[ad_1]

It’s clear that remote and hybrid work are here to stay—the pandemic has changed the way many companies do business forever. But it introduced a roadblock from HR’s point of view. For example, for payroll, businesses with employees in multiple states face hurdles in opening the necessary accounts for expenses. Others — fearing the consequences of disobeying — are letting vague rules dictate daily operations. According to a recent Deloitte report, more than half of companies do not allow employees to work in locations where the company is not established for tax purposes.

There is no solution to the ongoing challenge of ensuring that a company is compliant with multiple tax and employment laws. But Alex Kehaias in 2011 Founded in 2021, Mosey said the company is close. Mosey provides clients with automated tools to help US-based companies hire workers remotely and maintain compliance using reporting requirements for all 50 states.

“Solving where we work is one of the most important problems to solve for the future of work. It has great potential to improve access to opportunity, but many businesses are struggling today because multi-jurisdictional compliance is so difficult,” Kehaias told TechCrunch in an email interview. From early stage startups like Watershed, Mistir, Common Room to scale companies like Coda, Recharge, Ralbio are fast growing businesses. Almost every industry is being transformed by remote work, and our customers are reinventing the back office.

Setting the stage for future growth, Mosey today closed an $18 million Series A round led by Canaan with participation from Gusto, SemperVirens and Charge, bringing the startup’s total funding to $21 million. The funding will be used to expand the Mosey team, expand the platform and create new partnerships, Kehaias said.

Focus on compliance

Prior to founding Mosey, Kehaias was a product manager at Morgan Stanley and an engineering manager at Stripe, where he led the new user experience team. While at Stripe, Kehayaas built and led Stripe Atlas, a platform for early-stage startups that solves accounting hurdles, including – for a fee – incorporation and tax filing.

Kehayas says most companies rely on a mix of legal, financial and HR advisors to identify and manage their compliance requirements. This can quickly become expensive when multiple states are involved. Except for states with no income tax, each company has its own rules for income tax deductions that must be navigated. Things get more complicated if employees spend a short time in other states, or if the business is located in a state where temporary relief has been implemented during the pandemic.

One source puts the combined cost of corporate tax compliance at $2 billion.

“The pandemic has accelerated the move to remote work, and employee demand for location flexibility has never been higher. Out-of-state hiring has increased from 35% before the pandemic to 62% in 2022, and the number of offices has slowed,” Kehaias said. However, the rules and regulations for hiring and managing remote workers are complex and rapidly changing. This means significant changes in manpower, wages and taxes.

