[ad_1]

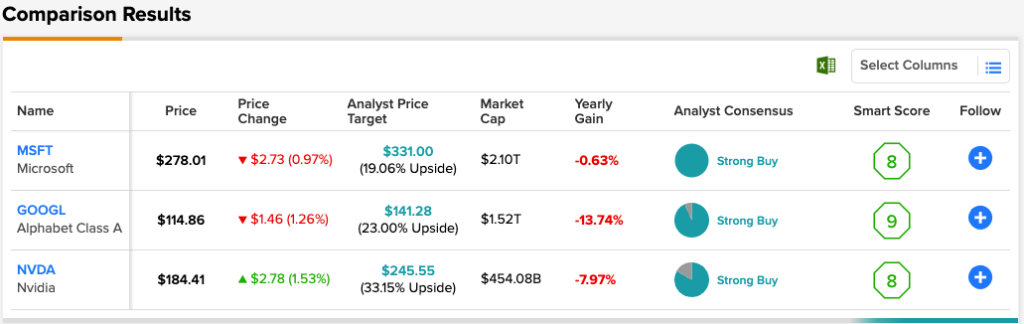

Whether or not we’re at the beginning of a tech-led renaissance, analysts say, the three tech titans listed in this piece look like great buys. Let’s use TipRanks’ Comparison Tool to analyze three tech stocks that Wall Street thinks are poised for upside in the coming year.

With the market rally widening in many sectors, many are hoping that the July rally will be more than just another bear market rally. Of course, timing the market is not a good idea.

Right now, many big tech stocks have fared better-than-expected second-quarter earnings results. With some positive gains behind stocks and valuation metrics skewing toward the low end, it’s no surprise that Wall Street still views this market’s tech darlings as bullish.

Microsoft (MSFT)

Microsoft is a tech titan that came up shy of its latest fourth-quarter results. The top and bottom lines came in at the low end of management’s guidance range.

Microsoft’s EPS of $2.23 missed the analyst consensus of $2.29, while revenue came in at an impressive $51.9 billion. Despite the rare quarterly miss, the stock rallied on management’s positive results. Such optimism has helped investors and analysts see beyond the uncertainty ahead.

Undoubtedly, the last quarter was weighed down by the many temporary issues common to most companies. A strong greenback, the fallout from the Ukraine-Russia crisis and supply constraints dampened the results.

In time, such headwinds will pass, and Microsoft will immediately return to its market-beating path. The company’s cloud strength was also impressive, with Azure growing 40% year-over-year, down slightly from the 46% growth posted last quarter.

The management is good, and I think they are right to be. Despite this, several Wall Street analysts revised their price targets to the downside. The latest price correction comes courtesy of Bernstein, who lowered his price target from $400 to $355.

Although last quarter was a mixed bag, investors seem to be paying more leverage for guidance. Additionally, the 29 Wall Street analysts who cover the name have an average price target of $331.00 on Microsoft and stand by their buy recommendation. This represents an upside of 19% from current levels.

Alphabet is another tech leader that has received high praise following its recent earnings performance, despite disappointing expectations. For the second quarter, Alphabet posted $1.21 in earnings per share, missing the analyst consensus estimate of $1.27. A variety of factors, including a strong US dollar, helped moderate the results. Holding the fort were Alphabet’s advertising and cloud businesses.

apple (APL) privacy-focused iOS updates weighed in on social media companies’ advertising efforts. Such updates may push advertisers to Google, which does not rely on tracking users across the web. Despite the softer climate for advertisers, Google saw its ad business grow nearly 12 percent year-over-year, driven in part by YouTube’s 13.5 percent growth.

Looking ahead, I wouldn’t be surprised if Alphabet takes more shares of social media companies struggling to cope with Apple’s recent changes.

Google has a vast village that maintains its cash flow in the search space. Although the company may be feeling the heat of declining ad spending as we head into the recession, it’s hard to imagine Google staying on its knees for much longer than its smaller ad rivals (especially those in the social space).

Even after a sharp recovery to $105 per share, the stock remains cheap at 21.7 times earnings and 5.4 times sales. Wall Street analysts seem to be in agreement, with 28 out of 30 analysts rating the stock outperform. Google’s average price target of $141.28 shows a 23% upside over the coming year.

Nvidia (NVDA)

Nvidia is a graphics chip powerhouse that will report second-quarter earnings later this month on Aug. 24. Gaming and data center should power the quarter, while Covid-induced supply challenges and Russia’s withdrawal may continue to weigh on them.

Either way, Nvidia stock is trying to bounce back after a 57% plunge from the top to the trough. After rising 24% last month, Navidi stock is down 45% from its all-time high, north of $333 a share.

Heading into Nvidia’s earnings report, the stakes could be high. Given investors’ upbeat response to big tech earnings, Mr. Market seems willing to give windfall firms a free pass this time around.

Despite disappointing quarters ahead, Nvidia is on the right side of many of the tech world’s trends. The company will continue to benefit from the rise of AI, the metaverse, the data center and gaming. By using new chips for the data center (Grace Superchip), the company can easily leave its rivals behind and widen the performance gap.

At just shy of 50 times earnings, Nvidia stock isn’t cheap. However, it doesn’t deserve to trade at multiples in line with its star-studded peers. Its leading chips have applications in many growing industries, which should support double-digit growth for some time.

Despite the more than 55% crash in the stock, Wall Street analysts remain remarkably bullish. Of the 30 analysts covering the name, 25 are buys and five are holds. Nvidia’s average price target of $245.55 suggests a 33.2% upside for the next year. The Street’s highest price target comes from Hans Mossmann of Rosenblatt Securities, who sees Nvidia shares rising 116.9% to a price of $400.

Analysts expect the best from NVDA.

Betting against market technology leaders is never a good idea. They are starting to gain traction again. While multiples are still relatively depressed, and the coming economic slowdown has analysts worried about lowering the bar, I don’t think there’s a better time to charge. At this point, analysts think Nvidia’s stock has an upside.

The 33.2% gain is the average upside expected by analysts, compared to the 116.9% gain expected by the most bullish analyst on the Street.

Disclosure

[ad_2]

Source link