[ad_1]

Marco Bello

Co-developed by Austin Rogers for the high yield investor

There’s more than one way to skin a cat, and more than one way for investors to gain exposure to high-growth and innovative tech companies.

In this article, we Here are two different ways to gain exposure to this high risk and high economic segment:

- Exchange-traded funds are innovative but largely ineffective. public Stocks, represented by Kathy Wood’s ARK Innovation ETF ( ARKK ).

- Business Development Companies (“BDCs”) that specialize in high-yielding, short-term loans as well as select equity stocks in innovation. Personal Companies, represented by Hercules Capital (HTGC) and Trinity Capital (TRIN).

ARKEC Active ETF has a very high turnover and expense ratio of 0.75%, which is somewhere between public and actively managed funds.

An ETF typically holds 35 to 55 stocks with an average market capitalization of about $5 billion, but there is a wide range of company sizes in the portfolio. Although all holdings can be considered “innovation” or “technological” companies, they operate in different fields/industries:

- The “genomic revolution” and other DNA-based biotechnology

- Automation and robotics

- Energy storage and battery technology

- Artificial intelligence

- FinTech (Financial Technology)

ARKK is a long-only, equity-only ETF that focuses on innovative (and typically newly IPO’d) stocks. Publicly traded. Companies. Sometimes these companies are profitable and sometimes not, but for the most part they remain in a cash-burning situation while continuing to invest in growth.

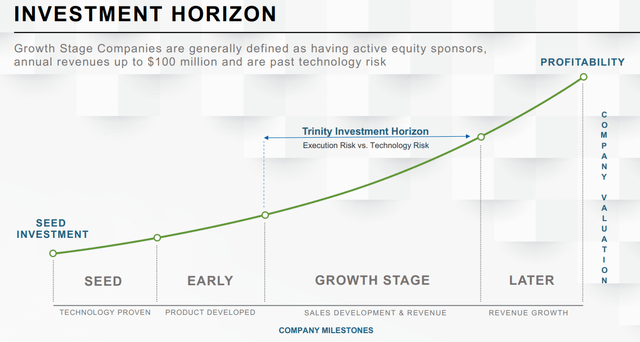

On the other hand, HTGC and TRIN are BDCs that focus on venture debt – special loans specifically for private companies that are growing rapidly within 2-4 years but are not yet profitable but are backed by venture capital funds. Moreover, they often take equity stakes or securities in their portfolio companies to profit from the few who become big winners.

These are mostly the same types of companies owned by the ARKK ETF, only they are still private and have not yet completed an IPO. An IPO is one of the liquidity events that can drive the ultimate return on capital (and the actual return on capital held) for the likes of HTGC and TRIN.

TRIN approach

In some cases, ARQ may be providing liquidity by purchasing shares of technology company IPOs. Therefore, it is important to note that ARKK invests in the same types of companies as HTGC and TRIN, only those that are in their early stages of growth and are on the way to becoming profitable.

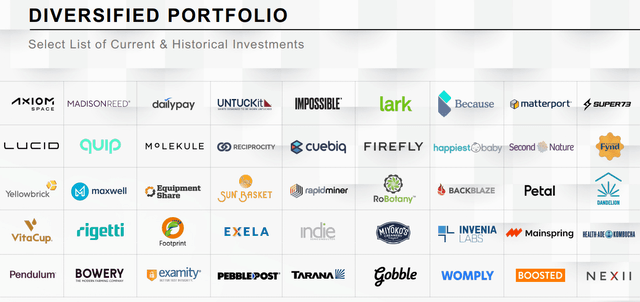

Here are some examples of TRIN’s portfolio investments, most if not all of which the company had equity exposure to:

