[ad_1]

MinttuFin/iStock via Getty Images

Introduction

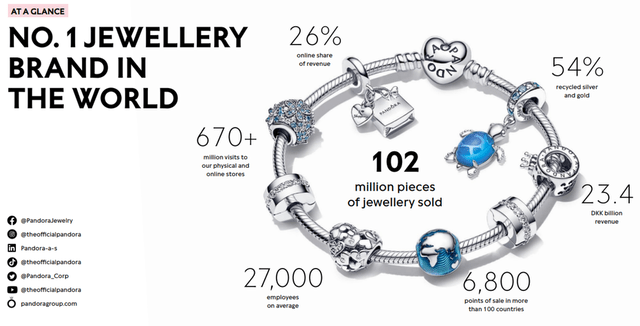

Pandora A/S (OTCPK:PANDY) is a Danish jewelry company with affordable prices for the masses. A few years ago, the Pandora brand was taking an obscure direction. The current management team initiated and relaunched a successful turnaround in 2018. The company’s image makes Pandora the first globally recognized jewelry brand for “modular” bracelets. To date, Pandora has a formidable vertically integrated business with high margins, strong cash generation and superior ROIC. The fear of the market has pushed the price down and they have reached exciting levels, which in my opinion can offer an excellent risk/reward ratio.

Business

Pandora has a fully vertically integrated business model: from product design research to distribution through physical and online stores. In the past, the brand has been in a negative spiral due to bad management policies, at the end of 2018, a 2-year round program called “Program Now” was launched to get the company back on track. CEO Alexander Lasik and the entire board of directors have done a great job of reducing fixed discounts and making product offerings simpler and more efficient. Today the Pandora brand is stronger than ever, now they are ready to exploit the strength of the company and enter the third phase of their history with the implementation of the “Phoenix Strategy” focused around 4 pillars, brand, design, customization and core markets.

Pandora Q1 22 presentation

In the year In 2021, 71% of the revenues came from Pandora Moments and collaborations, which is also the segment that allowed an impressive 20% sales growth. The success of Pandora’s charms has been remarkable, thanks to its highly lucrative partnership with Disney using the Star Wars and Marvel brands, with many fans lining up outside Pandora stores and putting themselves on waiting lists to get their favorite character jewelry. . The second largest source of revenue is Pandora Timeles, which will account for 17 percent of revenue in 2021 and 19 percent sales growth. Also In 2021, Pandora also launched their first collection of sweat-cut diamonds, Pandora Brilliance, which is currently only available in the UK but should be available globally in late 2022. To summarize, Pandora launched ME in September targeting Generation Z and accounted for 4% of revenues in Q4.

When it comes to the distribution of revenue between different sales channels, we find an important piece of content online:

Pandora 21 Annual Report

Some early articles on Pandora speculate that the share of online sales will continue to increase in the future, making Pandora the most popular online jewelry brand. The pandemic has no doubt affected sales of this type, but it does not appear to be management’s intention to make Pandora an e-commerce company. Several franchise store chains have been purchased in recent months, such as those in North America and Portugal. It highlights how the Phoenix strategy is a fundamental point in the development of concept stores. For jewelry shopping, many people prefer to go in person to try them on and see how they fit. Pandora’s online presence is still important and will not be abandoned, but in my opinion it is very important to set up a network of stores in strategic points to guide the company’s growth in this sector.

