[ad_1]

Credit card usage has increased over the past several years, according to credit card company American Express (AXP) growing at an incredible speed. The top line has grown in single digits consistently over the past five years (if you don’t include 2020).

But rising inflation has led to consumer spending freezes and a lack of credit cards, offsetting the benefits to the company.

However, AXP’s diverse and loyal customer base has allowed the company to survive the economic downturn and post positive results lately. So the company’s financials and growth incentives make it very attractive. We are bullish on stocks.

American Express pulls itself together post-pandemic.

Like other credit card providers, American Express’s business has taken a hit during the pandemic. However, it quickly expanded its services to target new, younger, affluent Americans. This growth strategy helped the company get more people to sign up for credit cards and strengthen the Amex brand.

Now that the pandemic is ending, American Express is back in business. As the cost of travel increased, the company experienced higher sales. According to AXP’s quarterly reports, travel spending reached pre-pandemic levels for the first time in March.

Fortunately, travel and entertainment spending more than doubled during the quarter, up 121 percent. Future travel bookings are up 37 percent in the U.S. and 48 percent globally compared to 2019, according to company CEO Stephen Scarry.

This level of recovery in travel and leisure represents a growth spurt for the foreseeable future. So, you might want to keep AXP stock on your radar.

American Express: Excellent Q1-2022 Results

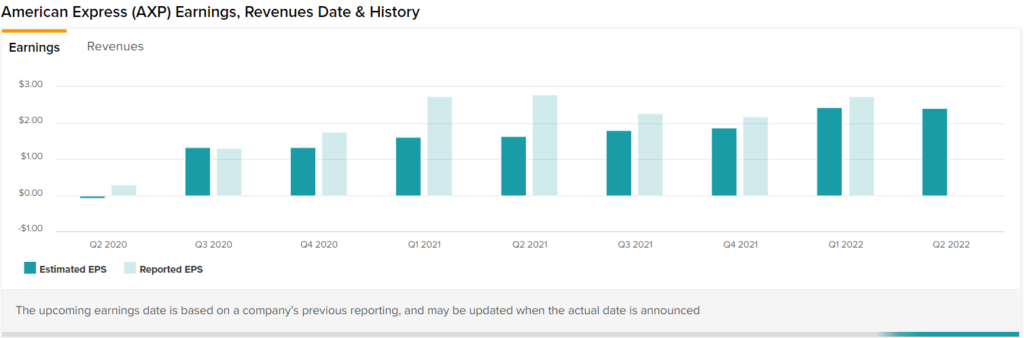

In April, AXP reported a strong first quarter due to continued business activity. The company’s revenue rose 29.5% year-over-year, to $11.7 billion. Also, earnings per share stood at $2.74, beating Wall Street estimates by 11 percent.

The company’s net revenue rose 30 percent year over year to $350.3 billion in the first quarter. At the same time, net write-offs remained low, indicating that the firm faced few problems related to deterioration in credit quality.

Additionally, American Express ended the first quarter with cash and cash equivalents of $28 billion, an increase of $6 billion sequentially. Additionally, AXP’s debt has been reduced from $39 billion at the end of 2021 to $38 billion by March 2022.

Analysts expect the company’s revenue to grow 19.4% through 2022.

The company’s dividend program and share buybacks provide great incentives to investors. Shares of American Express rose 0.6 percent on March 10 after the company announced a 20 percent increase in its quarterly dividend.

American Express has been a regular dividend-paying company for more than three decades, which is commendable. In addition, the company is consistent with its share buyback program to reward existing shareholders.

These acquisitions and divestitures paint a strong picture of the company despite a volatile environment. Moreover, she has enough money to invest in her future without running out of money in the near future.

Thus, American Express looks like a promising investment considering its profitability, growth prospects, and valuation (which I mentioned in the conclusion).

Wall Street’s take on AXP stock

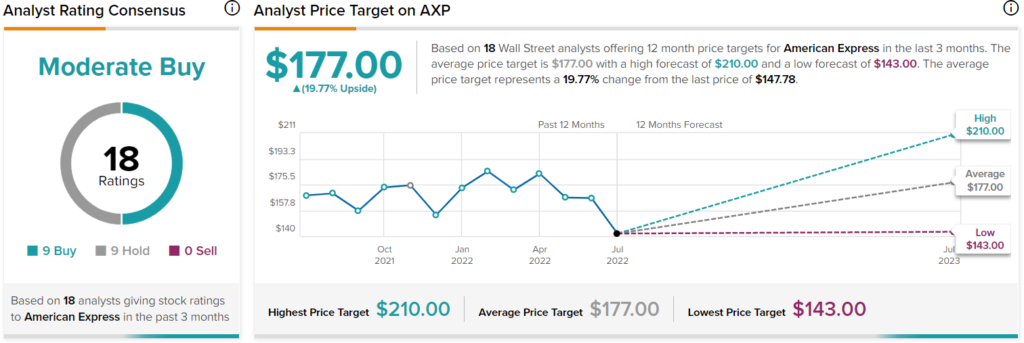

Turning to Wall Street, AXP stock maintains a moderate buy consensus rating. Out of 18 analyst ratings, nine buys, nine holds and zero sell ratings have been issued in the past three months.

The average price target for AXP stock is $178.31, indicating a potential upside of 19.8%. Analysts’ price targets range from a low of $143 per share to a high of $210 per share.

Conclusion – AXP stock could reward investors.

American Express looks undervalued and is trading at 2.2 times forward sales. Moreover, AXP management is optimistic given its strong first quarter report, encouraging outlook and recent dividend increases.

In addition, the company has a lot of money on the balance sheet. In the coming months, the recovery in travel demand should continue to push AXP stock. So I expect another strong showing in the coming quarters and throughout the year. The company reported its Q2 results on July 22.

Overall, American Express looks like a stock that could reap substantial gains in the future and serve as a core component of investors’ portfolios.

Disclosure

[ad_2]

Source link