TRIN approach

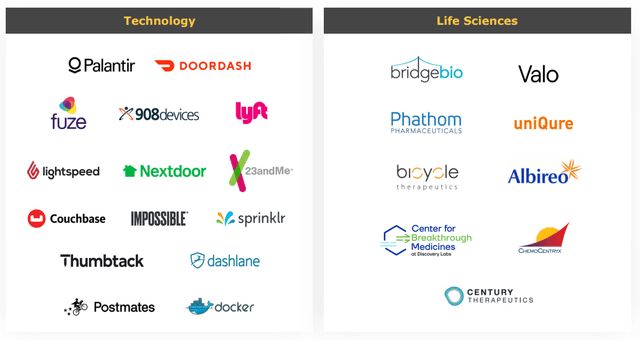

And here are some examples from HTGC’s portfolio, particularly its equity and bond holdings:

HTGC approach

From the perspective of the stock investor, it is important to note the differences in the main sources of income from each investment.

- ARKK does not pay profit, and it Only The source of return is capital appreciation from the appreciation of the underlying holdings.

- HTGC and TRIN both pay out distributable cash flow to shareholders in the form of dividends and thus yield high single-digit or low double-digit yields. Returns come primarily from dividends but can also come from capital appreciation.

Let’s compare ARKK to HTGC and TRIN to see why investors are choosing BDCs over Catty Wood’s popular ETFs.

Stability Vs. Popularity

ARKK has approximately $76 billion in assets under management, nearly 30x the total assets of HTGC and nearly 80x the total assets of TRIN. Then again, ARKK is a fund that holds dozens of companies, while HTGC and TRIN are individual companies.

However, ARKK’s average market cap of $5 billion is many times larger than HTGC’s market cap of $1.7 billion or TRIN’s ~$550 million.

Obviously, ARKK is the most popular investment. Indeed, it became a phenomenon in the financial world during the pandemic, as a cluster of high-tech stocks took advantage of the trend to stay at home and its chief spokeswoman, Kathy Wood, was frequently interviewed in the financial media.

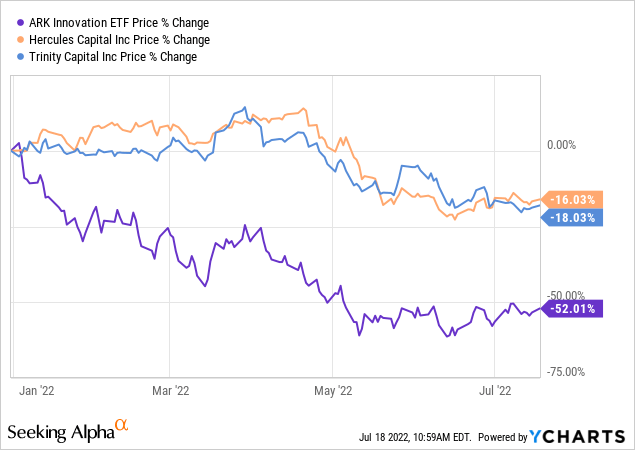

However, ARKK enjoyed a short period of 10-11 months in terms of stock-raising success and capital flow since the start of the epidemic, as ARKK completely returned its action to pre-epidemic levels – below it. in fact. Year-to-date, ARKK seems to have recovered after losing more than 50%.

Compare this to the price performance of HTGC and TRIN, which have depreciated but not disappeared. Almost Same level as ARKK.

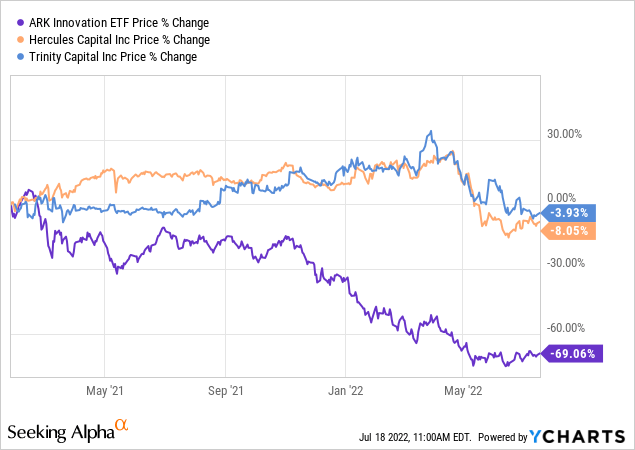

Zooming in further, we find that ARKK has seriously Since TRIN’s debut on the public markets in January 2021, HTGC and TRIN have underperformed by price alone.