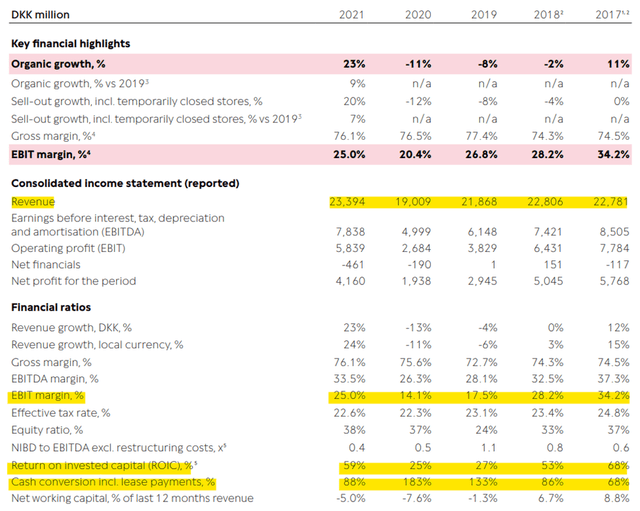

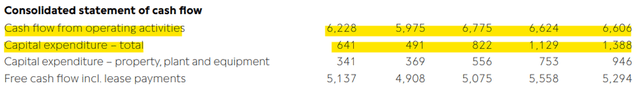

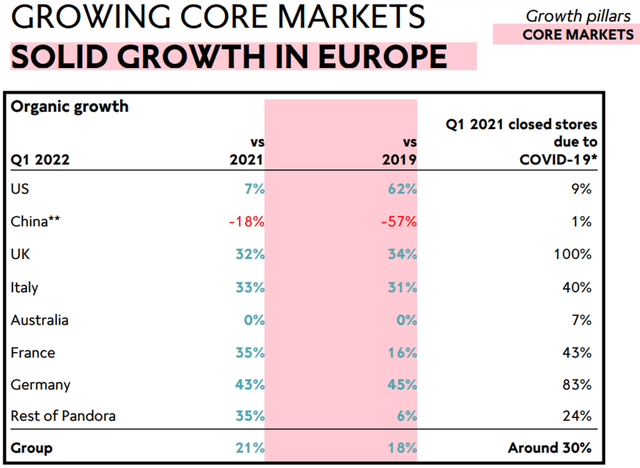

Phoenix’s strategy aims to double its revenue from the US compared to 2019 (DKK 4.7 billion) and triple its revenue from China in the long term compared to 2019 (DKK 2 billion). In order to achieve these ambitious goals, store expansion is necessary, and although investments in China have been postponed due to the current unfavorable conditions, I think Pandora’s products can be very successful in China. Management plans to invest $1 billion to upgrade production capacity at a new manufacturing facility in Vietnam that will enable it to produce 60 million pieces a year. In general, we are talking about a 60% increase in production. The opening of the new craft facility is scheduled for 2023 in Thailand and for 2024 in Vietnam. In the year Pandora’s revenue in 2021 was 23.39 billion DKK, 9% compared to 2019 (+23% compared to 2020), EBIT margin 25% and ROIC 59%. Cash flow of 6.23 billion kroner and capex of $641 million. The following charts show some important data from Pandora’s last 5 years, highlighting its troubled times and how they managed to come out of it. The point I think is most important is free cash flow, which is consistent even in difficult times.

Pandora 21 Annual Report

Pandora 21 Annual Report

Latest results

On May 4, 2022, Pandora published its first quarter results with positive results.

Pandora Q1 22 presentation

The growth was favored by the reopening of many stores, while the reference quarter was characterized by many store closures due to restrictions imposed by Covid-19. China was clearly the weakest market as it was easy to guess because of the unimplemented COVID policy by the Chinese government. After a very strong 2021 in the USA, the first quarter of 2022 showed signs of slowing down, but it’s noteworthy that revenues are still up at Marvel’s collection. Management expects a weak market in the US for the remainder of 2022.

Pandora Q1 2022 presentation

Pandora Q1 2022 presentation

Sales from online stores are down 17 percent, driven by more store closures in 2021 (about 30 percent). Although sales have increased by 155% compared to 2019, the fact that people prefer to buy jewelry in physical stores rather than online is a supporting point. Gross margin declined from 76.3 percent to 76 percent due to unfavorable developments in commodities markets and FX, while lower discounts and a more favorable channel mix helped boost gross margin. Regarding the EBIT margin, there was a significant improvement from 20.1% to 23% thanks to strong operating capacity. To summarize, EPS and ROIC increased significantly due to increased revenues and operating capacity with EPS reaching DKK 10.5 (DKK 6.3 Q1 2021) and ROIC reaching 49 percent compared to 29 percent last year.

Pandora Q1 2022 presentation

Price

In an attempt to be conservative with the review, I will typically look at three cases with different levels of development and multiples. I look at analysts’ FCF estimates of 4.7 billion kroner and 5.5 billion kroner for 2022 and 2023, respectively.

- Base Case: 2% CAGR to 2031, FCF Multiple: 15;

- Best Case: CAGR 5% to 2026 and 3% to 2031, FCF Multiple: 20;

- Worst case: No growth, FCF multiple: 10.

Looking back at previous years, I estimated that 35% of FCF was returned to shareholders through dividends. Some purchases have also been made over the years, but I have not considered their impact in the evaluation, but remember that they can have a very significant impact on the stock price. I used the 10% discount and here are the results:

- Base issue: 52.94 billion crores

- Best case: 74.58 billion crores

- Worst case: 35.20 billion crores

Pandora’s market capitalization at the time of this writing is about $46 billion, and assuming the three scenarios (60% base case, 20% best and worst case) probabilities, we get an intrinsic value of $53.72 billion. Buy it with 20% margin of safety and we have to wait until it reaches 43 billion. I feel very comfortable with the assumptions I made because I think they are reasonable if not too low. If the administration manages to execute the Phoenix strategy between 2018 and 2021, the results could be much better. As for the risk/reward ratio, I think the numbers speak for themselves, at best we can triple the capital in 10 years, at worst we’ll get a small capital gain, but in the meantime we’ll take a big dividend. In the best case, the FCF will be 7,45 billion DKK in 2031, the FCF multiple of 20 will be the market ceiling. 144 billion kroner, 3 times more than the current one.

Accidents

In my opinion, the main risks are a strong exposure to a single product type and geographic diversification. The moment and collaboration segment controlled 71% of the revenue in 2021, the percentage dropped to 66% in the first quarter of 2022 but there is still a strong dependence on one product type. The risk of this type of risk always depends on the type of product we are talking about. For example, Apple depends a lot on iPhone sales, but the product is unique and popular. Pandora charms are very popular and have been very successful for many years, proving that they are not just a passing trend. By introducing other types of jewelry, Pandora can help reduce this risk.

In terms of geographic exposure, Pandora is well diversified but has high exposure in markets such as Italy (10% of revenue in 2021), which are very weak in this macroeconomic environment. In total, the United Kingdom, France, Italy and Germany will account for 34% of sales in 2021 and Europe as a whole may suffer more in the medium term. On the other hand, Pandora’s revenue from China is only 5%, and once the restrictive measures are over and investments start, the growth of this market can offset the weakness of others.

In my opinion, competition is a secondary risk and will not be one of Pandora’s main problems in the coming years. Although we find the most important and famous brands in jewelry such as Tiffany or Cartier, most of them sell very unique jewelry. As an affordable jewelry brand, Pandora is the most popular brand worldwide and this is a competitive advantage that allows the company to avoid much competition.

Summary

Pandora is a great business that has gone through tough times but is well positioned to capture future growth opportunities. A strong global brand name and winning beauty formula are assets that Pandora can use to ensure its leadership position as collectors. My biggest business concern stems from medium-term macroeconomic conditions, where spending on non-essential items during a prolonged recession will be easily cut off by people and this will weigh on Pandora’s sales. Extending the time horizon, the current valuation is still very interesting and offers an excellent risk/reward ratio.

[ad_2]

Source link