[ad_1]

Wall Street stocks fell after disappointing business surveys on both sides of the Atlantic, while government debt prices rose sharply, adding to investors’ concerns about the outlook for the global economy.

The yield on the benchmark 10-year Treasury note fell 0.14 percentage points to 2.77 percent after confirming a contraction in trading activity in July. As prices rise, yields fall.

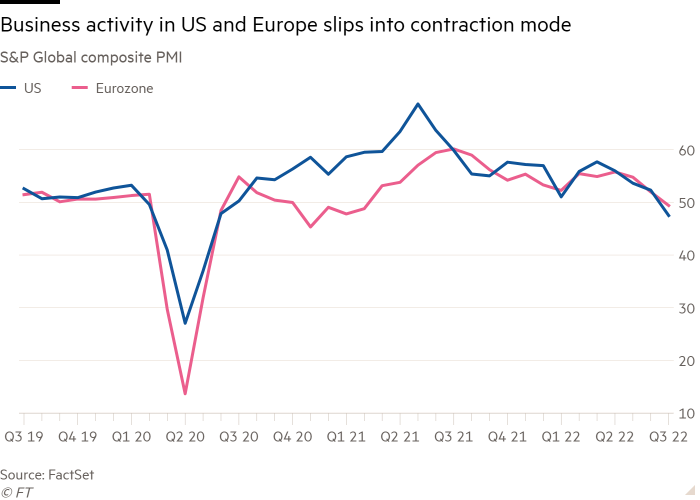

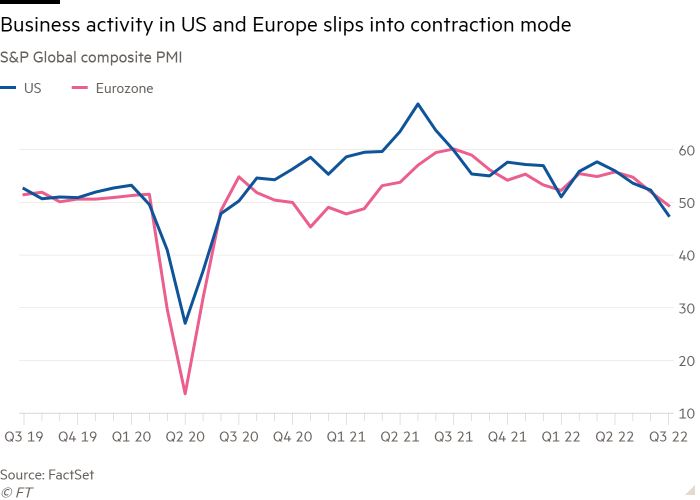

The S&P Global Composite Purchasing Managers’ Index fell from 52.3 in June to 47.5 in July, falling below the 50 level that would signal expansion for the first time since June 2020.

The decline was caused by particularly weak reports from respondents in the service sector, and heightened concerns that the Federal Reserve’s efforts to fight inflation by sharply raising interest rates are pushing the US economy into recession.

Seema Shah, chief strategist at Major Global Investors, said: “The Fed’s price stability is their number one goal and they should be targeting inflation.”

The results knocked stocks, with the S&P 500 index of blue-chip stocks down 0.9 percent.

The tech-heavy Nasdaq Composite Index slipped 1.9 percent as Snap reported that it was suffering from a difficult macroeconomic environment. The group’s shares fell 39.1 percent after it posted a quarterly loss of $422 million and reported a decline in advertising demand.

Google and Microsoft have been reassessing their investment priorities in recent weeks, investment bank Goldman Sachs warned this week of job cuts.

Eurozone bond markets also reflected economic concerns after a PMI survey fell to a 17-month low of 49.4, worse than economists had predicted.

The yield on Germany’s 10-year Bund fell 0.17 percentage points to 0.97 percent, while the two-year yield, which closely tracks interest rate expectations, fell 0.22 percentage points to 0.40 percent, according to Tradeweb data.

“There are several shocks to the eurozone economy,” said Hetal Mehta, senior European economist at Law & General Investment Management. At the beginning of the year, there may be an economic downturn.

Europe’s Stoxx 600 stock index rose 0.3 percent despite signs of distress in the bond market.

[ad_2]

Source link