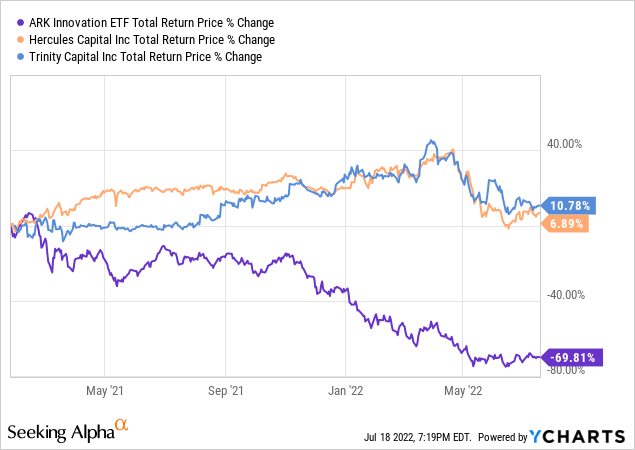

But price obviously doesn’t tell the whole story because HTGC and TRIN’s main source of returns are dividends. When we break down dividends to arrive at a total return comparison, we find that the performance gap between BDCs and ARKK has become more extreme since TRIN’s IPO.

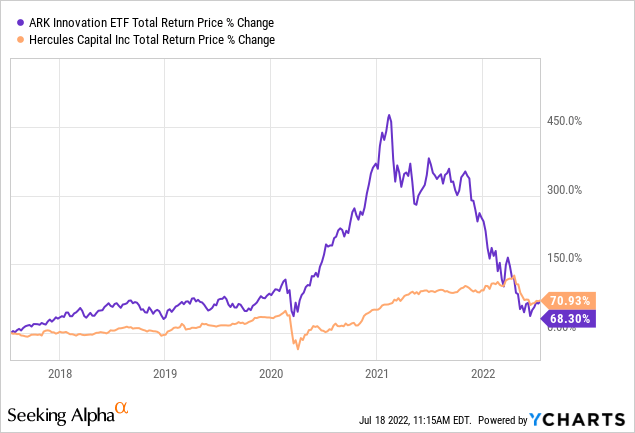

Leaving TRIN to go further back with a head-to-head comparison of ARKK and HTGC over the past five years, we find that HTGC has outperformed even after ARKK’s high profits during the pandemic and HTGC’s 25% share price over the past five years. Many months.

But after the bear market ends, should investors expect ARC to continue its massive performance?

There are some reasons to believe that it might. With Cathy Wood openly defending her strategy and investors fearing to miss another rally, ARKK could enjoy a strong recovery out of the current bear market.

Again, the large ARKK event enjoyed during the pandemic should also be viewed as a one-off event that cannot be repeated. ARKK benefited from stay-at-home obligations and social distancing, as well as stimulus money during the pandemic, when people gambled in the stock market. That fad is over. And maybe we won’t have another once-in-a-century pandemic for a while.

Moreover, when interest rates rise, investors pay more Seasonal Earnings beyond expectations in the distant future, like ARKK’s holdings.

