As will be detailed later, I see great opportunities to make QQQ even better.

But again, before turning the page, investors should be aware of volatility risks and choose the right fund for their time horizon and risk tolerance.

Source: ETF.com

SOXX vs QQQ: A Valuation Comparison

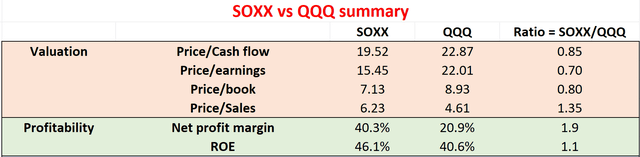

As mentioned earlier, SOXX has historically traded at a higher upside relative to the S&P 500 and QQQ. However, recent price corrections have brought the estimate down. SOXX’s current P/E of 15.45x is a ~17% discount to the S&P 500. And as the next chart shows, the discount to the QQQ is greater.

SOXX’s price-to-earnings ratio is just 15.4x, about 30% below QQQ’s 22.0x. Other metrics paint a similar picture. SOXX’s price-to-cash flow ratio is 19.5x, about 15% below QQQ’s 22.8x. And SOXX’s price-to-book value ratio is 7.13x, about 20% lower than QQQ’s 8.93x, despite SOXX’s QQQ’s 46% and 40% higher ROE. Finally, don’t be alarmed by SOXX’s high price-to-sales ratio. Price-to-sales ratio of 6.23x is about 35% higher than QQQ, but net margin is 90% higher.

Author

Final thoughts and dangers

There are good reasons to start considering the technology sector now. QQQ has never been a bad choice with its low fees, broad market representation and excellent liquidity. However, more aggressive investors with longer time horizons may want to consider SOXX due to the valuation correction and quiet volatility ahead. SOXX has historically enjoyed a valuation premium over the overall market. But it is currently ~17% off the S&P 500 and about 30% off the QQQ.

Finally, accidents. If you remember from the previous chart, SOXX charges an expense ratio of 0.4%, and QQQ charges a low expense ratio of just 0.2%. The surcharge always creates a drag on SOXX (0.2% per year). Also note that SOXX has a much higher turnover ratio than QQQ (32% vs 8.9%), which may have tax implications in some accounts.

Seeking Alpha

[ad_2]

Source link