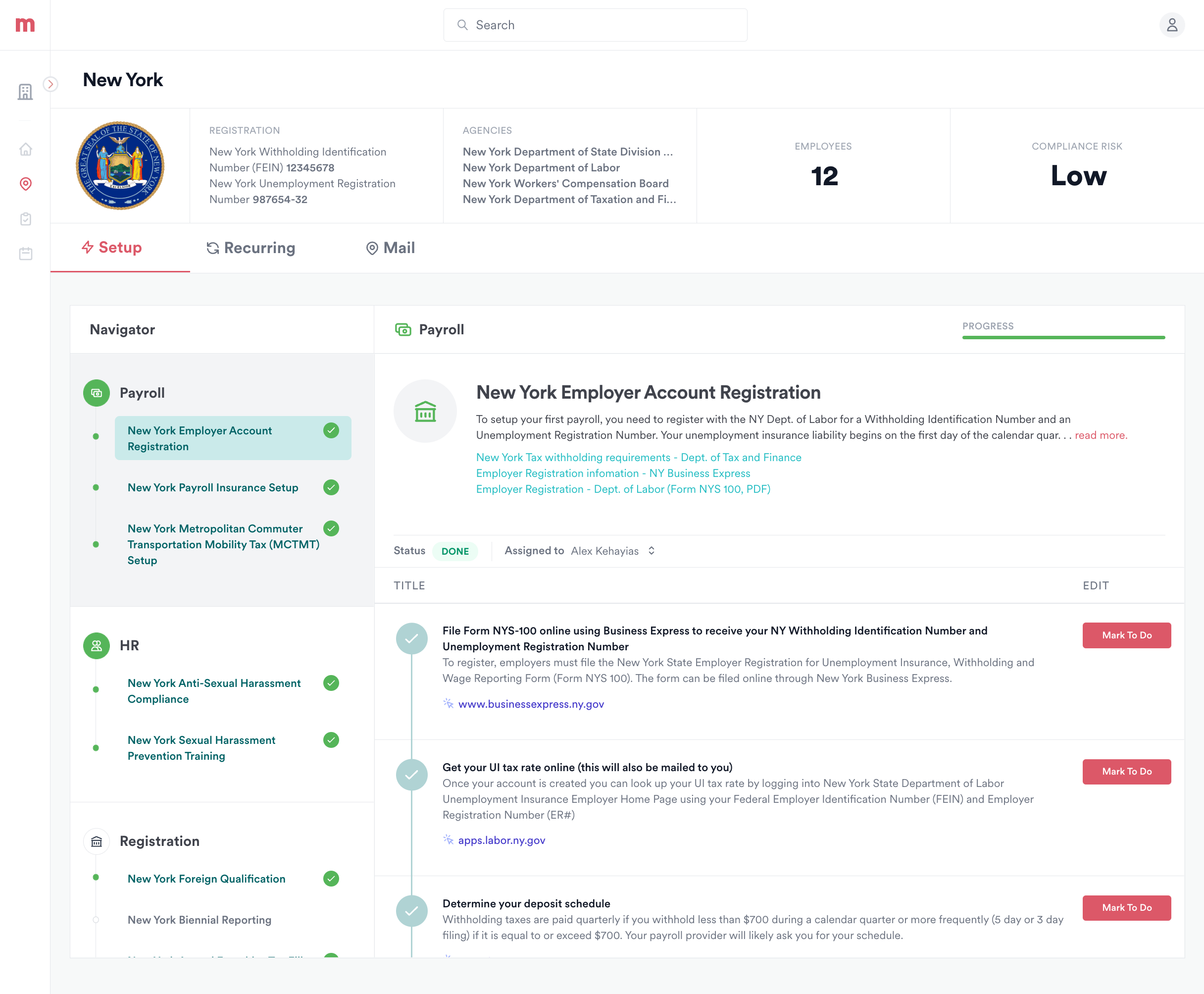

Image Credits: Moses

Mosey Solutions coordinates with payroll providers and government agencies to “recalculate” tax obligations on a regular basis. HR professionals can use the platform to automatically open employer and tax accounts – Mosey shows requirements on payroll, registration and taxes everywhere. It also sends alerts and reminders when new requirements are added and deadlines are approaching.

“Mosey’s case for C-suite decision makers is simple: lower the risk that comes with operating in multiple jurisdictions (such as fines, penalties and enforcement) and use technology to reduce compliance costs,” Kehayaas said. “Mose uses a wide range of automation to take more work off the hands of our customers. [providing] Flexibility to hire where the talent is.

Moses has his work cut out for him – the tax code is byzantine in the best of circumstances. And the startup faces stiff competition from companies like Dell, which has raised $156 million in April 2021 at $1.25 billion. Other competitors include Symmetric.ai, Multiplier, Collective and Remote, the last of which was valued at more than $3 billion as of April. 2022.

But Kehayaas says the platform is getting strong demand from Mosey’s early adopters, including clients like Calm, Tatari and Coda.

In another area of good news, funding for HR tech startups remains strong despite the continued economic slowdown, with VCs pouring more than $1.4 billion into HR startups in January, according to PitchBook.

“We’re a small team, but we’re growing fast. We’ll continue to build the products and systems needed to meet the demand we’re seeing.” “We are also working with our legal and tax partners to ensure we are always up-to-date and that businesses can trust us with such an important issue,” Kehayas said.

[ad_2]

Source link