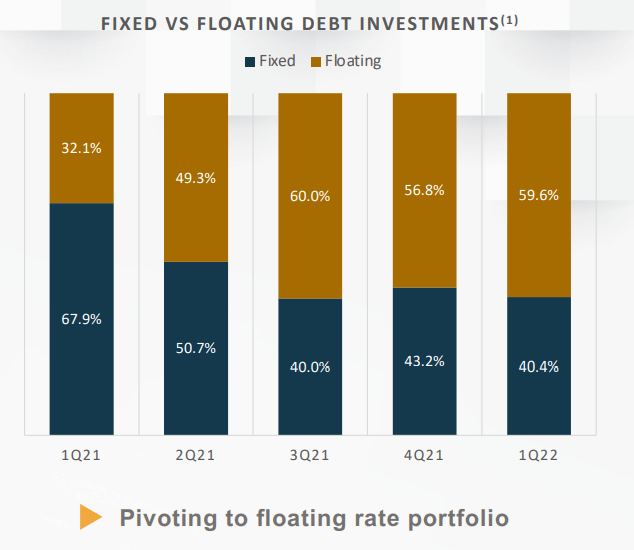

On the other hand, when interest rates rise, both HTGC and TRIN directly benefit because most of their portfolio loans are floating. As of Q1 2022, about 60% of TRIN loans are floating:

TRIN approach

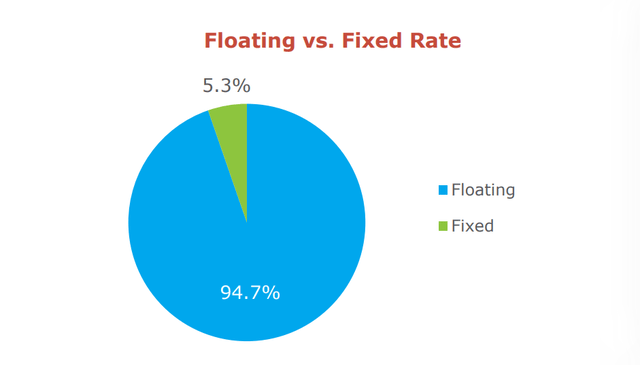

For HTGC, the percentage of floating rate loans is around 95%.

HTGC approach

Moreover, both BDCs have interest rate floors in their loans, which minimizes the downside from falling rates. Generally, these loans are the best of both worlds, as the downside of floating rates is limited while the upside can be huge.

The biggest risk for early growth companies

There is a constant need to raise more and more capital for all early growth companies that are still cash-strapped as they invest in expanding their business. That problem happens when the capital market dries up and money is scarce.

Without the ability to raise capital at affordable prices, start-up companies can easily run into trouble.

Is this a big problem for venture capital? Creditors Equity investors like HTGC and TRIN or ARKK?

I would argue that it is a huge problem for the equity investor because the inability to access capital at a reasonable price can seriously affect the ability of early growth companies to grow, resulting in underperformance of stock prices. This translates into poor price performance for ARKK.

On the other hand, venture lenders such as HTGC and TRIN are in a strong position, as venture-backed companies prioritize fulfilling their existing obligations. Avoiding defaults or bankruptcy is always preferable to any other option.

Of course, when the capital market dries up, equity outflows or holdings may become collateralized or yield lower than expected returns. But this is a relatively small portion of the total revenue generated by the venture debt business model developed by HTGC and TRIN.

at last

Cathy Wood is undoubtedly a smart person with a keen eye for innovative technology. Her research department is one of the best not only in identifying technology trends but also in capturing the thoughts and interests of investors. She is confident, unwavering and it is no wonder that the ARK Investing business has borne fruit in recent years.

But its flagship ETF, ARKK, is unlikely to enjoy another big rally out of the current health crisis, as it did during the outbreak. Covid-19 has created a very favorable environment for ARKK, and those exceptional circumstances are unlikely to be repeated anytime soon.

However, investors have the opportunity to invest in the same (often the same) companies as ARKK and have more stability, less downside risk, some equity opportunities and exposure to portfolio companies, and quarterly cash returns through dividends.

It feels great to invest in America’s innovation machine, and we look forward to strong returns as we participate in the growth of people at a high-yield investor. But there is more than one way to do this. Investors looking for high yield and relatively low volatility would do well to dive into HTGC and TRIN.

[ad_2]

Source link